Tokenomics Guide

How is Crypto Valuation Determined?

Abstract

As interest in cryptocurrencies continues to grow, it's important for investors to be able to assess a project's potential value and risks. Tokenomics, or token economics, is the study of anything that impacts the value or function of a token ― including supply, utility, and governance. Well-designed tokenomics can create a strong foundation for a project's success, but poorly designed tokenomics can have the opposite effect. In this guide, you'll learn about the different types of tokens, token distribution and governance, and take a closer look at DOGE, BNB, and UNI.

Keywords

Tokenomics; Token Economy; Crypto Tokens; Token Distribution; Token Launch; Crypto Circulating Supply

What are Tokens?

In cryptocurrency, there are two main uses of the term “token.” The first is any cryptocurrency or crypto asset. This is a broad use of the term that includes both Bitcoin and Ethereum. However, as the space has matured, so has the term “token.” It's now more common to use the term “token” to describe all digital assets that run on top of another cryptocurrency's blockchain, and the term “coin” to describe a digital asset which is native to its blockchain [1]. Both Bitcoin and Ethereum run on their own blockchain, but a digital asset like UNI runs on Ethereum's chain. Thus, most would categorize UNI as a token and Ethereum as a coin.

Coins operate on their own blockchains (Ether runs on the Ethereum blockchain, SOL runs on the Solana chain, etc.), and are the “currencies” of their chains. To make transactions on the chain, you must use the chain's native coin. With this coin, you can buy other digital assets and tokens. Using the previous example, you must first buy Ether (ETH) to use the Ethereum network, after which you can make transactions on the Ethereum chain transactions ― for example, trading ETH for UNI. Thus, you trade a portion of ETH for UNI, and also pay a gas fee (transaction fee) in ETH. Gas fees are required for every transaction made on a chain, which is why the native coin is always required to use its respective chain [2]. Once you have enough of the native coin for gas fees, you can engage in activity on the chain with whichever tokens you want ― like trading ETH for UNI, then later trading UNI for another token such as GIV. Put more simply, tokens represent assets payable with coins.

Types of Tokens

As the definition of token has matured, it's also developed subcategories. Different types of tokens serve different use cases within the cryptocurrency world.

Security Tokens

Security tokens equate to an ownership stake in a protocol, acquired by investors with the intention of the value increasing over time [3]. Equating this to the traditional finance world, security tokens are the blockchain version of owning a company's stock and equity. In some cases, security tokens offer additional rights like voting power, which is analogous to the board of directors in traditional finance. However, now it's distributed to all owners of the protocol's security tokens. Another additional feature of security tokens is the right to yield of the protocol [3], which are essentially “dividends” paid to owners of the security tokens. Organizing these payments at a large scale is possible because cryptocurrencies and tokens are programmable, whereas this would be laborious and inefficient in traditional finance.

There are two types of security tokens: equity tokens and asset backed tokens. Equity tokens represent partial ownership of a protocol, whereas asset backed tokens are backed by real-world assets like real estate or commodities.

Utility Tokens

Utility tokens are integrated into an existing protocol and used only within a specific protocol's ecosystem. They're used for the payment of services, unlike direct investments that one can see with a security token [4].

Example: Brave Browser launched the Basic Attention Token (BAT), which users of the browser earn by using the browser and watching ads on the platform [5]. Once a user has BAT, they can only use it to tip content creators through the browser or other platforms that have integrated with the BAT ecosystem and BAT wallets (e.g. Twitter). BAT cannot be spent outside of the ecosystem.

Transactional Tokens

Similar to utility tokens, transactional tokens are exchanged for goods and services. However, transactional tokens are not specific to one protocol's ecosystem and can be used to pay for goods and services across multiple ecosystems [6]. This makes them similar to a currency, but since they are tokens on the blockchain, they allow users to transact without going through a central authority. This allows transactions to be executed more quickly and grants users full custody of their assets immediately when compared to transactions that require a central authority, like most transactions in the current banking system [7].

Governance Tokens

Governance tokens allow owners to vote on decisions of a decentralized protocol through “on-chain governance.” The programmable nature of tokens allows this otherwise cumbersome process of collecting votes from a decentralized group of people to become trustless (because all votes are visible on the public ledger and the parameters for voting are preset by token code, fraud is less plausible), instant, organized, and anonymous if anonymity is desired.

Commodity

Commodity tokens are technically a subset of security tokens. They are backed by real-world assets with independent value such as real estate, gold, carbon credits or a sovereign currency [8]. Since commodity tokens are backed by a standard asset, they have an underlying value that isn't primarily based on speculation. These tokens allow for exposure to these assets on the blockchain, with lower fees than in traditional market products and instant self-custody [7].

What is Tokenomics?

Tokenomics is the process of studying the supply and demand characteristics of a token to plan and design the token launch [9]. This includes choosing parameters of the tokens, planning the initial token distribution strategy, releasing the token to the ecosystem, analyzing the economics of the token post launch, and influencing the token economy post-launch through supply controls like minting and burning [9].

There are certain parameters that form the foundation of most token launches. Those are summarized and described below:

Maximum supply

is the maximum amount of tokens that can be created, written into the token code [10].

Note: If a token has no maximum supply, additional tokens can be created. This can cause inflation within the token ecosystem and devalue individual tokens, lowering the price over time. This would be described as an inflationary token. DOGE is an example of this, which will be discussed in further detail later.

Initial supply is the amount of tokens released in the initial launch of a token. These tokens are released to encourage liquidity of the ecosystem and price discovery [11]. There are multiple strategies for initial token launches depending on the nature and purpose of the protocol. These are covered in a later section of this article.

Circulating supply

is the current number of tokens released to the ecosystem. Tokens are released based on a predetermined schedule and rules created by parameters in the code [12]. Circulating supply gives information on how mature the token economy is of a specific token, how far along in the token distribution plan a protocol is, and gives information on how much further inflation to expect for the token. When a token distribution plan is fully executed, maximum supply may equal circulating supply.

Mint rate

is the rate at which new tokens are created, or minted. If a token has no maximum supply, like DOGE, token creators can mint new tokens endlessly. The rate at which this occurs is called the mint rate. This rate helps determine future inflation of the token, since minting tokens causes inflation. Alternatively, a token with a maximum supply will have a mint rate for the duration of time between their initial launch and the moment they achieve maximum supply of tokens in the ecosystem [13].

Burn rate

is the rate at which tokens are destroyed and removed from the ecosystem (burned). Once a protocol has the maximum supply of tokens released to an ecosystem, they may choose to burn a portion of tokens to decrease the supply and benefit tokenholders through price movement. A protocol may also burn tokens or increase burn rate to counter a previous inflationary nature of the token economy [14].

Note: Mint and burn rates are decided by the central authority in a centralized ecosystem, but in a decentralized ecosystem are often decided by on-chain governance votes utilizing governance tokens held by users [15].

Token Distribution Plan

is the predesigned plan for token allocations that a team or protocol has decided to follow for initial token supply and future token distribution. This plan shows what proportion of total token supply will go to different stakeholders of the protocol. This differs vastly from protocol to protocol, but common stakeholders considered are team members and future employees, investors, advisors, and node operators (if applicable).

Token Launch Basics

The initial token launch is pivotal to a token economy's performance and success. Initial token launches should serve three purposes:

Securely distributing a token to initial stakeholders Fostering an environment of liquidity for holders Enabling price discovery in a relatively safe environment

Different protocols have different motivations for a token launch – some aim to reward contributors and early users of the protocol with a free stake in the protocol [16], while others aim to raise capital for their project as a primary source of funding [17].

With different motivations come different token launch strategies. There are four dominant token launch strategies:

Simple agreement of future tokens (SAFTs) Liquidity bootstrapping pools (LBPs) Auctions Airdrops

Simple Agreement of Future Tokens (SAFTs)

SAFTs are agreements between a protocol and an investor for future tokens [18]. These agreements occur before any tokens have been created, launched, or distributed. An investor will negotiate a token price with a protocol (often in their early stage) and give the protocol capital up-front for a predetermined proportion or amount of tokens once they are launched.

The SAFT agreement generally also includes parameters around an unlocking period for the investor, not giving the investor all tokens at once when the token is launched, but rather distributing their tokens in accordance with a vesting schedule. This reduces the chance of a “rug pull” occurring and limits volatility in the early token economy.

SAFTs are not generally open to the public, but rather offered to accredited or authorized investors [19]. If a project fails or ceases to develop to the point of token launch, investors lose their provided capital.

Liquidity Bootstrapping Pools (LBPs)

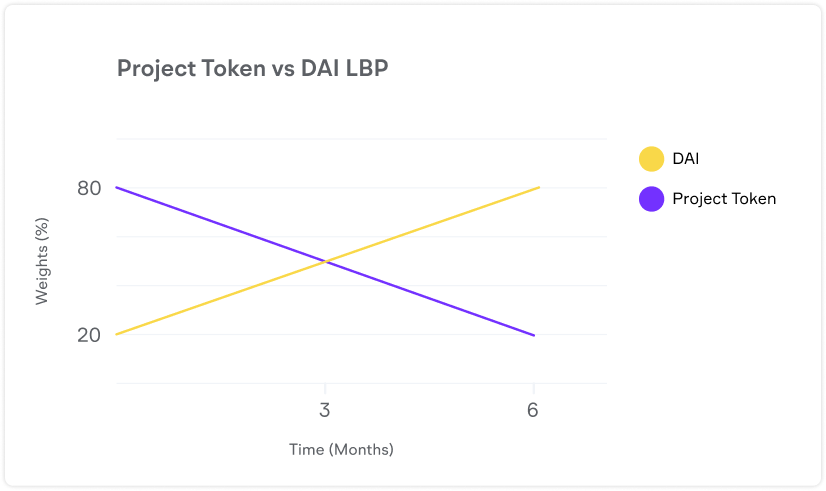

The use of LBPs allows a protocol to develop liquidity and raise capital for a project without requiring large amounts of upfront capital. Balancer was first to create the LBP, where protocols can create pools with different weights and custom weight ratios [20]. The weights gradually adjust from an initial ratio to the target ratio over a set period of time. When launching a new token (e.g. JOJO), this can be very beneficial because you can supply more JOJO to the pool and less collateral (e.g. DAI); this results in increased funding, because JOJO is supplied in higher proportion when the LBP is opened, and as more collateral (DAI) enters the pool by investors it is “traded” for JOJO. Startups likely have more of their token and less access to capital, so this offers a safe environment for their token to be traded for collateral and achieve price discovery, while limiting volatility and risk for early investors.

That was a lot of technical terminology — let's look at an example to make it a bit clearer. Let's say you create a JOJO/DAI pool and set a custom weight of 80/20. You can supply the pool with 80% JOJO tokens and 20% DAI. Over time, in an LBP, the pool weights gradually adjust from the initial 80/20 ratio to a predetermined target ratio (perhaps a flip to 20/80) over a set time period. Here's a visual representation from Balancer:

If the reserves of the pool stay the same, the changing proportion of JOJO and DAI also changes the JOJO/DAI price. For instance, if no one buys JOJO, the price of the token decreases over time (as seen in the Balancer chart, with time on the x-axis). This represents fair competition between front-running bots and the community, along with minimized volatility and fair distribution during the price discovery period of the LBP. The final price reveals what the community values the token price to be.

Token Auctions

Token auctions are auctions held for tokens of a protocol. Oftentimes, auctions are open to the public (as long as the auction complies with your country's investment regulations) and held to sell tokens prior to the initial token launch. Token auctions raise funds for a protocol and foster an environment for price discovery in a closed environment with set parameters.

Sushiswap's MISO project offers a user-friendly platform for token auctions, allowing protocols to set certain parameters for their launch. A platform like MISO connects investors interested in early stage projects with protocols looking for capital through the sale of tokens (normally so they can continue building out their product). Auctions can also be held directly by a protocol, without an intermediary platform like MISO.

Token auctions help achieve decentralization of the token at launch if many different people have purchased tokens through the auction, and if there are no restrictions on buying. Sometimes “whales” can buy a large portion of available tokens (or all of them), which could lead to big problems for the protocol's token economy down the road. Stargate is a new project that experienced this, with all tokens bought by two whales within two seconds of the auction opening [21].

Auctions can be a quick way to raise capital for a project and distribute tokens to an ecosystem, but careful planning is required to mitigate the risks of whales, rug pulls, and price volatility post launch.

Airdrops

Airdrops are events in which protocols send (“drop”) free tokens to contributors and early adopters of their protocol to enhance community, encourage adoption of the protocol, and distribute tokens in a fair way that leads to near instant liquidity. Airdrops are not released when a protocol is solely seeking funding for their project.

Airdrops are often utilized by DAOs to create an economy surrounding their project. Uniswap is a decentralized exchange that executed one of the most famous airdrops in history, dropping a substantial amount of UNI tokens to early users of the protocol [22]. The price of UNI rapidly increased and the airdrop ended up worth thousands of dollars, generating a lot of publicity for the project and recipients posted about their airdrop on social media [23].

Airdrops of value tend to get a lot of publicity within the space, giving them a marketing value as well. Occasionally, airdrops are used to maximize network effects by airdropping to people of influence, project partners, or protocols with similar values and goals.

Now that we've covered the basics of tokens and tokenomics, let's take a look at three large players in the cryptocurrency world: Dogecoin (DOGE), Binance (BNB Coin), and Uniswap (UNI).

Token Deep Dive: DOGE, BNB, and UNI

Now let's look at some examples of tokens and analyze the tokenomics parameters discussed. Based on the tokenomics, different information can be inferred about a project. This is discussed in each example below.

Dogecoin

Background

Dogecoin (DOGE) started out as a joke between two software engineers, Jackson Palmer and Billy Markus [24]. They aimed to create a peer-to-peer currency that was more accessible than Bitcoin and found the Doge meme comical, so they dubbed their token project “Dogecoin.” They used the same proof-of-work technology as Litecoin, tweaked it, and released DOGE a little over a week after the idea had materialized. This involved eliminating the maximum supply constraint that is characteristic of Bitcoin. In fact, 10,000 DOGE are minted every minute in the form of block rewards, leading to the current circulating supply of over 132 billion tokens [25].

Token Utility

Dogecoin was seen as a joke in its earliest days. It then developed into a cultural icon within the early cryptocurrency community, which led to notoriety and popularity. Although highly inflationary, Dogecoin surged in popularity among Reddit, Twitter, and influencers – most notably Elon Musk. DOGE started to be used to tip content creators on social media platforms, giving it some level of utility.

Later, it was argued that “[DOGE's] script technology and unlimited supply was an argument for a faster, more adaptable, and consumer-friendly version of Bitcoin” [24]. Musk adopted this view and even announced last January that Tesla merchandise could be purchased with Dogecoin [26]. The use of DOGE as a currency or storage of value is controversial, and diving into the tokenomics begins to show why.

Quantitative Tokenomics

Note: All values current at the time of writing. [27]

Market Capitalization: With a market capitalization of over $15 billion, Dogecoin is valued higher than many public companies. For comparison, Domino's pizza has a market capitalization of $14.4 billion and Lyft stands at $13.38 billion [28].

Maximum Supply: Dogecoin has no maximum supply, which infers that it is an inflationary coin. An inflationary coin does not necessarily mean it's a poor investment or poor design. In fact, Ethererum is also an inflationary coin and is one of the most successful cryptocurrencies in the space by market cap and adoption. Ethereum is currently transitioning from proof-of-work to proof-of-stake and Dogecoin is proof-of-work. On a proof-of-stake blockchain (like Ethereum), coins can be invested by being “staked” on the blockchain to yield rewards. These rewards often offset the inflation. For example, ETH can be staked for 6%, more than accounting for the inflation of new ETH into the ecosystem in a given year. Dogecoin has no such mechanism, since it's proof-of-work.

Inflation, Mint and Burn Rate: To offset an inflationary nature, a protocol can choose to burn tokens. However, with a burn rate of zero, no coins are taken out of circulation. Ethereum is currently inflationary, but offers staking rewards and occasionally burns tokens to reduce the amount of total circulating supply.

Summary

The 132.67 billion DOGE in circulation will only increase with the current parameters. DOGE offers no counter to inflation through staking or burning of tokens. Despite hype from internet communities and influencers, DOGE is a less optimal choice for a rational investor looking to maximize profit, which is explained by its underlying tokenomics. The token has low utility value because it is only spendable in a few niche communities. There was no careful planning behind the tokenomics of DOGE, allowing it to exemplify some of the largest red flags of a token – inflationary nature, low token utility, and the combination of no maximum supply and no burn rate.

Binance Coin

Background

Binance is the largest cryptocurrency exchange in the world by trading volume by a factor of 5 [29]. Binance has launched two cryptocurrencies itself: Binance Coin (BNB) in 2017 and Binance Smart Chain (BSC) in 2020.

Because Binance is a centralized exchange, its token launch was coordinated by Binance itself. Since Binance is a worldwide organization, it was required to comply with multiple governments during the course of its launch. This led to restrictions of buying/selling BNB and BSC in some countries, including the US. US citizens are not allowed to use Binance.com, but rather Binance.us, which offers a smaller selection of crypto tokens.

Most companies have one major financial objective – to increase the value of their company. However, this changes in the world of cryptocurrency. Not only does a company with a crypto token want to increase the value of their company, but they also want to increase the value of their token [30]. This incentivizes a company with a token, like Binance, to create value within their token ecosystem by offering benefits to BNB holders. This gives BNB utility from multiple sources, incentivizing ownership of the token which will increase token price.

BNB Utility

Binance adds value to the BNB ecosystem in multiple ways, incentivizing users to use and hold BNB. First of all, BNB provides an easy medium of exchange for trading assets within the Binance ecosystem. On Binance, most trades can be made between a token and ETH, BTC, or BNB. Binance also incentivizes users to use BNB by offering discounts on trading fees for trades made from or to BNB – all trades paid for in BNB receive a 25% discount [31].

Binance also offers affiliate rewards. Users who hold more than 500 BNB get twice the commission on Binance's referral program [32].

Finally, Binance incentivizes BNB ownership through a “Launchpad Lottery.” The lottery allows users to invest in early stage startups, similar to Kickstarter in the traditional finance ecosystem. The more BNB you hold, the more “lottery tickets” you receive and the higher chance you have to invest in these early stage startups that have been previously vetted by Binance. This incentive program follows the schedule below:

Through multiple incentives to users, Binance has achieved a high market capitalization for BNB and obtained many holders. Binance has a strong brand, a valuable token, and a high level of trust from the community. They thoroughly planned their tokenomics prior to launch and continue to adapt their tokenomics model to current market conditions.

Quantitative Tokenomics

Market Capitalization: The market capitalization of BNB is just over $68 billion, just higher than publicly traded companies like Moderna ($66.86B), Uber ($66.56B), and Ford ($65.49B) [34].

Maximum Supply: BNB has a maximum supply of around 116 million BNB. Originally, this number was 200 million BNB. The distribution was as follows:

Initial Coin Offering - 100 Million BNB Binance's Team (to be distributed over the next 5 years) - 80 Million BNB Angel investors - 20 Million BNB

This distributed BNB to various stakeholders, while maintaining a maximum supply of 200 Million BNB. However, the current maximum supply is lower because Binance has executed multiple burns. See more information in the Inflation, Mint & Burn Rate section. There is no way to increase the maximum supply of BNB.

Circulating Supply: The circulating supply is equal to the maximum supply, indicating that the token economy has matured to the point of releasing all tokens. Both the maximum supply and the circulating supply will always be equal to their current value or less, depending on future token burns.

Inflation, Mint & Burn Rate: BNB is a deflationary token because Binance has plans in place to burn tokens following a schedule. Binance originally used 20% of profits each year to burn an equivalent amount of BNB. In 2022, Binance shifted to utilizing a “BNB Auto-Burn” formula to determine the amount of BNB to burn that quarter [35]:

By reducing the total supply of BNB, each holder of BNB owns a larger proportion of the total supply. This rewards stakeholders and gives a deflationary nature to the BNB ecosystem. Binance will continue burning BNB each quarter until the total supply is 100 Million. Binance planned quarterly burns prior to even launching the token.

Historical burns are shown below:

Summary

Since its launch in 2017, BNB has performed well relative to other tokens. It has gained a large amount of market share and its total market cap surpasses many well known, highly-valued public companies. Binance carefully planned out its tokenomics prior to token launch, including the future burn schedule. The company successfully distributed all tokens into circulation, and follows protocols for quarterly burns. This allows the ecosystem to experience deflation rather than inflation, rewarding stakeholders and holders of BNB and countering inflation. Binance also strategized token utility, ensuring that BNB would attract users and benefit all parties. Altogether, these features incentivize ownership and use of BNB, which leads to increased demand. Increased demand paired with an ever-lower supply (due to burns) would result in increased price. Binance is a prime example of a healthy token launch backed by strong tokenomics procedures and planning.

Uniswap

Background

Uniswap is one of the world's largest decentralized exchanges based on visits, users, and daily volume [37]. A large majority of the world's cryptocurrency trading takes place on centralized exchanges like Binance. The alternative to centralized exchanges are decentralized exchanges, which are not governed by a central authority. Rather, the code of the protocol organizes and executes buy and sell orders for an asset and individuals provide liquidity to the market.

Decentralized finance has increased in total value locked year after year, while traffic to decentralized exchanges has also increased [38]. Currently, the “DeFi market dominance” is 6.4%, meaning that DeFi projects and protocols make up 6.4% of market capitalization of the entire cryptocurrency market [37]. As a leading decentralized exchange, Uniswap has helped facilitate many of these trades.

Uniswap became the world's highest-volume decentralized exchange a year and a half after its launch, and then SushiSwap emerged as a competitor. SushiSwap was a fork of Uniswap, meaning it took most of Uniswap's code but either slightly tweaked it or added features. One major difference between Uniswap and SushiSwap was tokenomics. SushiSwap had a governance token, while SUSHI and Uniswap did not.

That is, until Uniswap launched its UNI token in November of 2018. Despite losing some market share to SushiSwap, Uniswap emerged dominant in the world of decentralized exchanges – with much credit going to its tokenomics launch strategy [39]. Uniswap launched its token through an airdrop to the community and a liquidity pool (like an LBP). The airdrop to the community contained 15% of the genesis UNI supply. 400 UNI tokens were gifted to early users of the protocol and contributors to the project. At the time of writing, prices make the airdrop worth about $4200 [40]. Over time, the price success of UNI led to increased publicity over the “free money” that was dropped, increased brand awareness, trust, and overall market share for Uniswap.

Token Utility

Uniswap's token, UNI, is the protocol's governance token. Its primary function is governance over the Uniswap protocol. Token holders exercise their governance power by voting on major decisions the protocol needs to make, including decisions on how to allocate funds within the Uniswap governance treasury.

Beyond governance power, UNI's token is potential revenue share from Uniswap's generated revenue [41]. The governance contract contains a fee switch, which enables UNI holders to earn a portion of the protocol's fees if activated [42].

Quantitative Tokenomics

Market Capitalization: The market capitalization of Uniswap is smaller than that of the aforementioned crypto tokens. While it's one of the largest market caps in the DeFi space, Uniswap ranks lower among CeFi (centralized exchanges) due to DeFi market share at only around 6% of total market.

Maximum Supply: The maximum supply of UNI is 1 billion crypto tokens. Since the circulating supply has not yet reached maximum supply, Uniswap is still in the process of releasing tokens to the ecosystem. The rest of the tokens will be released over the next four years, with no exact date stated.

Circulating Supply: In its initial airdrop, 60% of the maximum supply of UNI was gifted to the community [44]. That 60% represents 600 million of the 689 million crypto tokens currently in circulation. Because the circulating supply is lower than the maximum supply, we can infer that the UNI ecosystem is still maturing and releasing new tokens over time. Uniswap is distributing the remaining 40% of UNI supply to team members, investors, and advisors following a four-year distribution plan [44].

Inflation, Mint & Burn Rate: As Uniswap is still releasing its UNI governance tokens into the ecosystem, it has not undergone any burn events yet. The tokens released over the next four years will be distributed as follows: 53.8% for team members and future employees, 44.5% to investors, and 1.7% to advisors. There is no mathematical or formulaic schedule for the release of these tokens, just that they will be released over the next four years and include vesting periods. Therefore, the “mint rate” will vary. These decisions will likely be made by UNI holders, as they exercise their governance rights for holding UNI tokens.

Summary

Uniswap used tokenomics and its token launch to remain dominant in the space when a competitor entered, and the move was wildly effective. The UNI airdrop is regarded as one of the most famous in the space and is still widely referenced within the cryptocurrency community. The Uniswap team also had careful planning pre-token launch and had plans for the future of their tokenomics that were flexible and reasonable. The UNI ecosystem is still growing and more tokens are being distributed into the space, but by allocating future tokens to key stakeholders of Uniswap, risks of rug pulls or sell offs are mitigated.

Conclusion

As cryptocurrency gains in popularity and market cap, the ecosystem is rapidly evolving. The terminology surrounding this expanding world is evolving with it, which can cause confusion. To summarize:

Coins are native to their own blockchains, while tokens are not. There are many types of tokens:

Security Tokens Utility Tokens Transactional Governance Commodity

Tokenomics is the process of designing a token launch and the study of “token economics.” Key tokenomics quantitative parameters to each token ecosystem are:

Maximum Supply Initial Supply Circulating Supply Mint Rate Burn Rate

It's important to note whether a token ecosystem is inflationary or deflationary, and the contributing factors. This offers valuable information about the maturity of the ecosystem and potential price trends for the future. Another quantitative factor to look at is how the token was initially launched.

Token launches come in many shapes and sizes, each with a different strategy and purpose:

Simple agreement of future tokens (SAFTs) Liquidity bootstrapping pools (LBPs) Auctions Airdrops

These are useful depending on the objective of the project and the structure of the organization. Centralized exchanges will have to take different steps to remain compliant, compared to a decentralized protocol. Decentralized protocols have a higher occurrence of airdrops to users.

Looking at three iconic tokens in the ecosystem, some of this knowledge can be directly applied. Dogecoin was a project that started as a joke and lacked careful planning and a strategic token launch, which can be seen in its current inflationary nature and price trending downward. Binance released BNB and had one of the most successful token launches for a centralized exchange. They still monitor the ecosystem and burn tokens to incentivize ownership of the token along with offering other benefits within their Binance ecosystem. Uniswap launched the UNI token in one of the most famous airdrops in history, and utilized token strategy to regain market share from a daunting competitor. Uniswap also planned its tokenomics and it paid off for the protocol, but they are not as mature as BNB and are still releasing tokens.

Tokenomics is imperative to any protocol, project, or centralized company that plans to launch a token. There are a multitude of factors to be carefully considered, both prior to launch and long after. The basics are covered here and exemplified by DOGE, BNB, and UNI.

[1] What is a Token? Coinbase.

[2] Gas and Fees. Ethereum.

[3] Are Token Assets The Securities of Tomorrow? Deloitte.

[4] Security Tokens vs. Utility Tokens: A Concise Guide. Blockchain Council.

[5] Brave Wants to Destroy the Ad Business by Paying You to Watch Ads in Its Web Browser. Gizmodo.

[6] Understanding Different Types of Coins and Tokens in Crypto. BitKE.

[7] How Blockchain Could Disrupt Banking. CB Insights.

[8] Natural Asset & Commodity Tokens. Coursera.

[9] What is Tokenomics? CoinMarketCap.

[10] Max Supply. CoinMarketCap.

[11] Token Liquidity — The Key to Success For Blockchain Startups. Medium.

[12] Circulating Supply. Binance.

[13] Understanding Tokenomics: The Real Value of Crypto. Finextra.

[14] What Does It Mean to Burn Crypto? CoinDesk.

[15] Decentralized Autonomous Organization (DAOs) and Continuous Organizations (COs). Limechain.

[16] What Is a Crypto Airdrop? CoinDesk.

[17] Auction. CoinMarketCap.

[18] Simple Agreement for Future Tokens (SAFT). Investopedia.

[19] Simple Agreement for Future Tokens (SAFT). Corporate Finance Institute.

[20] FAQ - Balancer V1. Balancer.

[21] Stargate ($STG) Spikes 116.6% since Alameda Research Snipe All The Tokens on Auction. Yellowblock.

[22] [Learn] Requirements & How to Claim Your 400 UNI. UniSwap.

[23] Uniswap's 2020 UNI Airdrop Now Worth $12,000. Crypto Potato.

[24] Dogecoin (DOGE). Investopedia.

[25] Dogecoin (DOGE). CoinGecko.

[26] Tesla Starts Accepting Once-Joke Cryptocurrency Dogecoin. BBC.

[27] Dogecoin. CoinMarketCap.

[28] Largest Companies By Market Cap. Companies Market Cap.

[29] Top Cryptocurrency Spot Exchanges. CoinMarketCap.

[30] The Valuation of Crypto-Assets. EY.

[31] Binance to Retain the 25% Trading Fee Discount When Using BNB. Binance.

[32] Binance.US Referral Program | Frequently Asked Questions. Binance Support.

[33] Binance Launchpad Lottery Ticket Allocation Rules. Binance.

[34] Largest Companies By Market Cap. Companies Market Cap.

[35] 18th BNB Burn. Binance.

[36] BNB Burn History. Coin-Tools.

[37] Top Decentralized Exchanges on CoinGecko by Trading Volume. CoinGecko.

[38] Decentralized Exchange (DEX) Trading Volume Charts. The Block.

[39] Exploring Popular Decentralized Exchanges. Gemini.

[40] Uniswap (UNI). CoinGecko.

[41] IntoTheBlock Report: How DEXs Use Incentives and Tokenomics to Generate Revenue. Yahoo! Finance.

[42] Temperature Check - Ultrasound UNI [Fee Switch Organization Funding]. Uniswap.

[43] Uniswap. CoinMarketCap.

[44] Introducing UNI. Uniswap.