How Does Crypto Fee Pricing Compare to Stock Trading Fees?

This article explains the differences between cryptocurrency and stocks and differences in fees.

Difference between Stocks and Crypto

In recent years, we've witnessed a monumental increase in entrants into the trading world for both stocks and crypto. This trajectory of popularity in trading has led some to associate crypto with stocks and vice-versa, despite being completely different from a fundamental level.

Purchasing crypto gives you the right to own, or digitally own, an amount of your choosing for a specific cryptocurrency. This ownership is acquired via an exchange that is based on a decentralized price ecosystem, where prices can be volatile and could vary from exchange to exchange. Depending on how the world embraces and adopts crypto, they can be viewed today as a store of value with a future outlook of becoming a medium for transactions.

In contrast, US publicly traded stocks provide traders a unit of ownership of a corporation that has gone public through a highly regulated stock market exchange such as the NASDAQ or NYSE. These companies who have gone public are obliged to regularly disclose materials such as earnings, forecasts, and future expectations. Since governance is high and centralized, volatility of stock prices tend to be historically lower than that of crypto price volatility.

Crypto pricing is derived from exchange to exchange independently

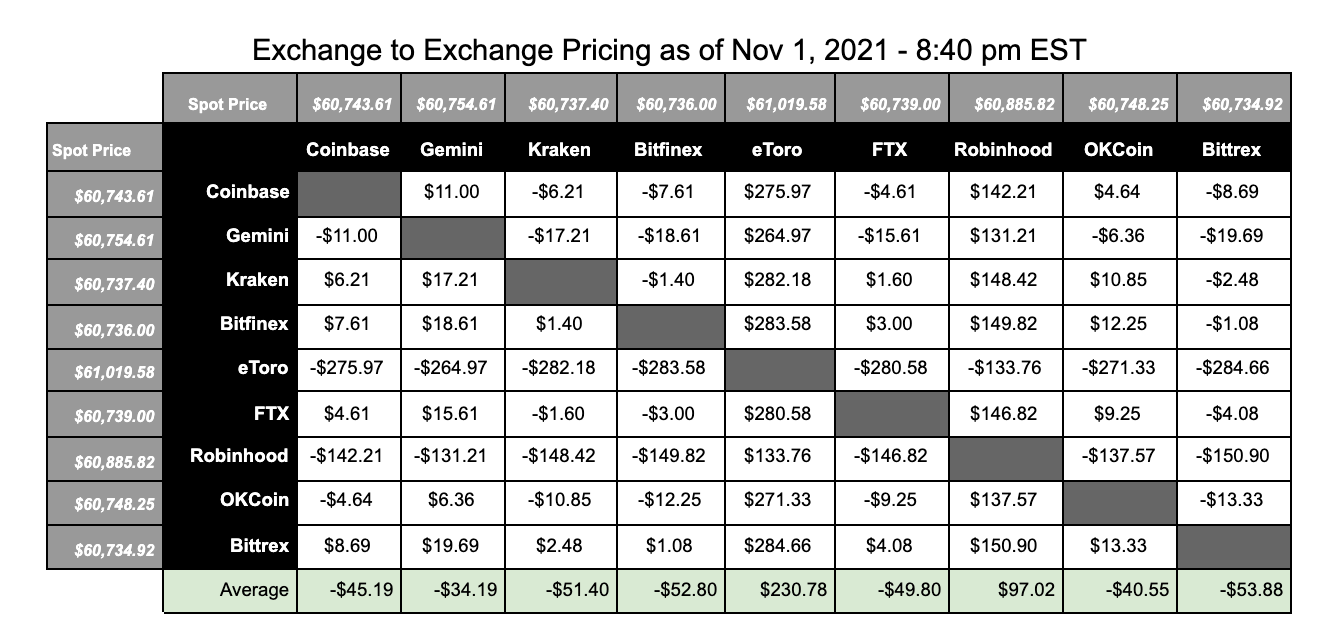

Cryptocurrencies by nature trade in decentralized form and are thus holistically priced, and derived from exchange to exchange independently. Since there is no global standard cryptocurrency price at any point in time, pricing, fees and spreads vary between platforms. In the case of Bitcoin, or any other popular cryptocurrencies, your fluctuating pricing also remains variable depending on exchange liquidity, timing, and external market events.

Crypto platforms may have multiple methods of charging a fee and/or spread premium

The biggest challenge with cryptocurrency pricing is that every platform has multiple methods of charging the end user a fee and or spread premium based on cumbersome pricing structures that are hard to follow. Since the market itself is decentralized and traded 24/7, disconnects in pricing between even the biggest exchanges are ubiquitous.

We've compiled a table below that compares the world's largest exchanges and the differences between their Bitcoin markets.

Please note that this chart is for illustrative purposes only.

What is an end-user fee and spread premium?

Commission fee or trade commission

Also called a stock trading fee, this is a brokerage fee that is charged when you buy or sell stocks. You may also pay commissions or fees for buying and selling other investments, like options or exchange-traded funds. This fee, which is standard in stock trading, also often applies to crypto trading as well.

For example, Alpaca does not charge a commission or trading fee on its equities. However, relevant SEC and FINRA fees may apply.

Spread markup or spread premium

The spread is the difference between the bid and ask price. The difference in price is the spread markup. While fees are the costs that exchanges show you on their fee pages, spreads are the difference between the price you pay and the average price of the cryptocurrency you buy.

Alpaca offers a competitive crypto trading platform. Our spread markup is calculated based on the rates of our partners. We try to provide the lowest spread markup we can offer.

Competitive API crypto trading for Broker API Partners

Our goal is to democratize trading for all and creating Alpaca Crypto API is another step in our larger plan. In order to achieve this:

- Our existing API infrastructure for equity trading provides users a platform to trade both equities and crypto seamlessly under one portfolio.

- We enable our users to trade cryptocurrencies directly via developer-first API.

To provide a competitive offering, we partner with global crypto leaders: FTX.US, ErisX and Silvergate. These partnerships enable us to offer customers crypto trading with fast execution, tight bid/ask spreads, reliable technology infrastructure, and superior custody of digital assets.

References

What is the difference between Cryptocurrency and stocks? PayPal.

Bitcoin Volatility vs Other Assets. Woobull Charts. Data from 2012-2021.

Brokerage Fees and Investment Commissions Explained. NerdWallet. Sep. 14, 2020

Forex Broker Commission vs. Spread Explained. Forex School Online.

About Alpaca

We are an API-first brokerage platform that enables developers to build apps and trading algorithms. Our platform powers fintech businesses globally to launch commission-free stock and crypto investing apps. We're backed by some of the top investors in the industry globally including Spark Capital, Portage, Social Leverage, Tribe Capital, Horizons Ventures, and Y Combinator. Securities services are offered by Alpaca Securities LLC. Crypto services are offered by Alpaca Crypto LLC.

Disclosures

Please note that this article is for informational purposes only. The example above is for illustrative purposes only. Actual crypto prices may vary depending on the market price at that particular time. Alpaca Crypto LLC does not recommend any specific cryptocurrencies.

Cryptocurrency is highly speculative in nature, involves a high degree of risks, such as volatile market price swings, market manipulation, flash crashes, and cybersecurity risks. Cryptocurrency is not regulated or is lightly regulated in most countries. Cryptocurrency trading can lead to large, immediate and permanent loss of financial value. You should have appropriate knowledge and experience before engaging in cryptocurrency trading. For additional information please click here.

Cryptocurrency services are made available by Alpaca Crypto LLC ("Alpaca Crypto"), a FinCEN registered money services business (NMLS # 2160858), and a wholly-owned subsidiary of AlpacaDB, Inc. Alpaca Crypto is not a member of SIPC or FINRA. Cryptocurrencies are not stocks and your cryptocurrency investments are not protected by either FDIC or SIPC. Please see the Disclosure Library for more information.

This is not an offer, solicitation of an offer, or advice to buy or sell cryptocurrencies, or open a cryptocurrency account in any jurisdiction where Alpaca Crypto is not registered or licensed, as applicable.