The world of automated trading and advanced strategies may feel out of reach for many retail investors, often requiring extensive coding knowledge or significant capital. However, as technology advances and barriers to entry are reduced, many financial platforms, like Composer, are aiming to level the playing field—increasing access to financial opportunities through easy-to-use platforms and artificial intelligence.

Composer is an investment platform where customers can build sophisticated algorithms using natural language, fundamentally changing the way people engage with the markets. We recently interviewed Ben Rollert, CEO and Co-founder of Composer, to discuss their growth since 2022. This includes the proliferation of their community, the implementation of new asset classes like crypto and options, and how they’re approaching building a platform for the next generation of investors.

Reshaping Investment Strategies Through Community

Founded in 2020 by Ben Rollert, Ananda Aisola, and Ronny Li, Composer Technologies' mission is to make investing software that feels fun, stimulating, and creative. The primary way they say they achieve this is with symphonies, their no-code, visual editor that allows users to build and backtest multi-strategy, hedge-fund like algorithms using artificial intelligence and natural language.

Symphonies can be created and shared by any Composer user with thousands currently available through their community where users actively share their strategies publicly. The development of the symphony marketplace has had profound effects on their growth. According to Ben, 80% of their users invest in community-built symphonies, creating a powerful flywheel of user adoption, retention, and mutual trust.

Another reason shared symphonies have such a large impact is that they allow users to navigate and engage with the market in potentially unique ways. For example, customers can either build their own hedge fund-like strategy for various market conditions, or they can invest in multiple symphonies in parallel. This diversification can create better risk-adjusted returns that are independent of market conditions.

Despite being a team of only 15 people, Composer has had outstanding growth in the past few years. Ben attributes this to his team, explaining, "Everybody on the team wants to work hard, and they're extremely talented. The other piece is extreme prioritization. We don't do too many things in parallel, because we can't. We do meaty projects sequentially. One of our biggest competitive levers is our organizational focus."

A Growing Partnership: Composer's Expansion into Options and Crypto with Alpaca

This organizational focus has had positive effects over the last few years as Composer has had substantial growth and implemented several product enhancements since their launch of US stocks and ETFs. Firstly, they integrated fully as a white-label solution with Alpaca, allowing customers to fund directly from their Alpaca account, creating a more seamless and polished user experience. They also upgraded their backend infrastructure, leading to more stability and reliability for their users.

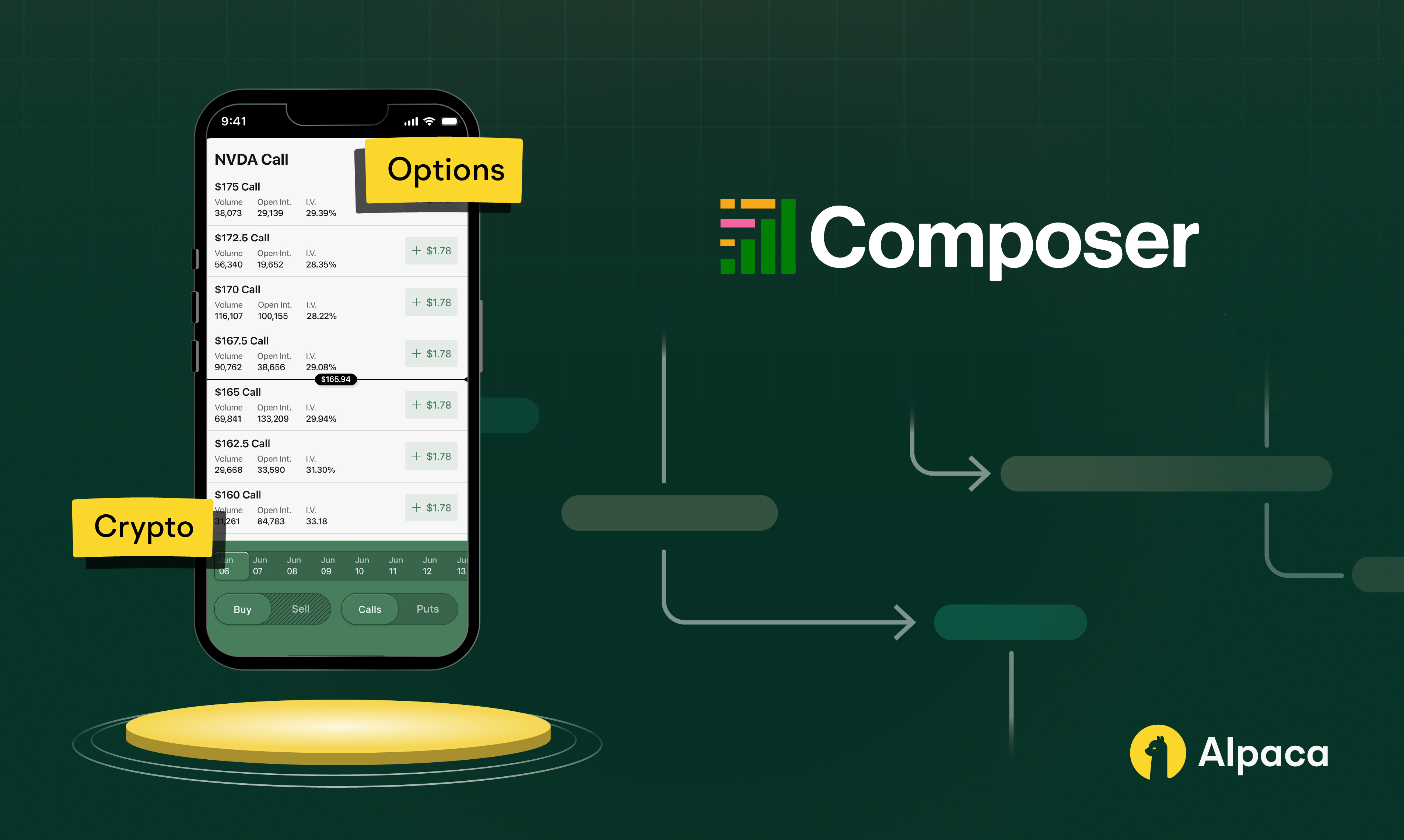

Secondly, they expanded their product offering to include crypto, and are on the verge of launching options trading, all powered by Alpaca’s Broker API. “Adding options trading to Composer represents the first step in bringing our data-driven, automated approach to the options market. Our research shows that upward of 60% of Composer users are currently trading options on other platforms, which fragments their trading workflow and separates their equity strategies from their options positions,” explains Ben. “Integrating options trading into Composer allows us to solve this immediate pain point while laying the foundation for the automation features our users have come to expect.”

As they launch options, they are focused on building a user experience that reflects their US stocks and ETFs product. “Composer users love the systematic, backtested approach and AI support they get with our equity strategies, and our goal is to eventually bring that same data-driven approach to their options trading,” continues Ben. “By adding this options integration, we're building toward what we believe will be the most intelligent trading platform in the market.”

Composer's growth has also been driven by their focus on leveraging AI and natural language within their symphonies. This emphasis on natural language enables a form of 'vibe trading,' allowing users to translate their trading strategies and hypotheses into actionable algorithms without traditional coding barriers.

With the addition of crypto and options, symphonies can be built on single asset classes, like US equities, crypto, or options, or through hybrid models, combining US equities and crypto into one strategy. This allows users to develop advanced single-asset strategies or strategies based on the relationships between equities and crypto. Hybrid symphonies are not capable with options.

“If it wasn't for Alpaca, we wouldn't be able to offer hybrid symphonies. It took a tremendous feat of engineering to be able to offer that because of the T+1 settlement issues,” explains Ben. “We smooth over all those issues for our users, which is pretty unprecedented. I'm unaware of any other product that allows you to do this.”

Beyond the launch of options trading, Composer has their sights set on continuing to lower the barriers of advanced trading. This includes partnering with international brokers, allowing them to license symphonies across the world or be the operating system upon which platforms are built.

Composer’s Vision for the Future: Ambitious Growth and Industry Disruption

With all of their recent growth and product development, Composer still has ambitious goals for the future. While their beginning revolved around gaining traction with early adopters and hobbyists, they recently expanded their target audience to more sophisticated traders. This includes working with larger accounts like LLCs, entity accounts, small family offices, and hedge funds.

In the long term, Ben envisions Composer becoming more than just a trading platform; “I want Composer to be an operating system for trading, where third-party developers can develop their own applications on top of Composer. I want people to be able to launch hedge funds, distribute them, and then become advisors and promote their services through Composer,” says Ben. “I want whole organizations to be able to onboard Composer.”

Composer’s overarching goal is to fundamentally disrupt the multi-strategy hedge fund space by leveraging their technology to lower the barrier to entry. Traditionally, such endeavors have demanded substantial research, development, and infrastructure investments. However, Composer believes that they can make advanced trading strategies accessible to a much broader audience through their low-code, sophisticated platform. The recent launch of their MCP server has also furthered their investment into supporting no-code algorithmic trading, a massive value add for their users.

“We're offering a product that is completely unique. Any other platform you would have to spend a ton of time coding and setting up your own infrastructure or cleaning your data. We get rid of all that. There's no other platform on Earth that does what we do," declares Ben.

“Composer’s evolution from US equities to options trading is nothing short of revolutionary,” said Yoshi Yokokawa, Co-founder and CEO at Alpaca. “Their approach—leveraging symphonies to simplify complex options strategies—is redefining how everyday investors access and execute sophisticated trades. We’re proud to partner with Composer as they continue to make advanced trading of options more intuitive, automated, and accessible to all.”

Contact Alpaca

About Alpaca

Alpaca is a US-headquartered self-clearing broker-dealer and brokerage infrastructure for stocks, ETFs, options, crypto, fixed income, and 24/5 trading – raising over USD170 million in funding. Alpaca is backed by top-tier investors globally, including Portage Ventures, Spark Capital, Tribe Capital, Social Leverage, Horizons Ventures, Unbound, SBI Group, Derayah Financial, Elefund, and Y Combinator.

Please note that we used NVDA in the image above as an example, and it should not be considered investment advice or a recommendation.

Options trading is not suitable for all investors due to its inherent high risk, which can potentially result in significant losses. Please read Characteristics and Risks of Standardized Options before investing in options.

The content of this blog is for general informational purposes only. All examples are for illustrative purposes only.

All product descriptions, comparisons, and platform features referenced above were provided by Composer. This information has not been independently verified and does not constitute a recommendation or endorsement by Alpaca.

Composer’s AI features are designed to assist with strategy creation and do not constitute financial advice. Users should carefully review all strategies before investing.

Alpaca Securities LLC, Alpaca Crypto LLC, nor AlpacaDB, Inc., are affiliated with Composer Securities LLC (“Composer”) and neither is responsible for the liabilities of the other.

Securities products and brokerage services are offered by Composer Securities LLC, a broker-dealer registered with the SEC and member of FINRA / SIPC. Composer Securities LLC and Composer Technologies Inc. are separate but affiliated companies.

The testimonials, statements, and opinions presented on the website are applicable to the specific individuals. It is important to note that individual circumstances may vary, and may not be representative of the experience of others. There are no guarantees of future performance or success. The testimonials are voluntarily provided and are not paid, nor were they provided with free products, services or any other benefit in exchange for said statements.

All investments involve risk and the past performance of a security, or financial product does not guarantee future results or returns. There is no guarantee that any investment strategy will achieve its objectives. Keep in mind that while diversification may help spread risk, it does not assure a profit, or protect against loss. There is always the potential of losing money when you invest in securities, or other financial products. Investors should consider their investment objectives and risks carefully before investing.

Past hypothetical backtest results do not guarantee future returns, and actual results may vary from the analysis.

Cryptocurrency is highly speculative in nature, involves a high degree of risks, such as volatile market price swings, market manipulation, flash crashes, and cybersecurity risks. Cryptocurrency regulations are continuously evolving, and it is your responsibility to understand and abide by them. Cryptocurrency trading can lead to large, immediate and permanent loss of financial value. You should have appropriate knowledge and experience before engaging in cryptocurrency trading. For additional information, please click here.

Fixed income securities can experience a greater risk of principal loss when interest rates rise. These investments are also subject to additional risks, including credit quality fluctuations, market volatility, liquidity constraints, prepayment or early redemption, corporate actions, tax implications, and other influencing factors.

Orders placed outside regular trading hours (9:30 a.m. – 4:00 p.m. ET) may experience price fluctuations, partial executions, or delays due to lower liquidity and higher volatility.

Orders not designated for extended hours execution will be queued for the next trading session.

Additionally, fractional trading may be limited during extended hours. For more details, please review Alpaca Extended Hours & Overnight Trading Risk Disclosure.

Securities brokerage services are provided by Alpaca Securities LLC ("Alpaca Securities"), member FINRA/SIPC, a wholly-owned subsidiary of AlpacaDB, Inc. Technology and services are offered by AlpacaDB, Inc.

Cryptocurrency services are made available by Alpaca Crypto LLC ("Alpaca Crypto"), a FinCEN registered money services business (NMLS # 2160858), and a wholly-owned subsidiary of AlpacaDB, Inc. Alpaca Crypto is not a member of SIPC or FINRA. Cryptocurrencies are not stocks and your cryptocurrency investments are not protected by either FDIC or SIPC. Please see the Disclosure Library for more information.

This is not an offer, solicitation of an offer, or advice to buy or sell securities or cryptocurrencies or open a brokerage account or cryptocurrency account in any jurisdiction where Alpaca Securities or Alpaca Crypto, respectively, are not registered or licensed, as applicable.