For many aspiring American investors, navigating the world of personal finance can feel overwhelming. Traditional platforms often cater to experienced investors, providing a wide array of investment tools that can be overwhelming to new investors. These situations may leave a significant segment of the population, particularly those working demanding jobs or those with less financial experience, feeling underserved and excluded. Individuals may then either shy away from investment opportunities or struggle to find resources that fit their unique needs.

Moola, a US-based, mobile-only financial platform founded by Jason Schappert and his wife, Magda, was created to help address these challenges. By offering an educational approach to financial empowerment specifically tailored for the everyday go-getter, Moola is on a mission to make personal finance radically simple and smart. We recently interviewed Jason to discuss Moola’s origins, mission, growth, and future plans.

Empowering Investors with the Financial Fundamentals

Inspired to help people achieve their dreams of becoming pilots, Jason and his wife made a pivotal decision in 2024 to sell their aviation business. Though their original venture changed course, their passion for empowering individuals to build financial wealth remained. Leveraging the equity earned from the sale and their recently acquired financial knowledge, Jason and Magda identified an opportunity: to develop a financial platform that simplifies investing for the everyday American. This led to the creation of Moola, which officially launched in March of 2025.

Drawing on their extensive experience in teaching and training, this opportunity materialized into Moola, an education-first investment platform that translates complex financial concepts into easily digestible information for investors who are newer to personal finance. In fact, for many Moola members, this is their first-ever brokerage account.

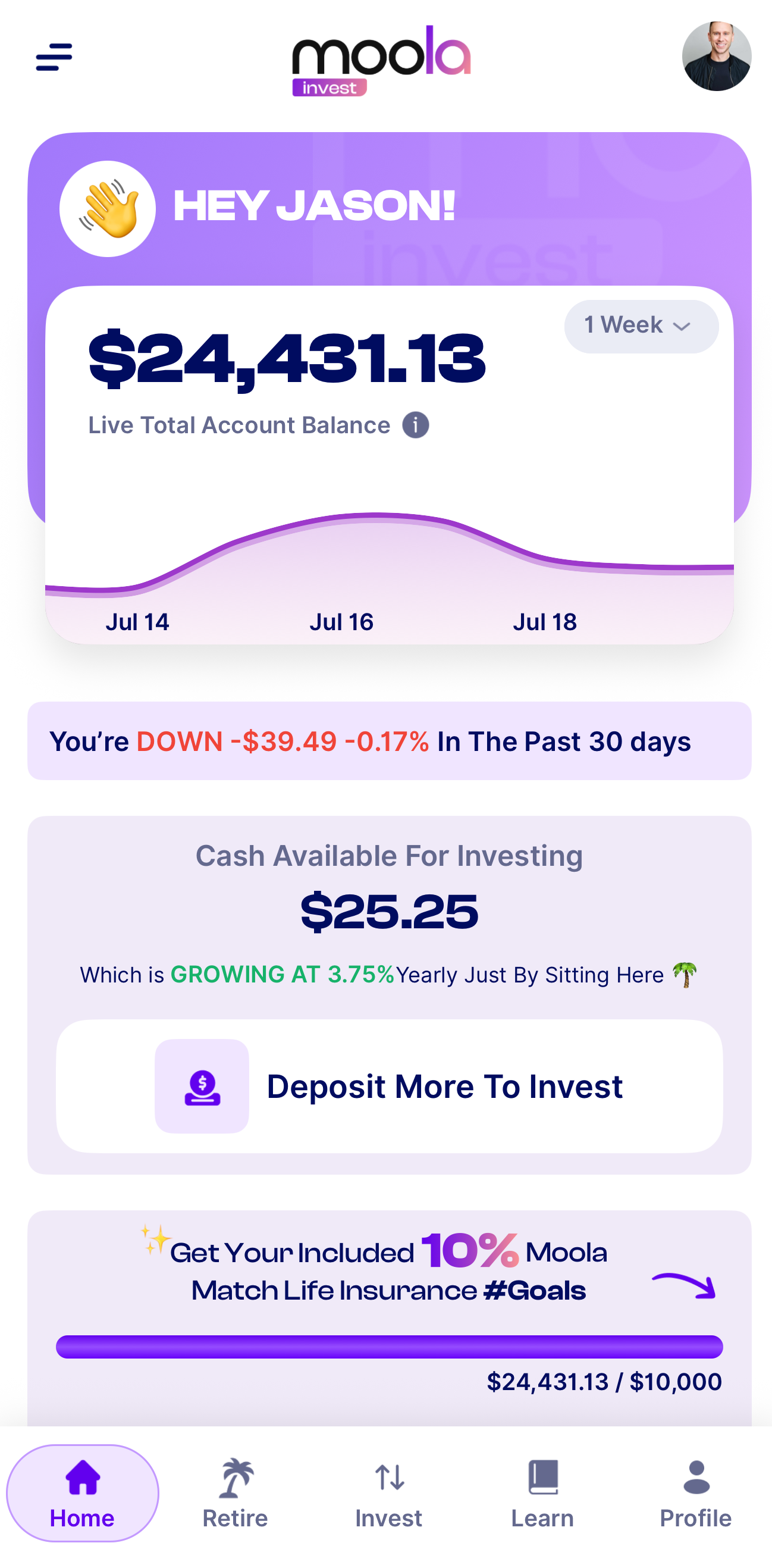

Knowing this, Moola aims to be a comprehensive toolbelt for individual finance, consolidating fundamental investment products like US stocks and ETFs, Individual Retirement Accounts (IRA) accounts, Fully Paid Securities Lending (FPSL) and high-yield cash* into a single, intuitive environment. The platform actively works to remove financial noise by presenting only relevant information and guiding their members through investment decisions. This caters specifically to the underserved individuals who are motivated to improve their financial future but may lack the time, prior knowledge, or access to traditional resources.

Jason elaborates on their unique customer focus: “We’re really trying to differentiate ourselves through our member profile. The typical Moola member is a 35-year-old nurse. Someone who wants to improve their personal finance but works 12-hour shifts. They lack the time to learn everything about finance, yet they’re hungry for more, both for themselves and their families.”

Moola's commitment to simplicity permeates every aspect of their operations. Their streamlined interface also minimizes complexity, ensuring that they’re only communicating necessary information and that financial terms are explained in plain English. “They don’t care about their trade volume,” says Jason. “They want to know what's going to set their IRA up for success when they’re 65 years old.”

Fueling Growth and Simplicity Through Their Partnership with Alpaca

As a lean, husband-and-wife team, Moola was looking for a brokerage infrastructure partner that could support their vision of building a simple, mobile-only investment platform. By leveraging Alpaca’s Broker API, Moola efficiently built and launched their platform, rapidly bringing their US stocks and ETFs, IRA accounts, FPSL, and high-yield cash* products to market.

Jason emphasizes the critical role that Alpaca played in helping Moola get off the ground in the early days: “Having Alpaca was like having another arm of our team. We are literally a husband and wife team. Right now I’m the developer, the marketer, and the support team. We are really wearing all of these hats as we grow early.”

One of the most critical aspects of this collaboration involved Know Your Customer (KYC) processes. Recognizing the inherent regulatory complexities, Moola initially utilized KYC-as-a-service through Alpaca to expedite their launch. "We used KYC-as-a-service through Alpaca to get us started. That was a beautiful thing because it allowed us to get out of the gate right away," Jason recalls. "It was one less burden we had to carry and figure out from a compliance and regulatory standpoint. It really helped us get to market."

Additionally, Alpaca’s fractional trading capabilities and ACH funding have been key features in providing an accessible and user-friendly experience for Moola’s members. “They look at a stock they want to purchase and it's $200 a share. They’re thinking, ‘how can I ever afford that?’ So through our partnership with Alpaca, we’re able to fractionalize down to the ninth decimal point, making it much more advantageous and affordable for our members,” explains Jason.

As Moola continues to grow, they are now transitioning to managing KYC themselves with the support of Alpaca. This shift is a testament to their scaling operations and the robust foundation laid with Alpaca.

Future Horizons: Crypto Integration and Customer-Centric Growth

Looking ahead, Moola has ambitious, yet achievable, plans for growth. Since their March launch, the company has observed significant customer adoption, primarily driven by their TikTok channel, which has attracted over 100,000 followers and actively engages new investors. Given the strong engagement in their initial months, Moola is confident in achieving their goal of $100 million in Assets Under Management (AUM) by the end of the year.

While much of this anticipated growth will stem from traditional investment tools like US equities, IRA accounts, FPSL, and high-yield cash*, Jason is particularly excited about integrating crypto offerings. Although the initial plan was to hold off on crypto due to its perceived risk, Jason explains that his change in rationale is driven by user behavior: “I was doing some research and looked at assets owned across our membership base. The number one owned asset after an S&P 500 index fund is iBit, the iShares Bitcoin ETF. Despite not offering crypto, our members are finding ways to purchase crypto, and they’re doing it through an ETF.”

Moola’s potential crypto offering, which is still in development and not yet available to users,would be a closed system, designed exclusively for investment purposes, without wallet addresses for in and out transfers. This design intends to reduce user exposure to common risks associated with cryptocurrency transactions This planned approach reflects Moola’s broader goal of delivering investment tools that prioritize simplicity, user education, and risk awareness.

Although the expected growth will necessitate increased staff and strategic hiring, Jason is determined to maintain the company’s mom-and-pop ethos for as long as possible. This commitment includes remaining visible to members, providing hands-on support, and fostering a community built on trust.

“Moola’s early growth is a clear sign that simplified finance is valuable to the everyday investor. We’re excited to be their partner in making traditional investment products like US equities, high-yield cash, and IRA accounts more accessible to underserved Americans,” says Yoshi Yokokawa, CEO and Co-founder of Alpaca.

Contact Alpaca

About Alpaca

Alpaca is a US-headquartered self-clearing broker-dealer and brokerage infrastructure for stocks, ETFs, options, crypto, fixed income, and 24/5 trading – raising over USD170 million in funding. Alpaca is backed by top-tier investors globally, including Portage Ventures, Spark Capital, Tribe Capital, Social Leverage, Horizons Ventures, Unbound, SBI Group, Derayah Financial, Elefund, and Y Combinator.

*High-Yield cash refers to Alpaca Securities’ cash management program pursuant to the FDIC Bank Sweep. Customer funds are treated differently and are subject to separate regulatory regimes depending on whether customer funds are held in their brokerage account or within the FDIC Bank Sweep. Specifically, Alpaca Securities is a member of the Securities Investor Protection Corporation (SIPC), which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash). The Federal Deposit Insurance Corporation (FDIC) insures up to $250,000 per deposit against the failure of an FDIC member bank. Customer funds held in brokerage accounts are SIPC insured, but are not eligible for FDIC insurance coverage. Funds maintained in the FDIC Bank Sweep are intended to be eligible for pass-through FDIC insurance coverage, but are not subject to SIPC coverage. FDIC insurance coverage does not protect against the failure of Alpaca, Alpaca Securities, or any of its or their affiliates and/or malfeasance by any Alpaca or Alpaca Securities employee. Program banks that participate in the FDIC Bank Sweep are not members of SIPC and therefore funds held in the Program are not SIPC protected. Please see alpaca.markets/disclosures for important additional disclosures regarding Alpaca Securities brokerage offering as well as FDIC Bank Sweep terms and conditions.

The content of this blog is for general informational purposes only. All examples are for illustrative purposes only.

Alpaca and MOOLA COPILOT LLC (“Moola”) are not affiliated and neither is responsible for the liabilities of the other.

All product descriptions, comparisons, platform features referenced, and images above were provided by Moola. This information has not been independently verified and does not constitute a recommendation or endorsement by Alpaca. Investing involves risk, including the potential loss of principal. Past performance, whether actual or backtested, is not indicative of future results.

Please read Important Risk Disclosures With Respect To Participating In Fully Paid Securities Lending Transactions carefully before deciding whether to participate in lending Fully Paid Securities or agreeing to enter into a Master Securities Lending Agreement with Alpaca Securities LLC. These disclosures describe important characteristics of, and risks associated with engaging in, securities-lending transactions.

Please review important Retirement Account Disclosures at https://alpaca.markets/disclosures before deciding to open an individual retirement account.

Fractional share trading allows a customer to buy and sell fractional share quantities and dollar amounts of certain securities. Fractional share trading presents unique risks and is subject to particular limitations that you should be aware of before engaging in such activity. See Alpaca Customer Agreement at https://alpaca.markets/disclosures for more details.

Orders placed outside regular trading hours (9:30 a.m. – 4:00 p.m. ET) may experience price fluctuations, partial executions, or delays due to lower liquidity and higher volatility. Orders not designated for extended hours execution will be queued for the next trading session. Additionally, fractional trading may be limited during extended hours. For more details, please review Alpaca Extended Hours & Overnight Trading Risk Disclosure.

Options trading is not suitable for all investors due to its inherent high risk, which can potentially result in significant losses. Please read Characteristics and Risks of Standardized Options before investing in options.

Fixed income securities can experience a greater risk of principal loss when interest rates rise. These investments are also subject to additional risks, including credit quality fluctuations, market volatility, liquidity constraints, prepayment or early redemption, corporate actions, tax implications, and other influencing factors.

The testimonials, statements, and opinions presented on the website are applicable to the specific individuals. It is important to note that individual circumstances may vary, and may not be representative of the experience of others. There are no guarantees of future performance or success. The testimonials are voluntarily provided and are not paid, nor were they provided with free products, services or any other benefit in exchange for said statements.

All investments involve risk and the past performance of a security, or financial product does not guarantee future results or returns. There is no guarantee that any investment strategy will achieve its objectives. Keep in mind that while diversification may help spread risk, it does not assure a profit, or protect against loss. There is always the potential of losing money when you invest in securities, or other financial products. Investors should consider their investment objectives and risks carefully before investing.

Cryptocurrency is highly speculative in nature, involves a high degree of risks, such as volatile market price swings, market manipulation, flash crashes, and cybersecurity risks. Cryptocurrency regulations are continuously evolving, and it is your responsibility to understand and abide by them. Cryptocurrency trading can lead to large, immediate and permanent loss of financial value. You should have appropriate knowledge and experience before engaging in cryptocurrency trading. For additional information, please click here.

Securities brokerage services are provided by Alpaca Securities LLC ("Alpaca Securities"), member FINRA/SIPC, a wholly-owned subsidiary of AlpacaDB, Inc. Technology and services are offered by AlpacaDB, Inc.

Cryptocurrency services are made available by Alpaca Crypto LLC ("Alpaca Crypto"), a FinCEN registered money services business (NMLS # 2160858), and a wholly-owned subsidiary of AlpacaDB, Inc. Alpaca Crypto is not a member of SIPC or FINRA. Cryptocurrencies are not stocks and your cryptocurrency investments are not protected by either FDIC or SIPC. Please see the Disclosure Library for more information.

This is not an offer, solicitation of an offer, or advice to buy or sell securities or cryptocurrencies or open a brokerage account or cryptocurrency account in any jurisdiction where Alpaca Securities or Alpaca Crypto, respectively, are not registered or licensed, as applicable.