This article originally appeared on QMR.ai, written by Martin Mayer

Please note that this article is for general informational purposes only. All screenshots are for illustrative purposes only. The views and opinions expressed are those of the author and do not reflect or represent the views and opinions of Alpaca. Alpaca does not recommend any specific securities, cryptocurrencies or investment strategies.

In this article, we will go through the basics of creating a fully working trading algorithm for cryptocurrencies and even connect it to Alpaca in order to trade. Of course, Python is the natural choice for such a task! Also, this video follows along with the article. Let’s get started.

Setting up an Alpaca account

Before diving into the code, we will have to create a free brokerage account in Alpaca Markets. This brokerage firm specializes in offering an excellent API for us to the interface, fetch live market data, and even place our orders.

There is nothing special to the registration form, so I’ll give you some credit and assume that you managed to create your account.

Once you’ve logged into your newly created account, you’ll be able to choose the “Live” (real money) account or the “Paper” account. In order to reduce the cost of your journey towards mastering algorithmic trading, I urge you to start by using your “Paper” Account. You can switch to this account on the top-right drop-down under Alpaca’s logo.

Once in there, click on the “View” button under the API Keys section, and go ahead and copy both strings.

That’s it – now let’s get to the fun part: coding our first algo trading script!

Getting started with Alpaca’s API with Python

Setting up our script

If you don’t already have Alpaca’s library installed, go ahead and do it:

pip install alpaca-trade-api Start a new Jupyter notebook or a blank file and import the required libraries:

from alpaca_trade_api.rest import REST, TimeFrame

import pandas as pdLet’s also set a few parameters that we will use throughout the tutorial. Replace the keys with your own ones!

BASE_URL = "https://paper-api.alpaca.markets"

KEY_ID = <YOUR_ALPACA_KEY>

SECRET_KEY = <YOUR_ALPACA_SECRET_KEY>Getting historical data from Alpaca’s API

Now, we are ready to connect to the API and request our first DataFrame of historical data for, say, Bitcoin.

# Instantiate REST API Connection

api = REST(key_id=KEY_ID,secret_key=SECRET_KEY,base_url="https://paper-api.alpaca.markets")

# Fetch 1Minute historical bars of Bitcoin

bars = api.get_crypto_bars("BTCUSD", TimeFrame.Minute).df

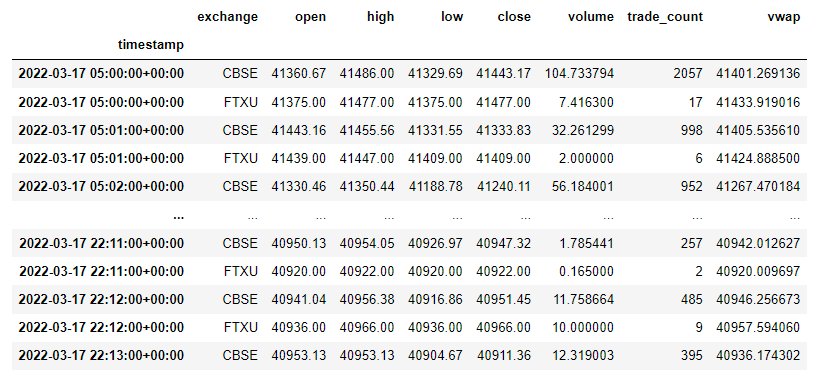

You might have seen that we are receiving prices from multiple exchanges. Currently, Alpaca routes its client’s orders to FTXU, but we will stick to CBSE (Coinbase) for doing our calculations. This is due to the fact that FTXU is somewhat illiquid and thus has missing data for 1Minute bars, whereas Coinbase is one of the most active cryptocurrency exchanges.

# Filter data by exchange

bars = bars[bars.exchange == 'CBSE']

print(bars)Submitting orders on Alpaca’s API

Submitting orders to Alpaca is as simple as it gets. Throughout this lesson, we will stick to trading with market orders.

# Create a market order to buy 1 Bitcoin

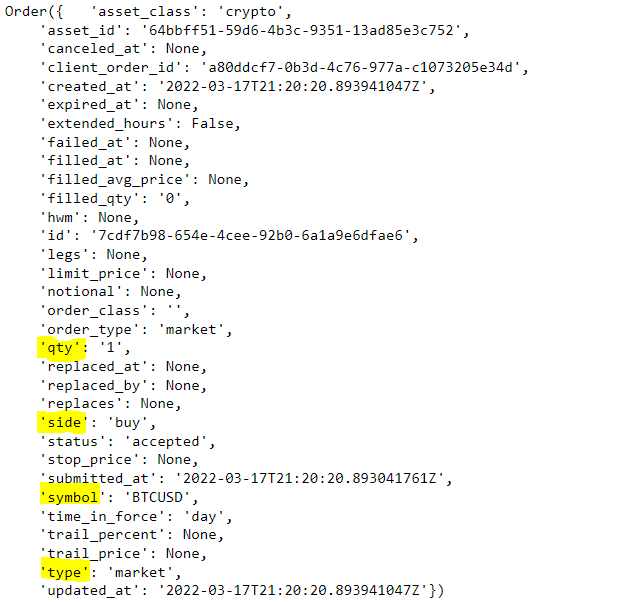

order_buy = api.submit_order('BTCUSD', qty=1, side='buy')This will not only submit an order on the exchange but also return an object of Order type:

# Create a market order to sell 1 Bitcoin

order_sell = api.submit_order('BTCUSD', qty=1, side='sell')It is also easy to find out what your current position is on a given asset.

# Get current position on Bitcoin. Yields error if we don't hold any

api.get_position('BTC')

# Get all positions and find out if we hold any Bitcoin

positions = api.list_positions()

position_qty = 0

for p in positions:

if p.symbol == 'BTCUSD':

position_qty = float(p.qty)

print(position_qty)Having seen the most important features that we will need, it is time to move on to something more useful and create an algorithm that buys and sells in the purest random way possible: by flipping a coin!

Don’t worry, this is just to set up our logic. Later, we will go ahead and create a strategy consisting of two moving averages crossing each other.

Creating a simple trading algorithm

A completely random trading algorithm

This first algorithm is very basic and consists of flipping a coin to check if we should buy or sell Bitcoin. Additionally, we only buy if we don’t already have a position. Conversely, we sell only when we currently have Bitcoin in our portfolio.

Let’s first take the previous script that checked our current position and turn it into a function we can reuse:

def get_position(symbol):

positions = api.list_positions()

for p in positions:

if p.symbol == symbol:

return float(p.qty)

return 0Now, let’s go to the algorithm itself. In order to debug and keep track of what is going on, I took the liberty to aggressively print out almost everything.

import random

SYMBOL = 'BTCUSD'

while True:

# GET OUR CURRENT POSITION

position = get_position(symbol=SYMBOL)

# SCIENTIFICALLY CHECK IF WE SHOULD BUY OR SELL

gods_say_buy = random.choice([True, False])

print(f"Holding: {position} / Gods: {gods_say_buy}")

#CHECK IF WE SHOULD BUY

if position == 0 and gods_say_buy == True:

# WE BUY ONE BITCOIN

print('The gods have spoken:')

print(f'Symbol: {SYMBOL} / Side: BUY / Quantity: 1')

api.submit_order(SYMBOL, qty=1, side='buy')

#HECK IF WE SHOULD SELL

elif position > 0 and gods_say_buy == False:

# WE SELL ONE BITCOIN

print('The gods have spoken:')

print(f'Symbol: {SYMBOL} / Side: SELL / Quantity: 1')

api.submit_order(SYMBOL, qty=1, side='sell')

print('Lets wait for the gods to manifest again...')

print("*"*20)

time.sleep(10)In order to improve our odds, I resorted to some kind of higher being, which I simply referred to as “the gods.” The code is pretty much self-explanatory, but in a nutshell, we have an infinity loop that checks every ten seconds if the gods want us to buy Bitcoin or not. Depending on whether we hold a position or not, we obey their wishes.

A Rule Based (Moving Average Crossover) Trading Algorithm

This algorithm will follow a trading strategy that consists of two moving averages. The first one, which we’ll call “Fast” will consist of calculating the average of the closing price during the previous 12 minutes. On the other hand, we have the “Slow” moving average, which acts the same but contemplates the closing price of the previous 24 minutes.

They are called “fast” and “slow” for a very simple reason: each new price has a greater impact on the “Fast” moving average because we use fewer periods in our calculation. The entire script looks as follows (it assumes that we already started the API and imported the previous libraries).

from datetime import datetime, timedelta

import math

import time

SYMBOL = 'BTCUSD'

SMA_FAST = 12

SMA_SLOW = 24

QTY_PER_TRADE = 1

# Description is given in the article

def get_pause():

now = datetime.now()

next_min = now.replace(second=0, microsecond=0) + timedelta(minutes=1)

pause = math.ceil((next_min - now).seconds)

print(f"Sleep for {pause}")

return pause

# Same as the function in the random version

def get_position(symbol):

positions = api.list_positions()

for p in positions:

if p.symbol == symbol:

return float(p.qty)

return 0

# Returns a series with the moving average

def get_sma(series, periods):

return series.rolling(periods).mean()

# Checks whether we should buy (fast ma > slow ma)

def get_signal(fast, slow):

print(f"Fast {fast[-1]} / Slow: {slow[-1]}")

return fast[-1] > slow[-1]

# Get up-to-date 1 minute data from Alpaca and add the moving averages

def get_bars(symbol):

bars = api.get_crypto_bars(symbol, TimeFrame.Minute).df

bars = bars[bars.exchange == 'CBSE']

bars[f'sma_fast'] = get_sma(bars.close, SMA_FAST)

bars[f'sma_slow'] = get_sma(bars.close, SMA_SLOW)

return bars

while True:

# GET DATA

bars = get_bars(symbol=SYMBOL)

# CHECK POSITIONS

position = get_position(symbol=SYMBOL)

should_buy = get_signal(bars.sma_fast,bars.sma_slow)

print(f"Position: {position} / Should Buy: {should_buy}")

if position == 0 and should_buy == True:

# WE BUY ONE BITCOIN

api.submit_order(SYMBOL, qty=QTY_PER_TRADE, side='buy')

print(f'Symbol: {SYMBOL} / Side: BUY / Quantity: {QTY_PER_TRADE}')

elif position > 0 and should_buy == False:

# WE SELL ONE BITCOIN

api.submit_order(SYMBOL, qty=QTY_PER_TRADE, side='sell')

print(f'Symbol: {SYMBOL} / Side: SELL / Quantity: {QTY_PER_TRADE}')

time.sleep(get_pause())

print("*"*20)

You might be wondering what the get_pause function is all about. Basically, since we are trading with 1Minute data, we want to run the loop every 60 seconds. Not only that, but we would also like to start each iteration at the start of each minute in order to get the most recent 1Minute bar as soon as it is available to us.

The get_position function is the exact same as in the random algorithm, whereas get_signal checks whether the most recent “Fast” moving average is greater than the “Slow” one.

Get bars fetches 1-minute bars for our target asset, keeps only the rows that correspond to Coinbase (exchange equal to ‘CBSE’) and adds both moving averages before returning the DataFrame.

Conclusion

Due to the fact that we covered all the basics to get started with algorithmic trading, this article ended up being longer than what I initially estimated it to be. Regardless, it has only equipped you with the tools to start creating your own rules.

Having said that, there’s a huge amount of topics covered here: we created an alpaca account and generated our API keys, installed all the required libraries, played with the basic functionalities of Alpaca’s endpoints, created a basic random strategy, and finally created a rule-based (albeit also simple) strategy.

About the Author

With an academic background in economics and financial engineering, in addition to having extensive programming experience, Martin Mayer works as the lead quantitative developer at Quantitative Methods Research. Before working as an algorithmic developer at Isola Capital, he worked as a mathematical modeler at Macroconsulting, a boutique consulting firm catering its services to the WB, UN, and the IDB, among others.

All investments involve risk and the past performance of a security, or financial product does not guarantee future results or returns.There is no guarantee that any investment strategy will be successful in achieving its investment objectives. Diversification does not ensure a profit or protection against a loss. There is always the potential of losing money when you invest in securities, or other financial products. Investors should consider their investment objectives and risks carefully before investing.

Alpaca does not prepare, edit, or endorse Third Party Content. Alpaca does not guarantee the accuracy, timeliness, completeness or usefulness of Third Party Content, and is not responsible or liable for any content, advertising, products, or other materials on or available from third party sites

Please note that this article is for informational purposes only. The example above is for illustrative purposes only. Actual crypto prices may vary depending on the market price at that particular time. Alpaca Crypto LLC does not recommend any specific cryptocurrencies.

Cryptocurrency is highly speculative in nature, involves a high degree of risks, such as volatile market price swings, market manipulation, flash crashes, and cybersecurity risks. Cryptocurrency is not regulated or is lightly regulated in most countries. Cryptocurrency trading can lead to large, immediate and permanent loss of financial value. You should have appropriate knowledge and experience before engaging in cryptocurrency trading. For additional information please click here.

Cryptocurrency services are made available by Alpaca Crypto LLC ("Alpaca Crypto"), a FinCEN registered money services business (NMLS # 2160858), and a wholly-owned subsidiary of AlpacaDB, Inc. Alpaca Crypto is not a member of SIPC or FINRA. Cryptocurrencies are not stocks and your cryptocurrency investments are not protected by either FDIC or SIPC. Please see the Disclosure Library for more information.

This is not an offer, solicitation of an offer, or advice to buy or sell cryptocurrencies, or open a cryptocurrency account in any jurisdiction where Alpaca Crypto is not registered or licensed, as applicable.