Please note that this article is for educational and informational purposes only All screenshots are for illustrative purposes only. The views and opinions expressed are those of the author and do not reflect or represent the views and opinions of Alpaca. Alpaca does not recommend any specific securities or investment strategies.

Why Blankly?

Blankly is an elegant Python library for interacting with crypto, stocks, and forex for in a consistent and streamlined way. Now, no more reading API or struggling to get data. Blankly offers a powerful feature-set, optimized for speed and ease of use, better backtesting, and ultimately better models.

We're bridging the gap between local development systems and live APIs by building a framework which allows backtesting, paper trading, sandbox testing, and live cross-exchange deployment without modifying a single line of trading logic.

Check out our website and our docs.

Trade Stocks, Crypto, and Forex Seamlessly

from blankly import Alpaca, CoinbasePro

stocks = Alpaca()

crypto = CoinbasePro()

# Easily perform the same actions across exchanges & asset types

stocks.interface.market_order('AAPL', 'buy', 1)

crypto.interface.market_order('BTC-USD', 'buy', 1)Backtest Instantly Across Symbols

from blankly import Alpaca, Strategy, StrategyState

def price_event(price, symbol, state):

# Trading logic here

state.interface.market_order(symbol, 'buy', 1)

# Authenticate

alpaca = Alpaca()

strategy = Strategy(alpaca)

# Check price every hour and send to the strategy function

# Easily switch resolutions and data

strategy.add_price_event(price_event, 'AAPL', '1h')

strategy.add_price_event(price_event, 'MSFT', '15m')

# Run the backtest

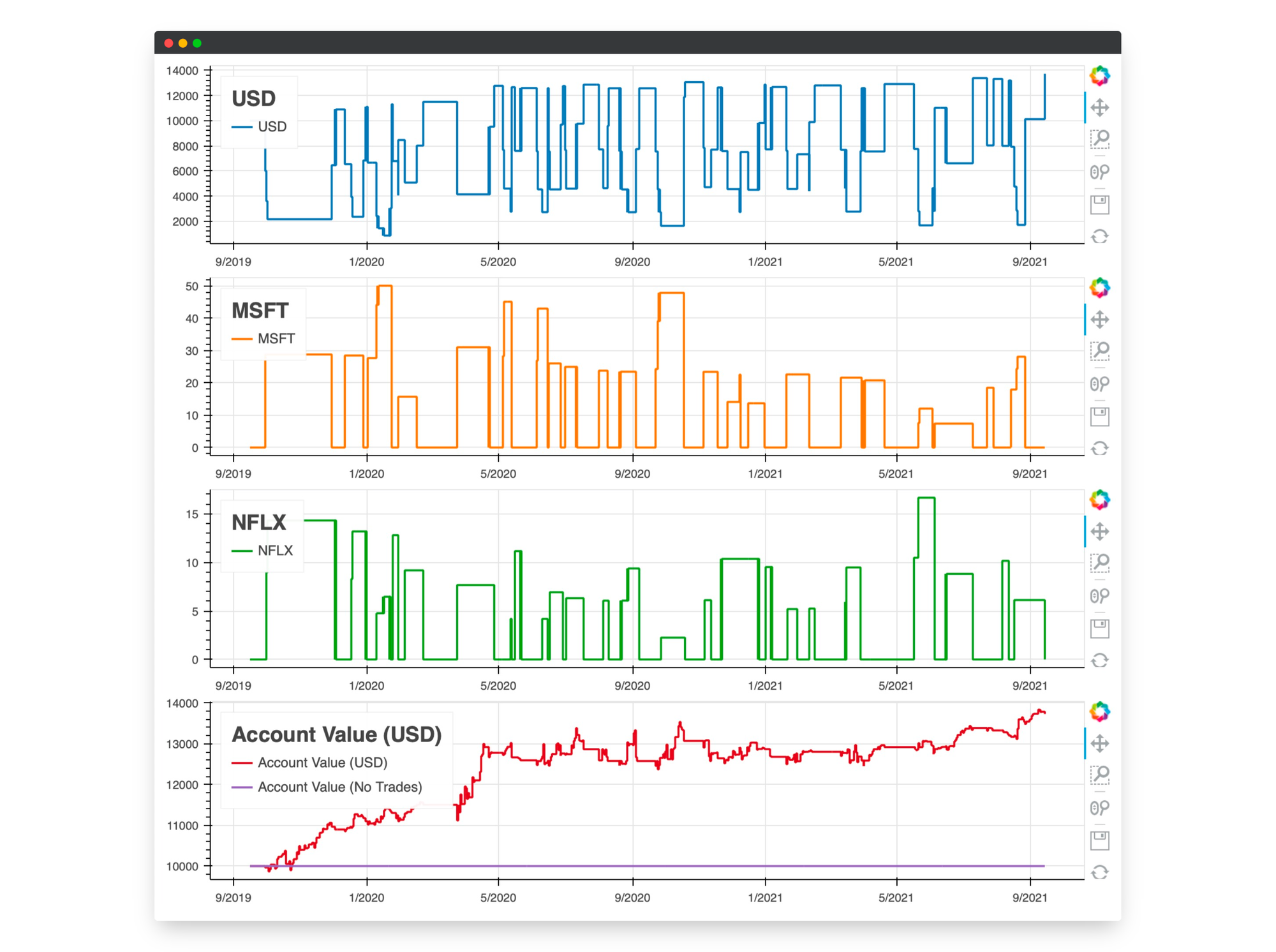

strategy.backtest(to='1y')Accurate Backtest Holdings

Useful Metrics

Blankly Metrics:

Compound Annual Growth Rate (%): 54.0%

Cumulative Returns (%): 136.0%

Max Drawdown (%): 60.0%

Variance (%): 26.15%

Sortino Ratio: 0.9

Sharpe Ratio: 0.73

Calmar Ratio: 0.99

Volatility: 0.05

Value-at-Risk: 358.25

Conditional Value-at-Risk: 34.16Go Live in One Line

Seamlessly run your model live!

# Just turn this

strategy.backtest(to='1y')

# Into this

strategy.start()Dates, times, and scheduling adjust on the backend to make the experience instant.

Quickstart

Installation

- First install Blankly using

pip. Blankly is hosted on PyPi.

$ pip install blankly- Next, just run:

$ blankly initThis will initialize your working directory.

The command will create the files keys.json, settings.json, backtest.json, deploy.json and an example script called bot.py.

If you don't want to use our init command, you can find the same files in the examples folder under settings.json and keys_example.json

- From there, insert your API keys from your exchange into the generated

keys.jsonfile.

More information can be found on our docs.

Directory format

The working directory format should have at least these files:

Project

|-bot.py

|-keys.json

|-settings.jsonAdditional Info

Make sure you're using a supported version of python. The module is currently tested on these versions:

- Python 3.7+

For more info, and ways to do more advanced things, check out our getting started docs.

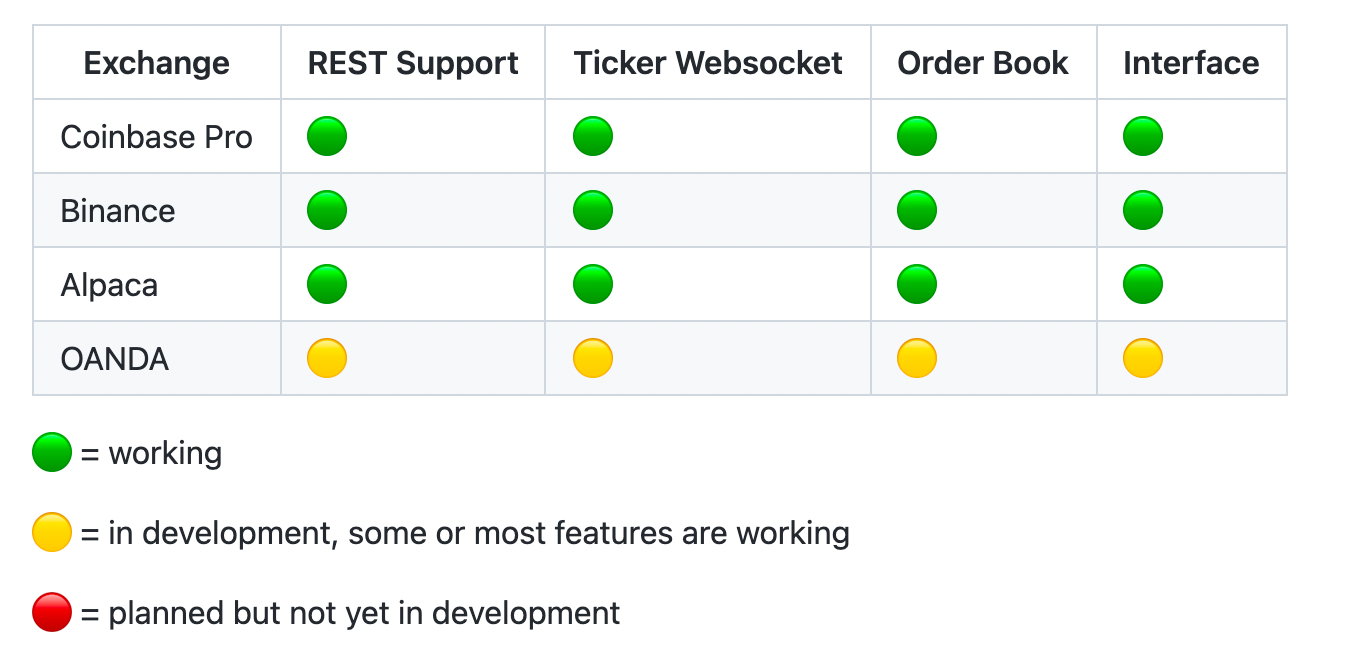

Supported Exchanges

Interface calls take ~300 µs extra to homogenize the exchange data.

RSI Example

We have a pre-built cookbook examples that implement strategies such as RSI, MACD, and the Golden Cross found in our examples.

The model below will run an RSI check every 30 minutes - buying below 30 and selling above 70.

import blankly

from blankly import StrategyState

def price_event(price, symbol, state: StrategyState):

""" This function will give an updated price every 15 seconds from our definition below """

state.variables['history'].append(price)

rsi = blankly.indicators.rsi(state.variables['history'])

if rsi[-1] < 30 and not state.variables['has_bought']:

# Dollar cost average buy

state.variables['has_bought'] = True

state.interface.market_order(symbol, side='buy', size=1)

elif rsi[-1] > 70 and state.variables['has_bought']:

# Dollar cost average sell

state.variables['has_bought'] = False

state.interface.market_order(symbol, side='sell', size=1)

def init(symbol, state: StrategyState):

# Download price data to give context to the algo

state.variables['history'] = state.interface.history(symbol, to='1y', return_as='list')['open']

state.variables['has_bought'] = False

if __name__ == "__main__":

# Authenticate on alpaca to create a strategy

alpaca = blankly.Alpaca()

# Use our strategy helper on alpaca

strategy = blankly.Strategy(alpaca)

# Run the price event function every time we check for a new price - by default that is 15 seconds

strategy.add_price_event(price_event, symbol='NCLH', resolution='30m', init=init)

strategy.add_price_event(price_event, symbol='CRBP', resolution='1h', init=init)

strategy.add_price_event(price_event, symbol='D', resolution='15m', init=init)

strategy.add_price_event(price_event, symbol='GME', resolution='30m', init=init)

# Start the strategy. This will begin each of the price event ticks

# strategy.start()

# Or backtest using this

strategy.backtest(to='1y')Other Info

Subscribe to our news: https://blankly.substack.com/p/coming-soon

Bugs

Please report any bugs or issues on the GitHub's Issues page.

Disclaimer

Trading is risky. We are not responsible for losses incurred using this software, software fitness for any particular purpose, or responsibility for any issues or bugs. This is free software.

Contributing

If you would like to support the project, pull requests are welcome. You can also contribute just by telling us what you think of Blankly.

Licensing

Blankly is distributed under the LGPL License. See the LICENSE for more details.

Alpaca does not prepare, edit, or endorse Third Party Content. Alpaca does not guarantee the accuracy, timeliness, completeness or usefulness of Third Party Content, and is not responsible or liable for any content, advertising, products, or other materials on or available from third party sites.

Brokerage services are provided by Alpaca Securities LLC ("Alpaca"), member FINRA/SIPC, a wholly-owned subsidiary of AlpacaDB, Inc. Technology and services are offered by AlpacaDB, Inc.

This is not an offer, solicitation of an offer, or advice to buy or sell securities, or open a brokerage account in any jurisdiction where Alpaca is not registered (Alpaca is registered only in the United States).