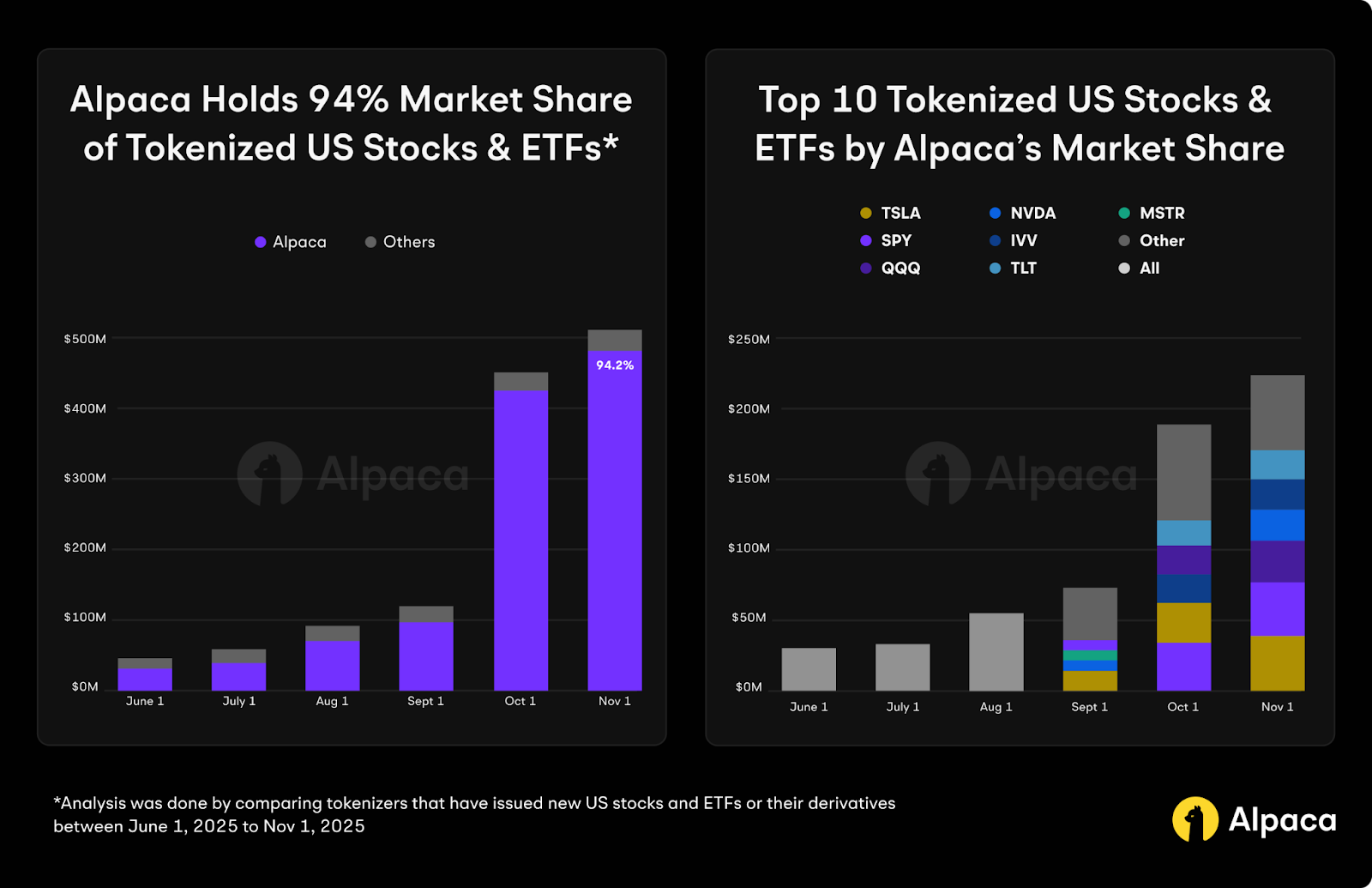

Alpaca, a global leader in brokerage infrastructure APIs providing access to crypto, stocks, ETFs, options, and fixed income, today announced it holds above 94% market share in tokenized US equities and ETFs — representing over $480 million in tokenized assets under custody (AUC). Additionally, Alpaca holds 97% of the market share for tokenized large and mega-cap US stocks with over $217 million in tokenized AUC.* These milestones follow strategic integrations with Ondo Finance, Backed Finance (xStocks), Dinari, and more — partnerships that are accelerating institutional and retail access to tokenized US equities worldwide.

Tokenization of US Equities Gaining Momentum

As of October, the total market capitalization of US equities reached $67.8 trillion,1 a 9% increase since January 2025. Representing nearly half (46%) of the $147.6 trillion global stock market,2 the US remains the primary focus for innovators and institutions driving the tokenization of traditional assets.

Global institutions are fully embracing tokenization, with BlackRock’s CEO, Larry Fink, recently stating that the industry is at “the beginning of the tokenization of all assets,”3 and as they make the tokenization of ETFs a strategic priority.4 Robinhood’s CEO Vlad Tenev echoed this sentiment, saying “tokenization is like a freight train. It can't be stopped, and eventually it's going to eat the entire financial system.”5

This advocacy for tokenized equities underscores a shared vision across financial services: a more inclusive, efficient, and programmable financial ecosystem that runs 24/7 with instant settlements.

The Infrastructure to Support Tokenization is Here

While talk about tokenization has gained momentum across the industry, the infrastructure to make it a reality, especially for US equities, has primarily been incomplete. Settlement systems remain slow, siloed, and costly, while regulation often lags behind innovation.

According to Janus Henderson, a leader in tokenized real-world asset funds,6 “tokenization is different from past attempts to modernize finance, because it is not just a new wrapper or a new distribution mechanism. It is a new foundation. The infrastructure of global capital markets evolves slowly, and the benefits of tokenization suggest it has in large parts been left behind.”7

Alpaca designed its Instant Tokenization Network to bridge regulated market infrastructure with blockchain technology — enabling real-time settlement, programmable compliance, and scalable on-chain issuance.

“TradFi and digital assets are no longer two separate, distinct worlds. The same principles of investor protection and market integrity have to apply on-chain. Tokenization won’t reach its potential until we bridge legacy systems with the chain,” said Yoshi Yokokawa, Co-Founder and CEO of Alpaca. “Alpaca’s position as a regulated clearing member across traditional assets and a crypto-native platform provides a practical foundation for tokenization. By building this infrastructure, we’re leading the way in bringing the whole global capital markets and financial services on-chain.”

According to Alpaca’s data, the top five tokenized US stocks and ETFs on public chains today are TSLA, SPY, QQQ, NVDA, and IVV — representing over $150 million in on-chain value.

If tokenization is a freight train, Alpaca is the railroad connecting TradFi and on-chain markets through their de facto global standard investing infrastructure. As the clearing broker for over 94% of the market share of tokenized US stocks and ETFs, and as partners continually onboard with their recently announced Instant Tokenization Network, Alpaca is positioning itself as a global leader in tokenization infrastructure. xStocks, one of Alpaca’s earliest partners for the tokenization of US equities, recently surpassed $10 billion in Total Daily Volume across CEX and DEX.8

For any issuers or authorized participants looking to build tokenization services, Alpaca is ready to onboard more partners at scale.

Learn more about tokenization at Alpaca: alpaca.markets/tokenization

Contact Alpaca

About Alpaca

Alpaca is a US-headquartered, self-clearing broker-dealer and a global leader in brokerage infrastructure APIs providing access to stocks, ETFs, options, fixed income, and crypto. Alpaca delivers embeddable finance solutions for tokenization, fully paid securities lending, high-yield cash, 24/5 trading, Shariah-compliant investing and more. Today, Alpaca powers over 8 million brokerage accounts across hundreds of fintechs and institutions in 40+ countries with over $170M in funding.

- “Total Market Value of the U.S. Stock Market”, Siblis Research, 2025

- “Global Stock Exchange Market Capitalization Reaches Record $148 Trillion in October 2025”, Voroni, November 3, 2025

- “BlackRock CEO Larry Fink: We’re at the beginning of the tokenization of all assets”, CNBC, Squawk on the Street, October 14, 2025

- “BlackRock Advances Tokenized ETFs Amid Push for Regulatory Clarity”, FinTech Weekly, October 22, 2025

- “Robinhood CEO: Tokenization is going to 'eat the whole global financial system'”, CNBC International Live, October 2, 2025

- “Blockchain and tokenization: Transforming asset management on behalf of clients”, Janus Henderson Investors, August 18, 2025

- “Tokenization is finance’s next ETF moment – and Wall Street isn’t ready”, Janus Henderson Investors, October 8, 2025

- “xStocks Official Dashboard”, Dune, data pulled November 16, 2025

*Where large and mega-cap companies are defined as any NYSE and Nasdaq stock valued over $10 billion according to Nasdaq.

Data as of November 15, 2025 using both publicly and privately available information across various data platforms.

Analysis was done by comparing tokenizers that have issued new US stocks and ETFs or their derivatives between June 1, 2025 to Nov 1, 2025.

Alpaca's Instant Tokenization Network is owned and developed by AlpacaDB, Inc. and Alpaca Crypto LLC

Additional geographic restrictions may apply for tokenization services based on local regulatory requirements. Neither Alpaca Crypto LLC nor Alpaca Securities LLC are the issuer of, nor directly involved in, the tokenization of any assets. Tokenization is performed by a third party. Tokenized assets do not represent direct equity ownership in any underlying company or issuer. Instead, tokenized assets generally provide economic exposure to the equity securities of an underlying issuer. As such, holders of tokenized assets have no voting rights, dividend entitlements, or legal claims to the underlying company shares or any residual assets in the event of the underlying company’s liquidation or insolvency, unless explicitly stated otherwise.

The content of this blog is for general informational purposes only. All examples are for illustrative purposes only.

Alpaca and the entities mentioned are not affiliated and are not responsible for the liabilities of others.

The testimonials, statements, and opinions presented on the website are applicable to the specific individuals. It is important to note that individual circumstances may vary, and may not be representative of the experience of others. There are no guarantees of future performance or success. The testimonials are voluntarily provided and are not paid, nor were they provided with free products, services or any other benefit in exchange for said statements.

Cryptocurrency is highly speculative in nature, involves a high degree of risks, such as volatile market price swings, market manipulation, flash crashes, and cybersecurity risks. Cryptocurrency regulations are continuously evolving, and it is your responsibility to understand and abide by them. Cryptocurrency trading can lead to large, immediate and permanent loss of financial value. You should have appropriate knowledge and experience before engaging in cryptocurrency trading. For additional information, please click here.

All investments involve risk and the past performance of a security, or financial product does not guarantee future results or returns. There is no guarantee that any investment strategy will achieve its objectives. Keep in mind that while diversification may help spread risk, it does not assure a profit, or protect against loss. There is always the potential of losing money when you invest in securities, or other financial products. Investors should consider their investment objectives and risks carefully before investing.

Options trading is not suitable for all investors due to its inherent high risk, which can potentially result in significant losses. Please read Characteristics and Risks of Standardized Options before investing.

Fractional share trading allows a customer to buy and sell fractional share quantities and dollar amounts of certain securities. Fractional share trading presents unique risks and is subject to particular limitations that you should be aware of before engaging in such activity. See Alpaca Customer Agreement at https://alpaca.markets/disclosures for more details.

Fixed income securities can experience a greater risk of principal loss when interest rates rise. These investments are also subject to additional risks, including credit quality fluctuations, market volatility, liquidity constraints, prepayment or early redemption, corporate actions, tax implications, and other influencing factors.

Orders placed outside regular trading hours (9:30 a.m. – 4:00 p.m. ET) may experience price fluctuations, partial executions, or delays due to lower liquidity and higher volatility. Orders not designated for extended hours execution will be queued for the next trading session. Additionally, fractional trading may be limited during extended hours. For more details, please review Alpaca Extended Hours & Overnight Trading Risk Disclosure.

Alpaca does not make any representation that its products or services are Shariah-compliant. Customers are solely responsible for determining whether any offering meets their own Shariah requirements.

Please read Important Risk Disclosures With Respect To Participating In Fully Paid Securities Lending Transactions carefully before deciding whether to participate in lending Fully Paid Securities or agreeing to enter into a Master Securities Lending Agreement with Alpaca Securities LLC.

These disclosures describe important characteristics of, and risks associated with engaging in, securities-lending transactions.

Alpaca Securities offers a cash management program pursuant to the FDIC Bank Sweep. Customer funds are treated differently and are subject to separate regulatory regimes depending on whether customer funds are held in their brokerage account or within the FDIC Bank Sweep. Alpaca Securities is a member of the Securities Investor Protection Corporation (SIPC), which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash). The Federal Deposit Insurance Corporation (FDIC) insures up to $250,000 per deposit against the failure of an FDIC member bank. Customer funds held in brokerage accounts are SIPC insured, but are not eligible for FDIC insurance coverage. Funds maintained in the FDIC Bank Sweep are intended to be eligible for pass-through FDIC insurance coverage but are not covered by SIPC. FDIC insurance does not protect against the failure of Alpaca, Alpaca Securities, or their affiliates, nor against malfeasance by their employees. Program banks that participate in the FDIC Bank Sweep are not members of SIPC, and therefore, funds held in the Program are not SIPC protected. Please see alpaca.markets/disclosures for important additional disclosures regarding Alpaca Securities brokerage offering, as well as FDIC Bank Sweep terms and conditions.

The OmniSub product is offered by AlpacaDB, Inc. as a technology service for sub-accounting related to omnibus clearing services. Approval for this technology service is subject to Alpaca Securities LLC due diligence review.

Securities brokerage services are provided by Alpaca Securities LLC ("Alpaca Securities"), member FINRA/SIPC, a wholly-owned subsidiary of AlpacaDB, Inc. Technology and services are offered by AlpacaDB, Inc.

Cryptocurrency services are made available by Alpaca Crypto LLC ("Alpaca Crypto"), a FinCEN registered money services business (NMLS # 2160858), and a wholly-owned subsidiary of AlpacaDB, Inc. Alpaca Crypto is not a member of SIPC or FINRA. Cryptocurrencies are not stocks and your cryptocurrency investments are not protected by either FDIC or SIPC. Please see the Disclosure Library for more information.

This is not an offer, solicitation of an offer, or advice to buy or sell securities or cryptocurrencies or open a brokerage account or cryptocurrency account in any jurisdiction where Alpaca Securities or Alpaca Crypto, respectively, are not registered or licensed, as applicable.