Any opinions expressed are opinions of the host and their guests. Alpaca Securities LLC does not recommend any specific investments or investment strategies.

Fintech Underground by Alpaca is a podcast devoted to all topics related to stock trading and APIs. From trading with algorithms or connecting apps or building out services, we aim to bring light to the different corners of Fintech.

TL;DR

On our eighth episode of Fintech Underground by Alpaca we interviewed James Kardatzke. As the CEO, and co-founder of Quiver Quantitative an up-and-coming alternative data platform, James discusses how they aim to bridge the information gap between wall street and non-professional investors with their datasets, API, and soon to launch mobile app

Summary

Offering alternative data sets such as sentiment analysis of the popular Reddit forum wallstreetbets to corporate jet flights to political beta, James joins us today to talk about starting Quiver Quantitative. Originally just a side project with his twin brother Chris, James discusses the almost two dozen datasets available along with some background on how they decide which datasets to add. Moving to their API, James touches on the launch and the different use cases Quiver Quantitative targets. Additionally, he explains their roadmap for the future which includes a soon-to-launch mobile app, brokerage integrations, and more!

Find the full transcript below. To hear more CEO/Founders of the most interesting Fintech companies speak about their experience in the industry check out our other episodes below

Full Transcript

Jason: [00:00:00] Welcome to FinTech Underground by Alpaca, a podcast devoted to stock trading API from trading with algorithms to connecting apps, to building out services Alpaca is built for developers and traders. And with that being said, let's get started. Hello everybody. Welcome back to FinTech underground by Alpaca.

In each episode, we aim to explore a different area within FinTech. I'm incredibly excited for today's episode, featuring James, the CEO, and co-founder of Quiver Quantitative and an up-and-coming alternative data platform. Along with our host, Yoshi CEO and co-founder of Alpaca, this episode is not one to be missed. Offering alternative data sets such as sentiment analysis of the popular Reddit forum wallstreetbets to corporate jet flights to political beta users can find alternative data, spanning a variety of interests along with an easy to use API and an upcoming mobile app Quiver Quantitative aims to bridge the information gap between wall street and non-professional investors. So let's get started.

Yoshi: [00:00:59] Hello, James, how are you?

James: [00:01:00] Hello Yoshi how are you?

Yoshi: [00:01:02] I really wanted to say thank you for taking your time to appear on our podcast today, FinTech Underground. I know we have a lot to talk about, but firstly, can you introduce yourself and about your company?

James: [00:01:12] Yeah. So my name is James Kardatzke and the CEO of Quiver Quantitative. Quiver Quantitative is an alternative data platform and specifically, we are an alternative data platform designed for retail investors.

So, what we do is we basically scrape interesting data sets from around the web, things that we think might be useful for making better investment decisions. And then we provide that on an easy-to-use platform where retail investors can sign up and start tapping into these data sets.

Yoshi: [00:01:37] I've been looking at your website and like, you know, I just see many kinds of funky, very unique data sets.

Right. The first thing I just want to really ask you, like, how do you come up with this you know, really cool, interesting datasets ideas.

James: [00:01:51] Yeah. So alternative data is actually been pretty popular in the hedge fund industry and among professional investors in general for the last decade or so it's around a $2 billion market.

Now, you know, with hedge funds, many of them are spending tens or hundreds of millions of dollars a year to collect these unique data sets. So there's already kind of, you know, some established literature and like information out there about what's already being used in the hedge fund industry. Well, we're kind of trying to do is take some of these data sets that are already being widely used on wall street, and then go out there scrape and collect them ourselves and make them available to anyone who wants to use them.

So to a certain extent, you know, we're just kind of trying to keep our ear to the ground to see what's being used by the professionals. But then we also pay pretty close attention to what retail investors really care about right now. And then try to go out there and find interesting and unique data sets that can give them some more, I guess, quantitative information about those fields.

Yoshi: [00:02:43] So you're saying that like many of these data sets that's on this website, so I'm just going to read it out. Like Senate trading, House trading, Wikipedia page views, and to the, you know, work visas for like state by state. When I looked at it, wow, this is really interesting data I really never thought about, but you're saying that these are already kind of a pretty natural, that like a lot of professional wall street guys are using already.

James: [00:03:08] Yeah. So it definitely varies case by case, but for many of these, you know, when you think about things like tracking social sentiment or tracking what retail investors are talking about on different forums, these are the things that wall street, or at least certain funds on wall street, have been paying attention to for several years.

So we kind of view ourselves as like the intersection there where we want to find things that are, you know, you're able to extract alpha from you're able to find unique investment insights from. But then we're also looking for things that are, I guess intuitive for people who may not have a deep financial or deep data science background, and that are kind of accessible for retail investors and people who may not have decades of experience in the professional investing industry.

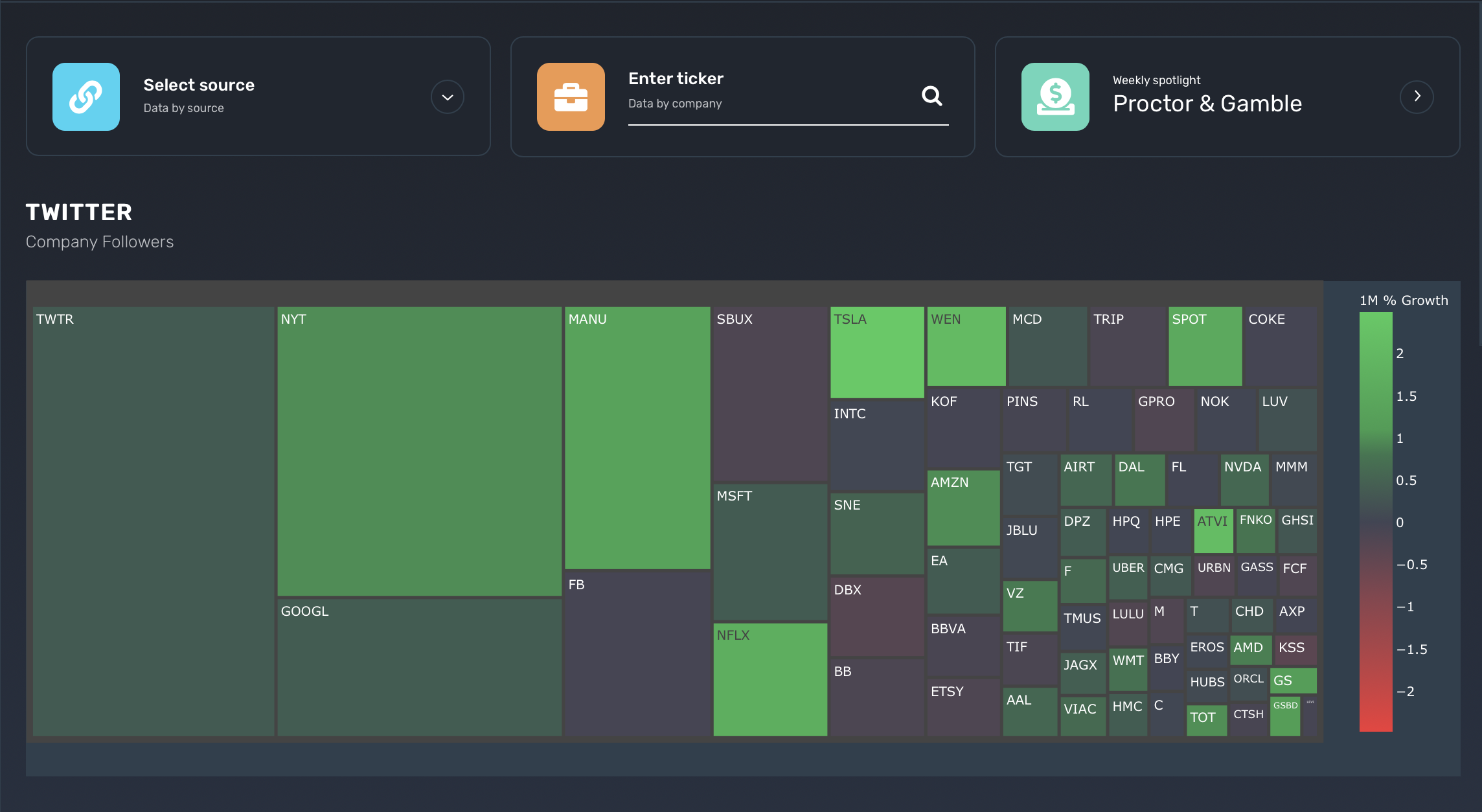

Yoshi: [00:03:48] Because I think like when you think about social sentiment, there's like, of course, Twitter feed, or like even Stocktwits feed and the wallstreetbets discussion. This is, you know, a part of that, your, your dataset, but for example, like how does work visas you know, how the people use this kind of dataset?

James: [00:04:05] The work via data that's kind of an interesting way to think about which companies might be hiring or adding new workers. You can also look into that data and see what sort of positions different companies are adding. And then also what sort of wages those companies are paying. So again, like this is something that's fairly popular, you know, being able to track which companies are hiring and expanding and which companies may be growing and shrinking their workforce.

It can be a good way to kind of think about just a company's path in general.

Yoshi: [00:04:28] So like, you know, the visa status, because affects a lot of worker numbers of the employees, each of the companies are employing, got it. That reminds me of those parking lot, like satellite image kind of stuff.

James: [00:04:40] Yeah that is a classic example is, you know, there, there are some alternative data companies who will put up satellites over at Walmart's parking lot or something to see how many cars are going in and out. Front run the earnings numbers, but yeah, that's one of my favorite examples.

Yoshi: [00:04:54] What is the kind of like your favorite experience and the data set that you've found, or like, you know, or even you're working on right now that you want to share, that you felt like major, super excited about

James: [00:05:06] One of my favorite stories that were one of the things that got me really into alternative data in the first place was hearing about a hedge fund that used corporate private jet logs so that the hedge fund would track where each corporate private jet was departing from and then arriving to, and by tracking those jet logs, they're able to see that there's one company Occidental Petroleum, who their private jet basically touched down in Omaha, Nebraska.

Which of course, you know, like Omaha that's where Berkshire Hathaway's based. That's where Warren Buffett's based. So this hedge fund professional is able to see that. And they actually predicted that the company was then going to have a major investment in it made by Berkshire Hathaway. So they were able to front-run that two weeks later, it turns out that was the case.

Berkshire Hathaway announced the acquisition and the company's stock jumped up like 15%. So those like just one really cool example I can think of how someone took an untraditional data feed. And then used it to take away really interesting insight. And you know, we ourselves have been kind of working with corporate flight data ourselves a little bit through Quiver but that's just one of my favorite datasets, just in terms of how out there and how unique it is.

Yoshi: [00:06:13] That really makes me feel like if I can make money with getting those alternative data and I can be a hedge fund, like are there any data source or how do you get that kind of news or information because I think firstly, you have to learn or figure out what's really happening because you're saying that like you're trying to firstly get what already hedge funds are using to be distributed to the retail. Right? So like you firstly need to learn about what they're doing. Like how are you getting that information in use?

James: [00:06:44] Yeah. So it depends on data set by data set. But our process generally is after we identify an area that we think might be interesting or useful, we go out there and we try to find a public data source or you know something that we're able to either scrape or access through a public API. And then in some cases, it means that we write a script that will scrape a website every hour or something and pull the data from that site updated into our database. And then we can distribute it through our web platform and through our API. In other cases, though, it's just as simple as tapping into a public API that a company already has set up.

So we can just pull the data directly, then do whatever processing we need to do on that. And then distributed to our user base.

You just so interesting in all those data, but how long you've been doing this company now?

Yeah. So it's been about a year and a half now. First started working on it in the winter of 2020

Yoshi: [00:07:34] And you recently, I guess like six months ago, released the API access to your product. How has been the kind of user reaction to your product in general? And how is it became different or like, bigger through API products?

James: [00:07:48] Yeah. So initially we just had the web platform where people could sign up and create a free account.

So it's been growing pretty consistently. We now have about 70,000 registered users on that core, just checking in, basically visiting the dashboard through our website quiverquant.com. Launching the API it's kind of a completely different ball game, where for that we have several different use cases that people can have through the API.

You know, first of all, you may have people who are just hobbyists or researchers who are interested in tapping into these data feeds and doing deeper back testing at it. You know, we've had several like professors or research students reach out, wanting to do a project like, you know, seeing if there's anything to be found in Senate trading data or like wallstreetbets data or something like that.

So we do have plans set up where it's, you know, easy for individuals who want to use it for non-commercial use to just tap into it and get fairly cheap access to all of these data feeds. We've also been working with some enterprises who want to integrate this data into their own product. So, you know, say that you're a brokerage who wants to be providing good research tools to users.

It's pretty easy through our API to sign up for a plan where you're able to license and then republish and redistribute our data so that you can start bringing that to your own users as well. Like that's really, we see a great way of kind of leveraging the power of this data, where we don't need to go out there and have people sign up to our platform. We can work with other platforms that already have a large user base and get our data plugged into their platforms that it can have a much wider reach and that more people can get use out of it.

Yoshi: [00:09:14] Something that like Alpaca should be doing. So thank you for mentioning that.

James: [00:09:21] Just saw that you launched your market data API this morning, actually.

Yoshi: [00:09:24] Yeah, I know. I know. That's what I'm saying.

Yeah. And then the final use cases, we've also been to work with some institutions who if you're doing algo trading or something, you can tie directly into these data feeds and start setting up automated strategies, trading off them. So those are kind of the three main areas that we see our API being used, the hobbyists, the enterprises, and then the institutions.

Wow. So how are you thinking about growing these data sets and you know, how are you trying to scale and ideate and do the research.

James: [00:09:56] So we've generally been adding about two new data sets to our platform every month. Other than that, like that's kind of driven by market news and kind of what people are finding topical.

Like we don't necessarily have like a game plan for like what data sets we're going to be adding for a platform six months from now. Generally, like I said, we just kind of keep our ear to the ground. I see what people are talking about a lot and then go out there and try to find new data that's relevant to that.

Cause I think in general, like, especially for retail investors, a lot of the value from these alternative data sets comes from you can find data on things that are super topical right now, but not, might not necessarily be topical six months from now. For example I think that's really opposed to kind of like a lot of these fundamental data sources where if you're looking at a company's income statement or their earnings report.

Like a lot of the data in that is going to be, you know, in terms of like the form, it's going to be pretty consistent quarter over quarter, going back several decades. And it's nice because you can like see an easy line. Like over time you can analyze it over a large period of time. But then what if you think about something like COVID, like, what if you think about something like the impact of the U S election.

Like these are things that are going to have a really big impact on the market for a short period. And they may not be super relevant after that, but we think it's still important that retail investors have a way to understand the impact of those events and then be able to make data-driven decisions on how they're going to respond to that.

So that's kind of how we think about like what data sets we're going to be going out there and acquiring is just kind of keeping an eye on what's relevant and then trying to match that. But in terms of just broader product development, we're also working on a mobile app right now that we're hoping to launch in mid June.

So we're really excited for that because a lot of our users to the platform have been coming from mobile devices. So. Hoping to give a better experience to those users.

Yoshi: [00:11:33] So could you tell me a little bit about this mobile app experience because you know, someone is hobbyist or more of the businesses or broker dealer partners they want to of course access to probably like you're more of the desktop, but how is that?

Like, you know, people are using your platform via mobile device already. And then because that person, she, or he will probably like place trades or do something. With that data to do some actions, right?

James: [00:11:58] Yes so right now, if someone's on mobile and they want to access our platform, basically they have to open their safari or their web browser or whatever, go to quiverquant.com and then just access it in browser.

So our mobile app we're attempting to replicate all the features that you can find on our desktop platform. And just bring it in a application format where it's optimized for mobile and like you kind of hinted at there. I think that that just makes the investing experience a lot better for a lot of these people, because you know, a lot of our users they'll be making trades through like Robinhood or Fidelity or another app on their phone where it becomes a lot easier if it's just a matter of like, you know, switching to the quiver app.

Getting whatever data you need to make your decision. And then switching back over to whatever app you're trading off of so that you can plug in that trade, you know, going forward. We want to have an even more integrated experience where, like I mentioned earlier, like we want to get our data onto these brokerage platforms so that people don't even need to switch back and forth between quiver and another venue.

They can just have the data right where they're making their trades and there doesn't need to be this. You know, split between the platforms they're using.

Yoshi: [00:12:59] Got it. Got it. That makes sense. Going back to the dataset, so you said like you were adding two per month, but how many of them do you have now?

James: [00:13:07] Yeah, so I think we have about two dozen data sets right now. Everything that we have isn't currently listed on the website there's a couple of data sets that were relevant for a certain period of time, but then are no longer relevant so we remove them. But yeah, in general, I think we've collected about two dozen different data sets, covering a pretty wide variety of topics.

Yoshi: [00:13:24] This is like almost in order to get the data sets that people want to be looking at is you even have to get that kind of sentiment, data of Twitter and the Reddit to see what's being talked about.

James: [00:13:37] Right. We're definitely pretty tied in some of those retail investing communities.

I mean, that's sort of seen a lot of our growth come from is just doing content marketing on sites like wallstreetbets they're like StockTwits so yeah, we're pretty tied into the community and we get pretty fast feedback from people on whether or not a new data sets actually interesting to them or not.

Yoshi: [00:13:56] It goes like your product itself is a content marketing contents. Yeah. So let's go into you James, but you started your career as a hedge fund manager, working for the hedge fund.

James: [00:14:08] Yes so kind of what was the direct precursor to starting !uiver was an internship I had at a hedge fund out in Boston.

That's where I first really got my first experience with seeing how alternative data was being used in a professional setting and kind of where I learned the ropes of like what it takes to go out there and collect some of these data sets.

Yoshi: [00:14:24] So you realize that like that's actually useful, you've seen it with your eyes that it's being used and you just kind of decided that, Hey man, like this can be pretty cool and useful for retail investors as well.

James: [00:14:34] Yeah, exactly. Yeah. I think my biggest takeaway was not only that it was really useful in the professional investment community, but also that you didn't really need to have a deep financial background or a deep data science background to make use of some of these data sets.

Like, you know, I think from the outside looking in, when you think of something like alternative data, you might think of something that requires a lot of like almost a quant background in order to really interpret and make use of. But in reality, a lot of these data sets, I think that you can draw pretty interesting insights from. You know, even if you're just a complete outsider to the investing world.

Yoshi: [00:15:04] That's so true because it just, that itself is not a number like, you know, the flights to Omaha or like which state is like have more H1 visa that's so like natural.

James: [00:15:17] I think there is a lot of room for making like qualitative drawing, like qualitative insights on the top of these quantitative data sources that we're trying to provide.

Yoshi: [00:15:25] And I think we touch it a little bit is I think like, why I'm so interested about this, is that how you can scale, right? Like, can you say like two data sets per month, but how are you thinking about your growth strategy?

Of course, like, you know, user base you continue to be very much connected to the community, but also in terms of the content, like, how are you thinking about growing that side?

James: [00:15:46] Yeah, so I guess in terms of scaling, like basically our growth so far has mostly come from like native content marketing, like I've said earlier, So just sharing our new data and our new data dashboards with these trading communities and then kind of letting them take over.

And, you know, some of our dashboards have gone viral and like wallstreetbets and things like that, where you know, there's like a bit of a self-propagating effect where if people like it, they'll share it with other people and that'll drive growth a lot. But for longer-term, I think that some of these enterprise partnerships are really where we see ourselves being able to reach a much broader audience and kind of continue to scale exponentially over time.

You know, we'd like to be able to be tied into a lot of these other brokerages and a lot of these other platforms that already serve millions of users. And I think that's kind of long run the best way that we can get our name out there as much as possible and continue growing quickly.

Yoshi: [00:16:34] How are you thinking about a growth strategy of the contents? To like increase two a month to like 20 new datasets a month.

James: [00:16:43] Yeah, exactly. Yeah. I mean, to a certain extent, I don't think that necessarily is something that I guess that we see as like a major area that needs to be scaled, like to a certain extent I think that there's a finite amount of data sets that are going to be really interesting, useful for people in a given month.

So, you know, I, I think that might be an area where that's not really a huge priority for us right now is like scaling out as many datasets. Because obviously if you're a retail investor using our platform, you don't want to be overwhelmed with 120 different data sets being thrown at you where you have no idea what's interesting or what you want to look into.

So we do kind of want to keep it somewhat limited so that we make sure that we get the data sets that are most relevant to people right now. And we're not just throwing a ton of numbers at them where they don't really know how to make use of it.

Yoshi: [00:17:25] That makes sense. So, and like in a lot of datasets that you're seeing is mainly kind of US-based data.

But like, are you thinking about getting some kind of data globally internationally as well?

James: [00:17:35] Yeah, it's definitely something we've thought about is right now we've been almost entirely focused on US equities, but we've done a little bit of work with crypto lately, but in general, I think that we'd like to expand our scope quite a bit over the next year to again, be looking at other regions and then also looking at other asset classes as well, because, you know, I think a lot of retail investors, aren't just focused on U.S. equities. Obviously, and that there's a lot of other interesting areas that we can start doing more digging into.

Yoshi: [00:18:01] Yeah. Because I feel like you know, this also connects to kind of global macro strategy too, right? Looking at how population or how the big trend is moving. So it's going to be really interesting. So turning your question into more about you.

Like you did an intern to hedge funds and you had experience there, but what made you really like trigger yourself to start your own company instead of working for the hedge funds or like, you know, other tech companies that you've already interned at that kind of industries.

James: [00:18:33] You know, originally Quiver wasn't really intended to be full like standalone company.

Like it kind of started as more of a hobby that my twin brother and I, who is my co-founder and CTO. We're working on where we started off by collecting data on wallstreetbets discussion. So we'd be scraping the discussion on that forum. We'd be publishing a dashboard and then sharing it with the wallstreetbets community.

So it was really only after, you know, shortly after we started doing that, we started seeing quite a bit of traction and you know, quite a bit of interest in this data. And then we started looking into some other datasets as well putting out data on like Senate and House trading. And it was kind of just a snowball effect where generally we began to realize that there was a lot of interest in this sort of stuff and that it was worth working on as like a standalone company.

So there definitely, wasn't a single moment where I like decided that I'm going to be doing this full-time versus a more traditional career path. But just because of the amount of traction we started seeing in the amount of interest we saw in it, it definitely you know, made sense that we start working on it as a full-time.

Yoshi: [00:19:30] And you were born and raised in Wisconsin. And like so you work with your brother f om like your home?

James: [00:19:39] Yeah. So right now we're working remotely from just back in our hometown. Basically our team is about six people. So we have four of our six members are based on Wisconsin.

Then we have two people out of state, but hoping actually here in the next couple of weeks, now that things are starting to open back up that we're going to be moving into an office down in Madison, Wisconsin. So. It'll be nice to actually meet all the members of my team in person pretty soon.

Yoshi: [00:20:00] That's exciting. And that's what you're planning to grow the team in the Wisconsin office?

James: [00:20:05] Yeah. I mean, we're, we're still obviously open to hiring people remote because it's worked out pretty well so far just having everyone calling into zoom meetings and stuff, but we didn't, we haven't necessarily needed to be in person, but it's definitely going to be nice seeing people face to face and we like hiring people around the Wisconsin area too, because we think there's a lot of talent coming out of the university down there.

Yoshi: [00:20:25] That makes sense. You know, we Alpaca we try to hire everyone from everywhere and I'm actually in Kyoto. Japan.

James: [00:20:34] What time is it over there now?

Yoshi: [00:20:35] I don't know. It's like 1:30 AM.

But yeah, like, I think what remote work allows us to do is like, we can be anywhere, but like, we still cannot fight or change that time zone especially like we're in a stock market. So like, you know, there are market hours. Yeah. So like how was like, you started this with your twin brother, but like, I think there's when you start a company with someone that close I'm sure that there are a lot of things going on, but like, how was your experience like pros and cons that you've seen so far ?

James: [00:21:10] At first, there's definitely a bit harder to adjust to make sure we're not stepping on each other's toes too much, because both of us have pretty strong opinions about stuff. And we tend to be kind of argumentative with each other just by nature. But over time we've definitely gotten a much better idea of what stuff's in his domain, what stuff's in my domain.

So we're not, you know, arguing over whether we want this button on this page be formatted in one way or the other, like basically it started working quite well, and we both obviously know each other quite well, so we know where we each have our strengths and weaknesses and can collaborate on it pretty effectively.

Yoshi: [00:21:43] So how are you thinking about taking your company to maybe like five to 10 years? Like, what is that like grand world domination plan for quiver in general?

James: [00:21:53] I think that in a lot of ways, alternative data is just as useful to retail investors as fundamental data is. But at the same time right now, it's just completely inaccessible.

Like it's very hard to find that. So in five to 10 years, we'd like to see alternative data be just as widespread and widely used as fundamental data is. So, you know, we'd like to have it be included in basically every major brokerage be included on like all the investment research sites, like Yahoo finance, like Bloomberg.

And we'd kind of like to be the driving force behind that. And I think that kind of starts with the API where it's just us licensing out the data to other brokerages and other institutions, enterprises who would like to tie it into their own platform. But then we'd also like to continue growing our own user base and getting more and more people coming to quiverquant.com and then the quiver app later on to start making their own investment decisions.

Yoshi: [00:22:42] Or maybe like making your own alternative data sets by yourself or something like data creation team.

James: [00:22:49] Yeah. I mean, we haven't attempted to make any datasets. On our own user’s behavior on our platform.

But, you know, at some point that something that might be interesting to look into.

Yoshi: [00:23:00] You know, it's, about getting the time but we always ask this question for our participants, but considering like these complex market decisions, then this involves money of course, and sensitivity around the data.

There are many things that, you have to care about because of course, working at a hedge fund, so you see it's a little bit different compared to other industries as well. And you know, there are lot little regulation compliance you know, around that. Like, so with that set, like, is FinTech worth it for you?

James: [00:23:30] Yeah, I'd say a hundred percent. You know, like you said, there is kind of a lot of compliance things that you have to think about. And just in general, maybe it's a little bit harder to get into than it might be in some other industries. But I think that there's a lot of super exciting stuff happening in FinTech right now.

Like I think the stuff that you guys are doing and the stuff that's being done at a lot of brokerages, like Robinhood is just, in general, making a super exciting space to work in right now, especially on the investing and the trading side of things. So, you know, personally, I can't really imagine doing entrepreneurship in any, any other field.

FinTech has been where all of my interest has been in. It's definitely, I think been a hundred percent worth it.

Yoshi: [00:24:06] That's great. You know, that's great to hear that. And like I just am very pumped up what you are doing it just personally interests me a lot about like what you're building.

So thank you very much for sharing your story James today. And thank you very much for coming to our podcast.

James: [00:24:19] Thank you for having me.

Jason: [00:24:21] I also wanted to thank all of our listeners for joining us today. On this episode of FinTech underground by Alpaca as always check on all of our past episodes and all major streaming platforms podcasts can be found. Thank you.

If you liked this episode of Fintech Underground by Alpaca make sure to check out our other episodes below

You can also follow Alpaca and our weekly updates on our LinkedIn and @AlpacaHQ on Twitter!

Brokerage services are provided by Alpaca Securities LLC ("Alpaca"), member FINRA/SIPC, a wholly-owned subsidiary of AlpacaDB, Inc. Technology and services are offered by AlpacaDB, Inc.