Please note that this article is for educational and informational purposes only. All screenshots are for illustrative purposes only. The views and opinions expressed are those of the author and do not reflect or represent the views and opinions of Alpaca. Alpaca does not recommend any specific securities or investment strategies. Investing and investment strategies involve risk, including loss of value and the loss of principal. Past performance does not guarantee future returns or results. Please consider your objectives before investing.

This article first appeared on Medium, written by Victor S.

There are so many articles on predicting stock prices, but this article provides two things to the reader, that no other article talks about:

- The use of confidence intervals in stock trading to determine stop-loss and take-profit

- The use of Alpaca in stock trading to track profits and test trading strategies

Both of which provide important tools to the next generation of machine learning trading algorithms.

Concept:

The program will consist of three main parts:

- The Data Setup

The data will be accessed via the yfinance library, in daily intervals, The data will include the opening,high,low and closing price of the asset. The data will be normalized and then reshaped to fit the neural network

- The Neural Network

The neural network will be a convolutional LSTM network that can extract the feature and also access temporal features of the dataset. This network fits the data because some of the complex patterns are not only convolutional, they are also time based.

- Creating Orders

The Neural Network will predict the daily opening and closing prices. If the opening prices is larger than the closing price, the network will short sell the stock. If the closing price is larger than the opening price, the network will buy the stock.

After training the network, I will compute the loss of the network and use this value as a a confidence interval, to determine the stop loss and take profit values. I will use requests to access the Alpaca API to make orders.

With the key concept in place, let’s move to the code.

The Code

Step 1 | Prerequisites:

from numpy import array

from numpy import hstack

from keras.models import Sequential

from keras.layers import LSTM

from keras.layers import Dense

from keras import callbacks

from sklearn.model_selection import train_test_split

from keras.layers import Flatten

from keras.layers import TimeDistributed

from keras.layers.convolutional import Conv1D

from keras.layers.convolutional import MaxPooling1D

from IPython.display import clear_output

import datetime

import statistics

import time

import os

import json

import yfinance as yf

from keras.models import model_from_json

import requests

from keras.models import load_model

from matplotlib import pyplot as pltThere are quite a lot of prerequisties of the program.They are spread out as so, to prevent importing the whole library and taking up space. Please note that importing clear_output from IPython.display is only for Jupyter notebooks. If you are using scripts it is not necessary to import this.

Step 2 | Access Data:

def data_setup(symbol,data_len,seq_len):

end = datetime.datetime.today().strftime('%Y-%m-%d')

start = datetime.datetime.strptime(end, '%Y-%m-%d') - datetime.timedelta(days=(data_len/0.463))

orig_dataset = yf.download(symbol,start,end)

close = orig_dataset['Close'].values

open_ = orig_dataset['Open'].values

high = orig_dataset['High'].values

low = orig_dataset['Low'].values

dataset,minmax = normalize_data(orig_dataset)

cols = dataset.columns.tolist()

data_seq = list()

for i in range(len(cols)):

if cols[i] < 4:

data_seq.append(dataset[cols[i]].values)

data_seq[i] = data_seq[i].reshape((len(data_seq[i]), 1))

data = hstack(data_seq)

n_steps = seq_len

X, y = split_sequences(data, n_steps)

n_features = X.shape[2]

n_seq = len(X)

n_steps = seq_len

print(X.shape)

X = X.reshape((n_seq,1, n_steps, n_features))

true_y = []

for i in range(len(y)):

true_y.append([y[i][0],y[i][1]])

return X,array(true_y),n_features,minmax,n_steps,close,open_,high,lowThis function takes data from yfinance and splits it into its respective sections. It also reshapes data into the form:

(n_seq,1, n_steps, n_features)A four-dimensional array to fit the Convolutional LSTM network.

Step 3 | Prepare Data:

Accessing the data is only half of the challenge. The rest is putting the data into the correct format, and splitting the data into training and testing datasets.

def split_sequences(sequences, n_steps):

X, y = list(), list()

for i in range(len(sequences)):

end_ix = i + n_steps

if end_ix > len(sequences)-1:

break

seq_x, seq_y = sequences[i:end_ix, :], sequences[end_ix, :]

X.append(seq_x)

y.append(seq_y)

return array(X), array(y)This function splits the sequence into time series data, by splitting the sequence into chunks of size n_steps.

def normalize_data(dataset):

cols = dataset.columns.tolist()

col_name = [0]*len(cols)

for i in range(len(cols)):

col_name[i] = i

dataset.columns = col_name

dtypes = dataset.dtypes.tolist()

# orig_answers = dataset[attr_row_predict].values

minmax = list()

for column in dataset:

dataset = dataset.astype({column: 'float32'})

for i in range(len(cols)):

col_values = dataset[col_name[i]]

value_min = min(col_values)

value_max = max(col_values)

minmax.append([value_min, value_max])

for column in dataset:

values = dataset[column].values

for i in range(len(values)):

values[i] = (values[i] - minmax[column][0]) / (minmax[column][1] - minmax[column][0])

dataset[column] = values

dataset[column] = values

return dataset,minmaxThis function changes all data into a value between 0 and 1. This is as many stocks have skyrocketed or nosedived. Without normalizing, the neural network would learn from datapoints with higher values. This could create a blind spot and therefore affect predictions. The normalizing is done as so:

value = (value - minimum) / maximumWhere minimum and maximum are the minimum and maximum values of the feature.

def enviroment_setup(X,y):

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.33)

return X_train, X_test, y_train, y_testThis function uses sklearn’s train_test_split function to shuffle the data and divide into training and testing datasets.

Step 4 | Create Neural Network:

def initialize_network(n_steps,n_features,optimizer):

model = Sequential()

model.add(TimeDistributed(Conv1D(filters=64, kernel_size=1, activation='relu'), input_shape=(None, n_steps, n_features)))

model.add(TimeDistributed(MaxPooling1D(pool_size=2)))

model.add(TimeDistributed(Flatten()))

model.add(LSTM(50, activation='relu'))

model.add(Dense(2))

model.compile(optimizer=optimizer, loss='mse')

return modelThis is the basic architecture of the Convolutional LSTM network. The optimizer that I found that works best with this network is Adam.

Step 5 | Train Neural Network:

def train_model(X_train,y_train,model,epochs):

dirx = 'something directory'

os.chdir(dirx)

h5='Stocks'+'_best_model'+'.h5'

checkpoint = callbacks.ModelCheckpoint(h5, monitor='val_loss', verbose=0, save_best_only=True, save_weights_only=True, mode='auto', period=1)

earlystop = callbacks.EarlyStopping(monitor='val_loss', min_delta=0, patience=epochs * 1/4, verbose=0, mode='auto', baseline=None, restore_best_weights=True)

callback = [earlystop,checkpoint]

json = 'Stocks'+'_best_model'+'.json'

model_json = model.to_json()

with open(json, "w") as json_file:

json_file.write(model_json)

history = model.fit(X_train, y_train, epochs=epochs, batch_size=len(X_train)//4, verbose=2,validation_split = 0.3, callbacks = callback)

return historyFor the training function, I used the criminally underused Model Checkpoint callback to save the best weights of the model. Change the dirx variable to where you want to store your model.

Step 6 | Evaluation and Prediction:

def load_keras_model(dataset,model,loss,optimizer):

dirx = 'something directory'

os.chdir(dirx)

json_file = open(dataset+'_best_model'+'.json', 'r')

loaded_model_json = json_file.read()

json_file.close()

model = model_from_json(loaded_model_json)

model.compile(optimizer=optimizer, loss=loss, metrics = None)

model.load_weights(dataset+'_best_model'+'.h5')

return model

def evaluation(exe_time,X_test, y_test,X_train, y_train,history,model,optimizer,loss):

model = load_keras_model('Stocks',model,loss,optimizer)

test_loss = model.evaluate(X_test, y_test, verbose=0)

train_loss = model.evaluate(X_train, y_train, verbose=0)

eval_test_loss = round(100-(test_loss*100),1)

eval_train_loss = round(100-(train_loss*100),1)

eval_average_loss = round((eval_test_loss + eval_train_loss)/2,1)

print("--- Training Report ---")

plot_loss(history)

print('Execution time: ',round(exe_time,2),'s')

print('Testing Accuracy:',eval_test_loss,'%')

print('Training Accuracy:',eval_train_loss,'%')

print('Average Network Accuracy:',eval_average_loss,'%')

return model,eval_test_lossAfter saving the best weights, load the model again to ensure that you are using the best weights. The program then evaluates the program, based on data that it has not seen before. It then prints a set of variables to give comprehensive insight on the training of the network.

def market_predict(model,minmax,seq_len,n_features,n_steps,data,test_loss):

pred_data = data[-1].reshape((len(data[-1]),1, n_steps, n_features))

pred = model.predict(pred_data)[0]

appro_loss = list()

for i in range(len(pred)):

pred[i] = pred[i] * (minmax[i][1] - minmax[i][0]) + minmax[i][0]

appro_loss.append(((100-test_loss)/100) * (minmax[i][1] - minmax[i][0]))

return pred,appro_lossThis is the function that makes the prediction of the program. We have to perform the inverse of the normalization function to get the value in terms of USD.

Step 7 | Create Order:

BASE_URL = 'https://paper-api.alpaca.markets'

API_KEY = 'XXXXXXXX'

SECRET_KEY = 'XXXXXXXX'

ORDERS_URL = '{}/v2/orders'.format(BASE_URL)

HEADERS = {'APCA-API-KEY-ID':API_KEY,'APCA-API-SECRET-KEY':SECRET_KEY}These are the basic parameters and endpoints to make alpaca orders. You can get your own API key and secret key here.

def create_order(pred_price,company,test_loss,appro_loss):

open_price,close_price = pred_price[0],pred_price[1]

if open_price > close_price:

side = 'sell'

elif open_price < close_price:

side = 'buy'

if side == 'buy':

order = {

'symbol':company,

'qty':round(20*(test_loss/100)),

'type':'stop_limit',

'time_in_force':'day',

'side': 'buy',

'take_profit': close_price + appro_loss,

'stop_loss': close_price - appro_loss

}

elif side == 'sell':

order = {

'symbol':company,

'qty':round(20*(test_loss/100)),

'type':'stop_limit',

'time_in_force':'day',

'side': 'sell',

'take_profit':close_price - appro_loss,

'stop_loss':close_price + appro_loss

}

r = requests.post(ORDERS_URL, json = order,headers = HEADERS)

print(r.content)This function applies the take profit and stop loss idea:

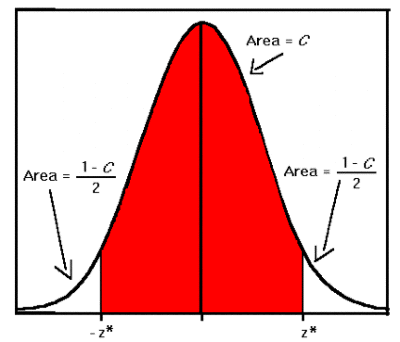

Take profit and prevent loss as the close price fluctuates along the predicted closing price.

The length between the borders of the red area and the center is the loss value. The borders act as the stop loss and take profit value, as these are the value that the program predicts the price will fluctuate within.

Conclusion

Machine Learning and Stock Trading come hand in hand, as both are the prediction of complex patterns.

I hope that more people will use the Alpaca API and confidence intervals when it comes to algorithmic trading.

My links

If you want to see more of my content, click this link.

Alpaca does not prepare, edit, or endorse Third Party Content. Alpaca does not guarantee the accuracy, timeliness, completeness or usefulness of Third Party Content, and is not responsible or liable for any content, advertising, products, or other materials on or available from third party sites.

Brokerage services are provided by Alpaca Securities LLC ("Alpaca"), member FINRA/SIPC, a wholly-owned subsidiary of AlpacaDB, Inc. Technology and services are offered by AlpacaDB, Inc. This is not an offer, solicitation of an offer, or advice to buy or sell securities, or open a brokerage account in any jurisdiction where Alpaca is not registered (Alpaca is registered only in the United States).