PredictNow.ai

How It Works

What is PredictNow.Ai?

PredictNow.ai is a no-code machine learning SaaS based in Toronto, Canada that is primarily focused on helping traders apply machine learning to their investment strategies in order to predict the profitability of their next trade. PredictNow.ai can calculate the most important input variables groups (also known as “clusters”) that empower a user’s prediction and only incorporate those in the prediction decision.

Users have to train a machine learning model based on their historical results, where they receive predictive performance results for both the in-sample and out-of-sample datasets. This trained model is then downloaded and is used in the Live section. In the Live section, users upload the model file along with the data features for that day into the PredictNow.ai software. The software then utilizes the previously trained model to provide a prediction for the daily dataset. We also provide access to a Rest API, allowing the user to directly implement the PredictNow.ai software into their internal processes.

This no-code process can help traders predict the profitability of their trades and help improve their existing trading strategies.

How to sign up for PredictNow.Ai and link an Alpaca brokerage account?

If you are an existing Alpaca user linking to PredictNow.ai is quite simple. Go to the PredictNow.ai website and sign up for an account. You can initially get full access through a 30-day free trial. Once this is done on the PredictNow platform you will see an option to sign in to Alpaca.

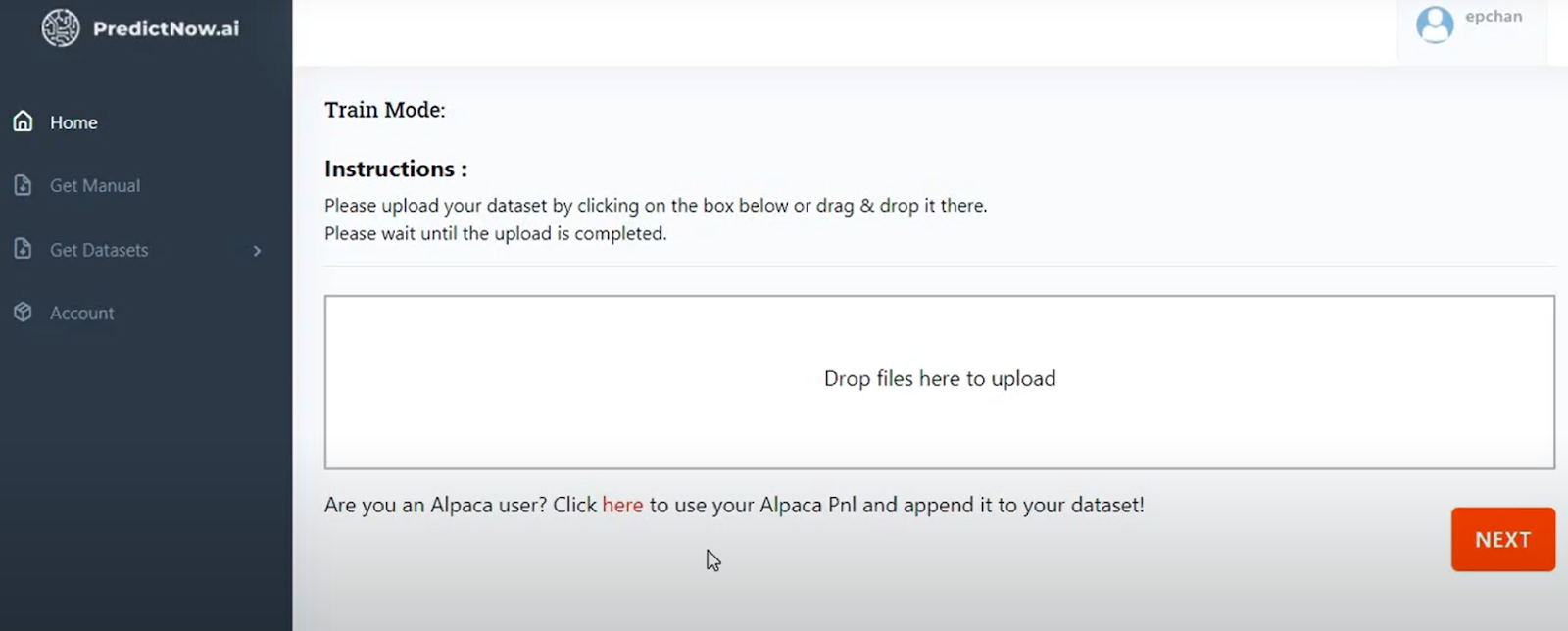

As soon as you’re logged in you will receive an authentication page asking for your permission to allow PredictNow to access the relevant information. As soon as you click to allow it will take you back to the train mode page on PredictNow.Ai.

How to use PredictNow.Ai with Alpaca Data?

Once you’ve given permission to the PredictNow.ai platform your brokerage data can be directly imported from Alpaca to PredictNow.ai.

PredictNow.ai currently offers Alpaca users two Profit and Loss or PNL modes to choose from. One is the round-trip PnL. A round trip would basically be taking a long version and selling it or taking a short version and buying it later. For each of the entries for the realized round-trip PnL, the associated timestamp is the trade entry timestamp. The second PnL is the MTM or mark to market is basically one entry for each business day and this illustrates the change in NAV on a day-to-day basis.

Users will first work in train mode to create a model using training data and once the model is complete and you are satisfied with probability analysis you can go ahead and download the model and upload it into the live mode.

Below is a demo which walks you through how to link your Alpaca data to PredictNow and how to train and use the live modes. This demo will also go into detail regarding which results are relevant and what specific data sheets indicate.

If you have any questions or trouble setting up, please do not hesitate to reach out to us at [email protected]. Our team also offers professional consulting services and is happy to guide you through setting up a successful model to further improve your trading strategy.