5 Reasons Why Remittances To India Remained Strong During The Pandemic

Contrary to predictions, remittances to India did not decrease substantially during the pandemic. Here's a look at why.

An estimated one in nine people around the world relies on remittances, which are funds sent by non-residents to their resident family members and friends.

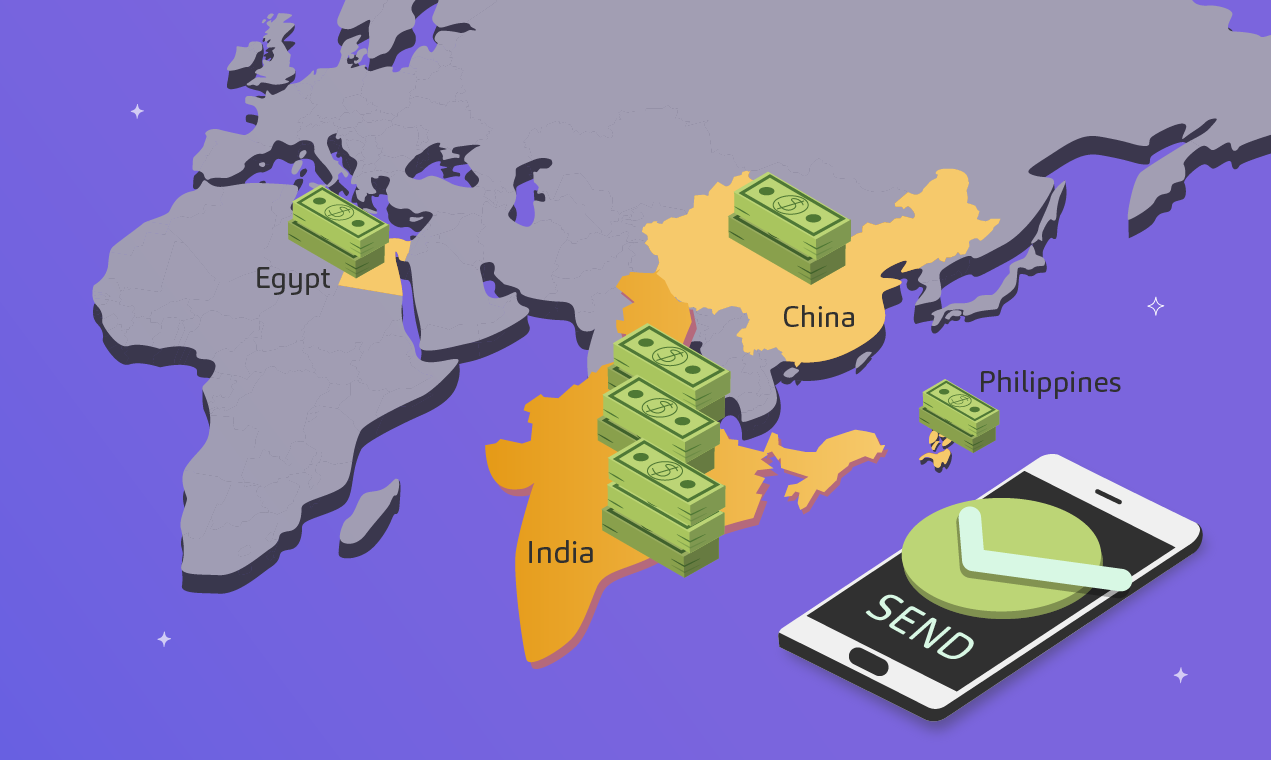

India is the largest recipient of remittances, followed by China, Mexico, the Philippines, and Egypt. Non-resident Indians sent home an estimated $87 billion in 2021, with the United States being the biggest source of remittances — accounting for over 20% of these funds.

Contrary to earlier predictions, remittances to India have not decreased substantially during the global pandemic. In 2020, the World Bank and International Monetary Fund (IMF) predicted that remittances would drop 20% due to the economic impact of COVID-19, but they only fell 1.6% from 2019. In India, they fell just 0.2% in 2020. More recently, remittances to low- and middle-income countries were projected to grow 7.3% in 2021, reaching $589 billion.

There are several possible reasons for the strength of remittances to India and other South Asian nations during the pandemic, per the World Bank.

Savings repatriation: The U.S. issued 1.2 million fewer visas to work-eligible foreigners between March 2020 and July 2021, compared to the pre-pandemic period from March 2018 to July 2019. During the pandemic, a number of individuals returned to India due to job losses or other challenges in the job market. According to the World Bank, “a portion of the recorded rise in remittances could represent repatriated savings of emigrants returning home after losing their jobs or not finding new opportunities,” and remitting funds home along with them.

Formal capturing of remittance statistics via recorded channels: Before the pandemic shut down borders in 2020 — drastically limiting international travel — it was much easier for individuals to travel with cash or gifts. The shift of some of these funds to formal, recorded channels (such as digital payments and wire transfers) accounts for some of the increase in remittances to South Asia in 2020.

Financial innovation: Fintech apps like Google Pay and Alipay facilitate fast, inexpensive digital funds transfers. The increased use and accessibility of these tools contributed to the overall increase in remittances in South Asia in 2020. Overall, digital transactions in India grew by close to 90% in the three years from FY19 to FY21.

Generosity: Indian migrants and other non-residents may have been more inclined to support friends and family in India in 2020 given the dire economic conditions the pandemic imposed on developing nations. In fact, The World Bank notes that South Asian countries “rank high compared to other middle-income countries on a measure of altruism based on FINDEX,” and that “current giving campaigns by diaspora amid the health crisis in India suggest this altruism is alive and well.”

Host country transfers: In 2020, the top three source countries for global remittance outflows were the United States ($68 billion), the United Arab Emirates ($43 billion), and Saudi Arabia ($35 billion). Each of these countries offered some form of economic stimulus to businesses and residents that year. As with the direct stimulus payments in the US, some Indian migrants and other non-residents were on the receiving end of funds transfers or reduced costs from their host countries. This enabled them to send higher-than-normal amounts to South Asia in 2020.

Wrapping up

While some of these potential reasons were unique to the pandemic — such as host country transfers — others, like financial innovation, are ongoing and may continue to influence remittance rates in India and elsewhere. That said, migrant flows will have the greatest impact on remittances. Remittances in India are projected to grow 3% in 2022 to $89.6 billion, reflecting a drop in the total number of Indian migrants.

The content of this article is for general informational purposes only and is believed to be accurate as of posting date but may be subject to change.

Brokerage services are provided by Alpaca Securities LLC ("Alpaca Securities"), member FINRA/SIPC, a wholly-owned subsidiary of AlpacaDB, Inc. Technology and services are offered by AlpacaDB, Inc.

This is not an offer, solicitation of an offer, or advice to buy or sell securities, or open a brokerage account in any jurisdiction where Alpaca Securities is not registered (Alpaca is registered only in the United States).