Updated on December 10, 2025.

We’ve long supported our trading community with access to stocks, ETFs, and crypto trading through our TradingView integration. Now, we’re excited to expand our available asset classes further to include options!

This new integration builds on the same secure API connection you already use to link your Trading API account with TradingView. Once connected, you can place options orders directly through TradingView’s powerful charting and trading interface.

In this guide, we’ll walk through the key steps to get started so you can take full advantage of options trading with Alpaca on TradingView.

You can also find the video tutorial on YouTube.

To get the most out of this guide, explore the following resources first:

Note: TradingView does not support multi leg options trading at this moment. Multi leg orders must be placed on Alpaca’s dashboard or through Alpaca’s Trading API. Also keep in mind that the correct Time in Force is set to Day, not GTC.

Analyzing a Covered Call Payoff Diagram with Strategy Builder

Before placing any options trade, it’s best practice to review a payoff diagram for your strategy.

TradingView makes this easy with its Strategy Builder, a powerful tool that you can use even without connecting a brokerage account. For details on this tool, you can check New Product Launch: How to Use TradingView Options.

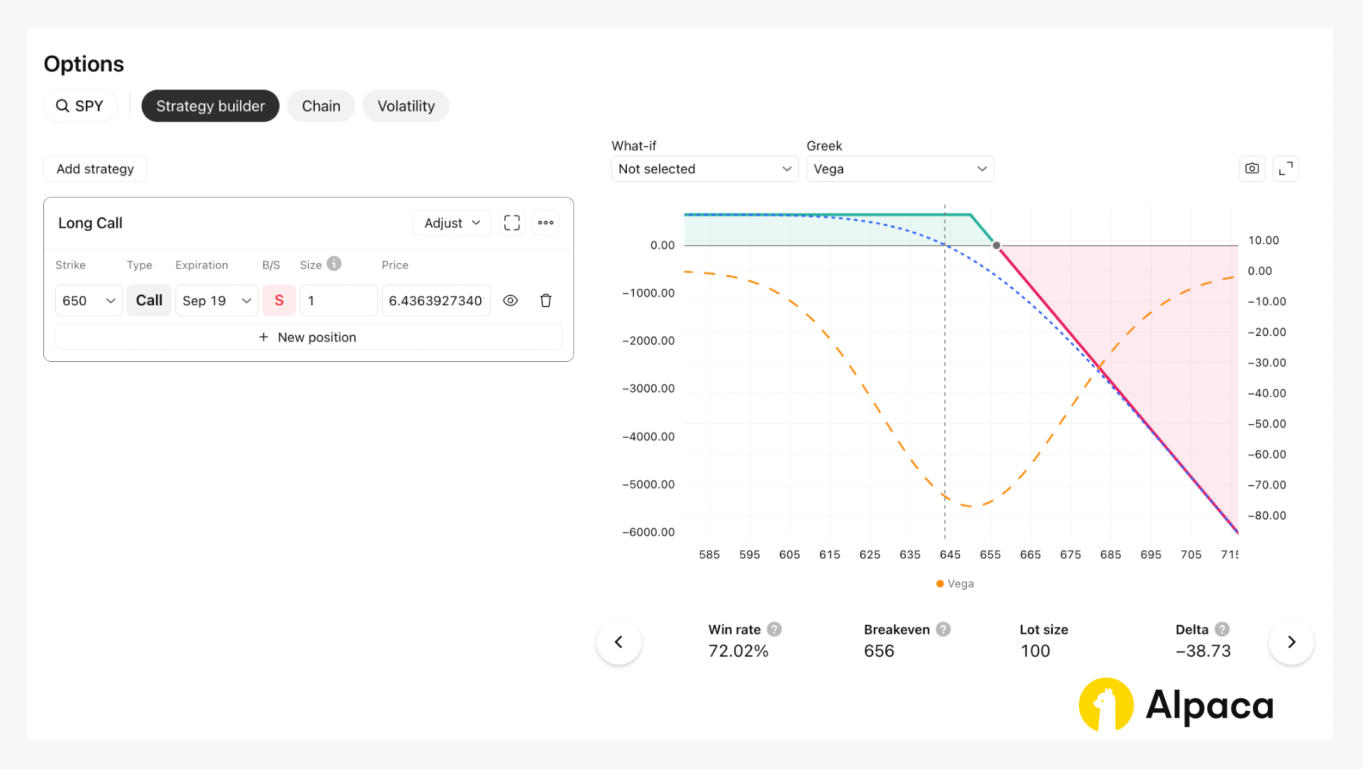

In this example, we'll demonstrate how to analyze the payoff diagram for a covered call options strategy on the SPY ETF and walk through its other key metrics.

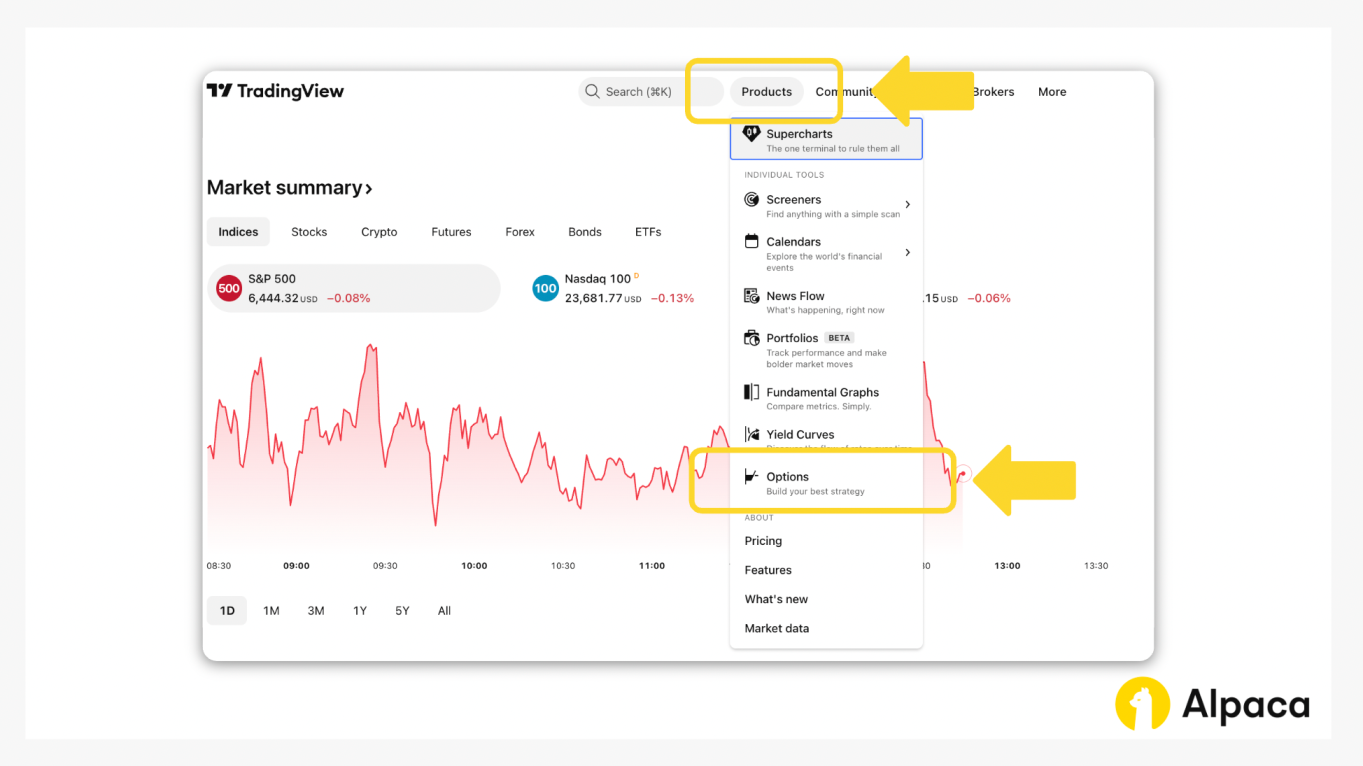

From TradingView’s main navigation, go to the top menu, select Products, and click Options to launch.

With Strategy Builder, you can:

- Create, test and visualize options strategies with real-time data.

- Use pre-built strategies filtered by bullish, bearish, or neutral outlooks.

- Customize strategies with adjustable parameters like expiration dates and strike prices.

- Get estimates for max profit, max loss, win rate, and more.

- Compare multiple strategies on a single chart for performance analysis.

To check the payoff diagram for a covered call on SPY, we'll use the following parameters:

- The underlying current price: 642

- The strike price: 650

- The expiration date: September 19, 2025 (32 days as of August 18, 2025)

The payoff diagram shows a clear visualization of the covered call’s potential outcomes. Below the chart, key metrics are provided including: theoretical win rate, breakeven point, Delta, and additional indicators to evaluate your strategy.

This can help you evaluate whether the strategy aligns with your outlook and risk tolerance.

*Please note that we are using SPY as an example, and it should not be considered investment advice.

Connecting Alpaca Trading API Account with TradingView

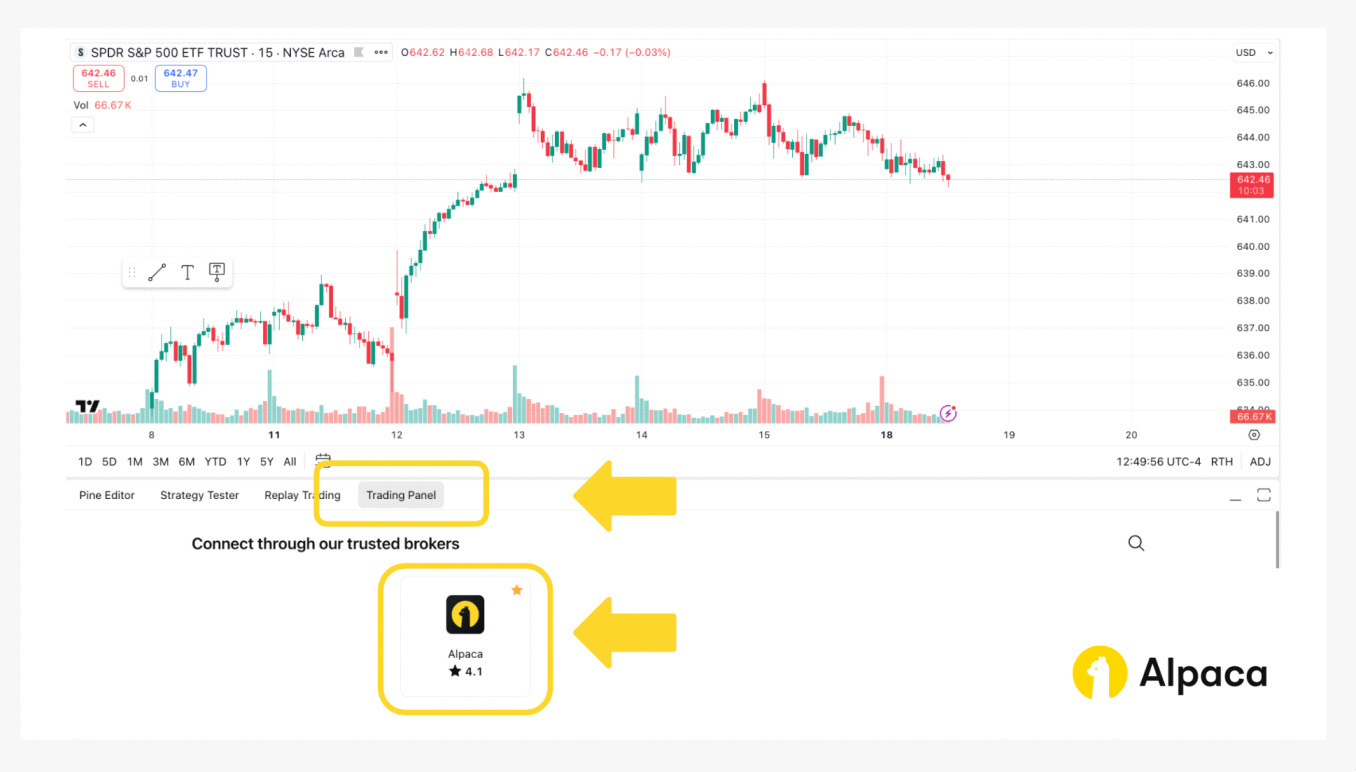

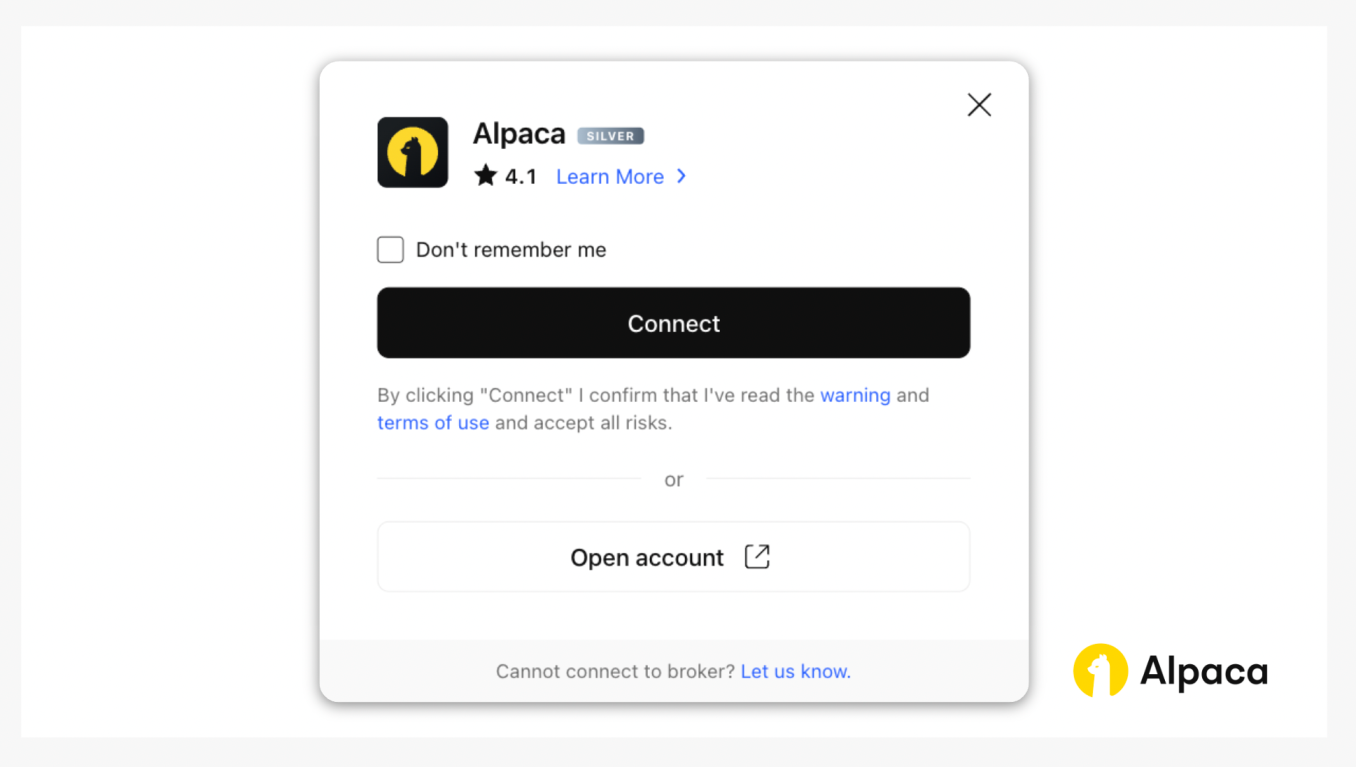

After confirming your strategy's theoretical performance, connect your Alpaca Trading API account with TradingView through its Trading Panel and select Alpaca as your desired broker.

If you already have a TradingView account but not one with Alpaca, you can sign up now for free.

Click Connect, both live and paper accounts are supported by Alpaca.

Trading Covered Calls Options Strategy with Alpaca

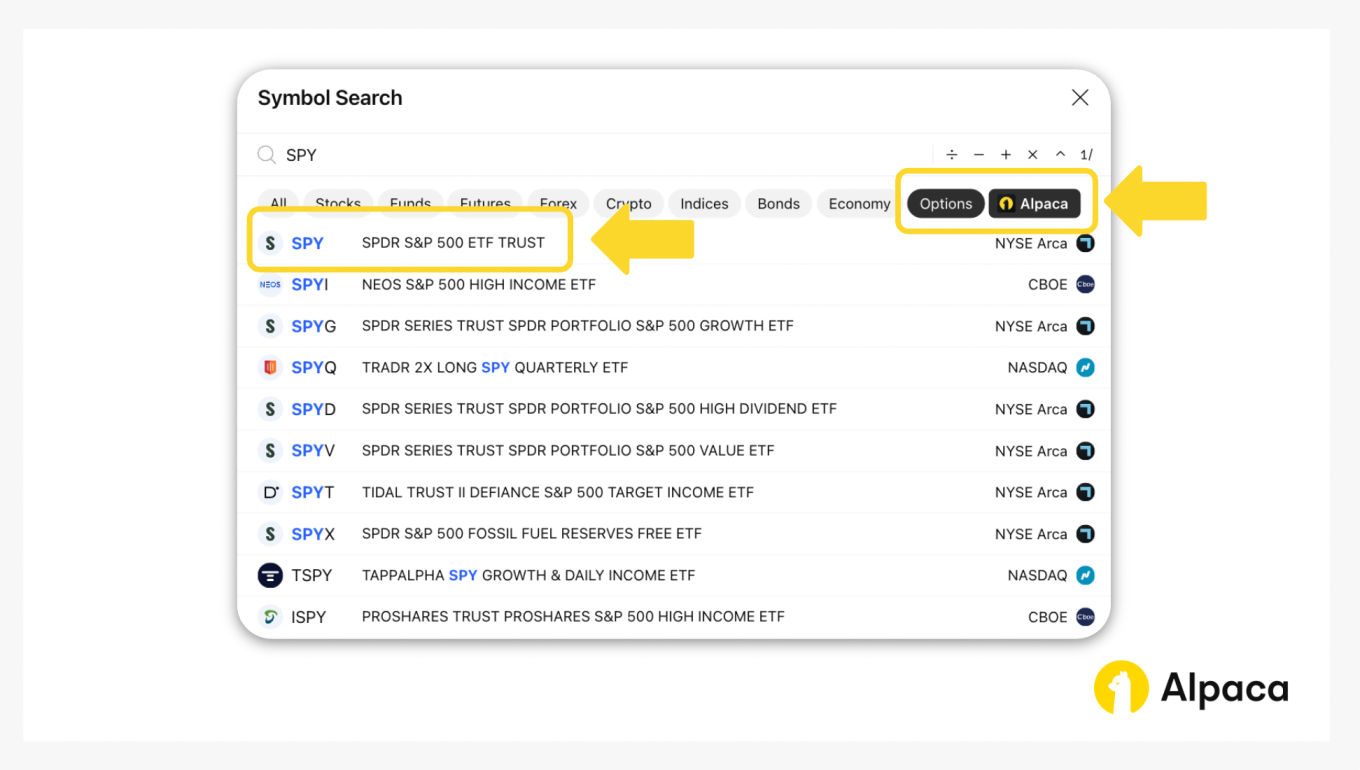

After establishing your connection, you can place options trades directly from the chart screen. Return to the Superchart and search for the symbol you want to trade like SPY for example.

Note: Be sure to apply the Options filter, then select the appropriate underlying security.

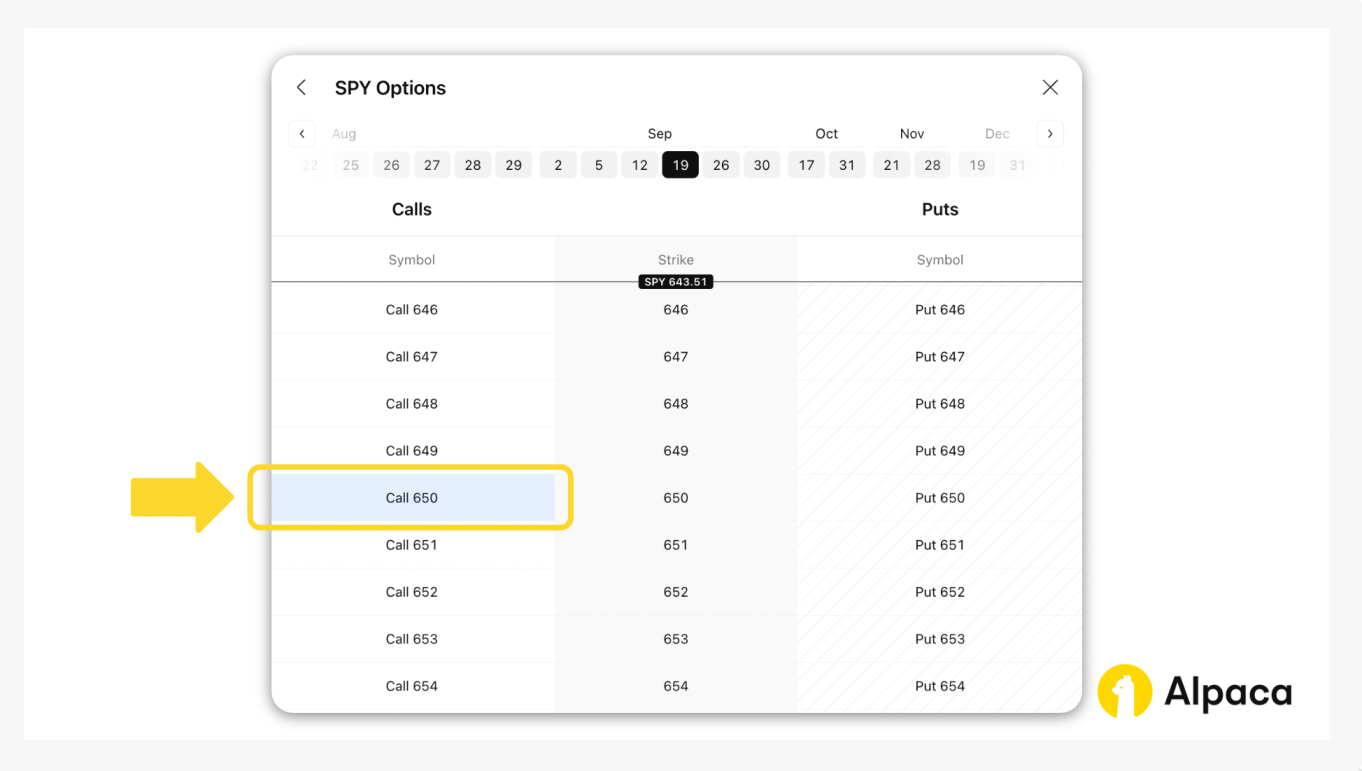

You’ll then be prompted to choose the options contract you want to trade. In this case, we’ll select the 650 Call expiring on September 19, 2025.

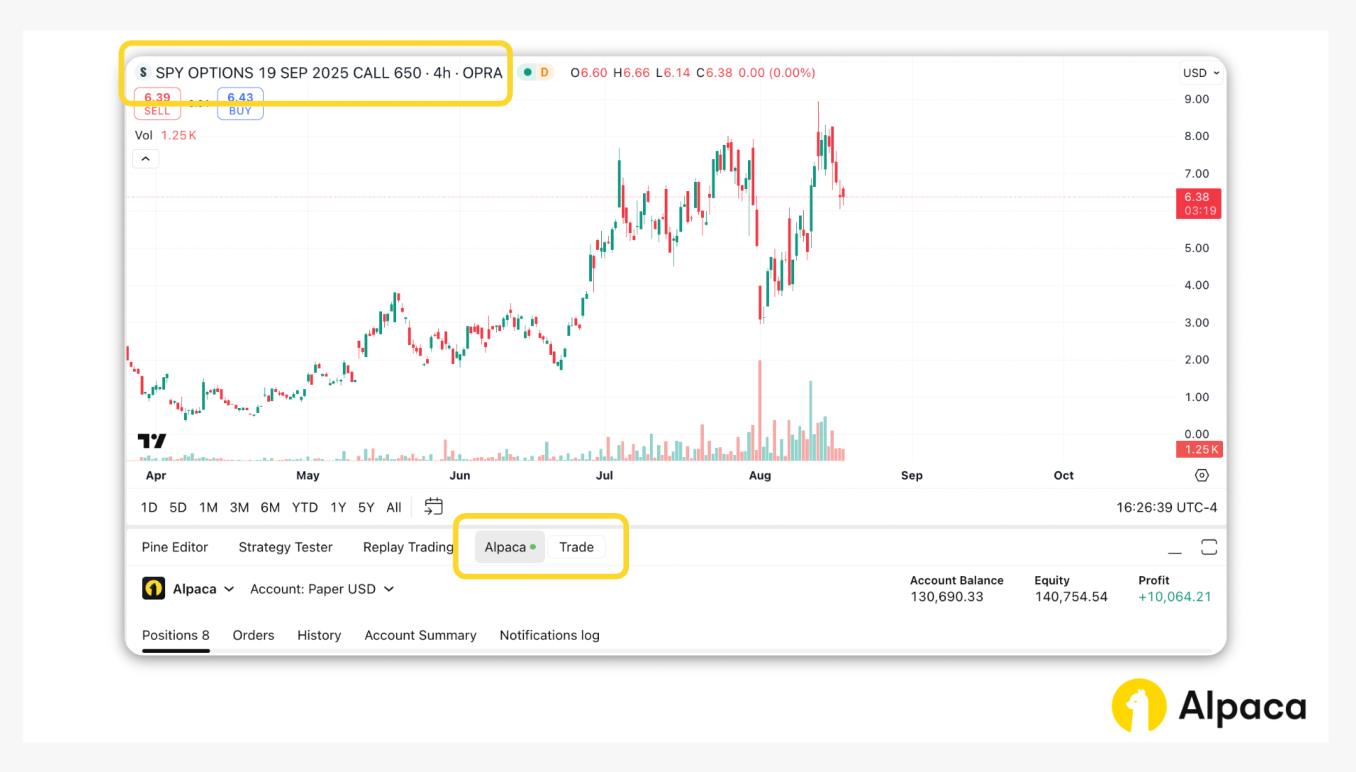

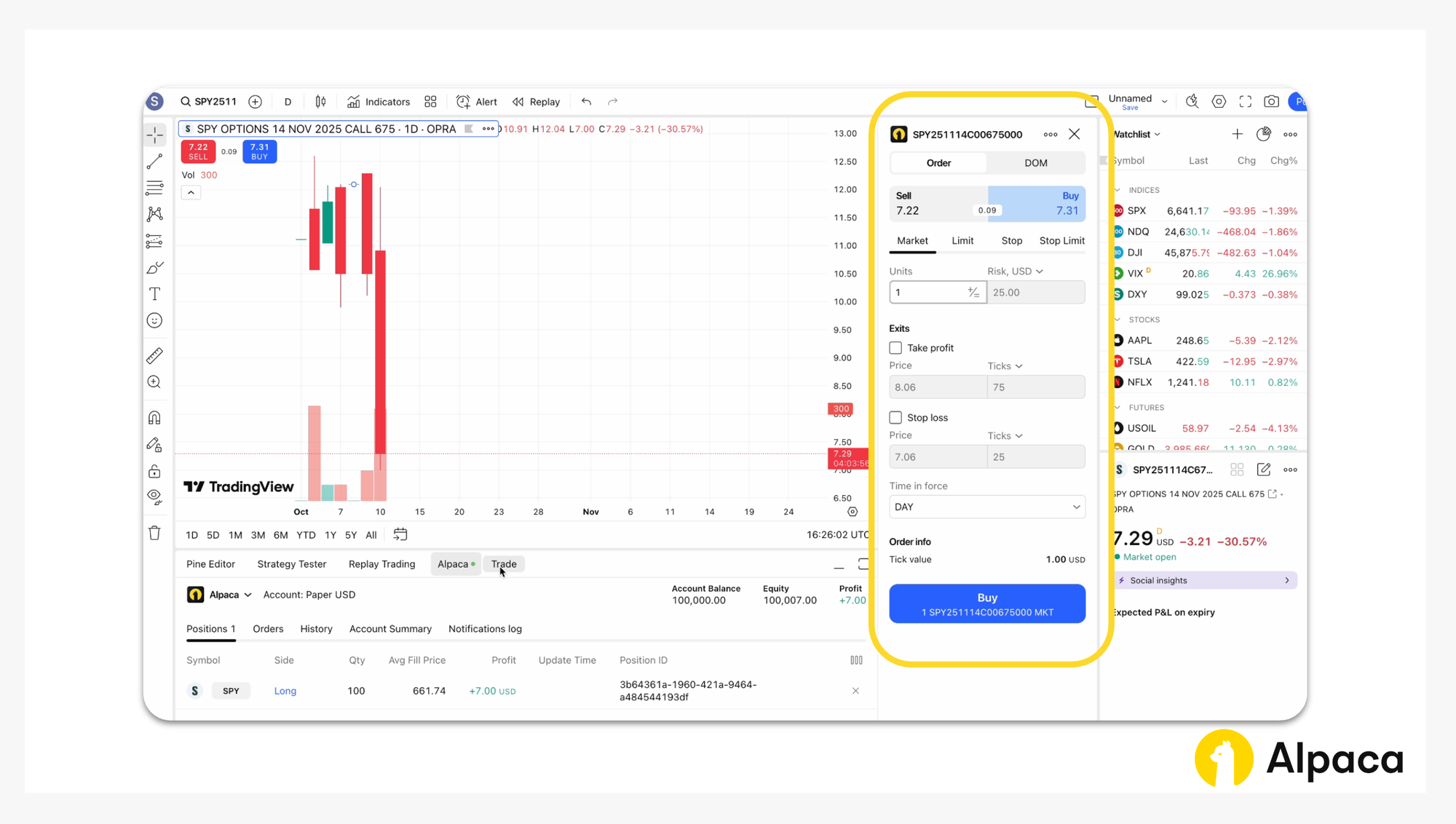

TradingView will then display the chart for your selected option. To place a trade, click the Trade button located below the chart.

Trading Covered Calls From Charts

On the right in TradingView, you’ll see the options chain which lists calls and puts sortable by strike price. You can also adjust the expiration date using the buttons at the top of the chain.

Selecting an option will display the contract on the chart, along with Sell and Buy buttons. Clicking either button opens an order ticket, where you can enter key details such as:

- Order type: Market and Limit

- Size

- Price

- Time in force: Day

Note: TradingView does not support multi leg options trading at this moment. Multi leg orders must be placed on Alpaca’s dashboard or through Alpaca’s Trading API. Also keep in mind that the correct Time in Force is set to Day, not GTC.

You can check the Alpaca API documentation for Order Types and Supported Time in Force for options trading.

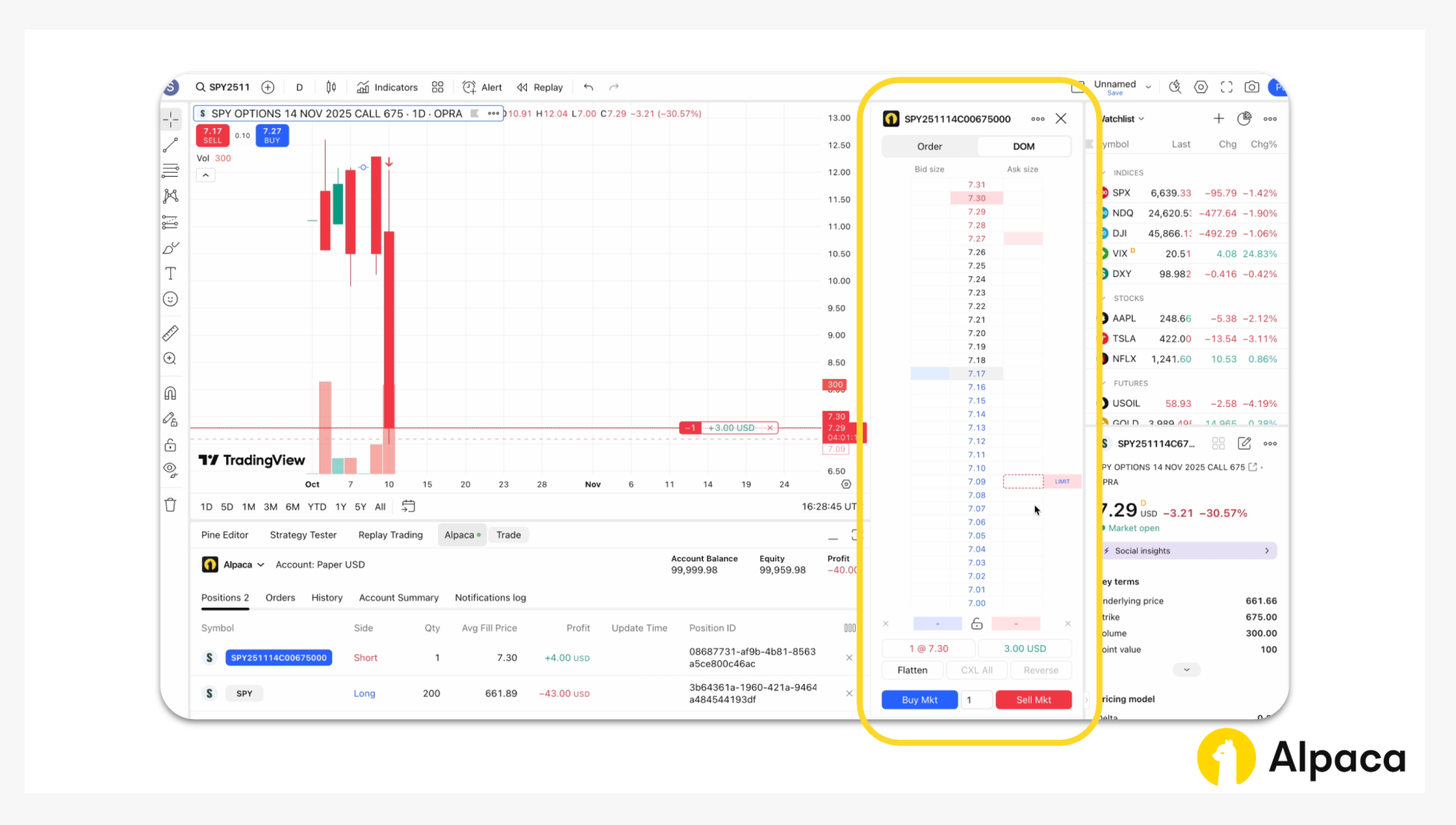

Trading Covered Calls Using Depth of Market (DOM)

The Depth of Market (DOM) tool provides an alternative way to trade covered calls. It displays a price ladder that can make creating limit orders more straightforward.

At the bottom of the DOM window, a dedicated box allows you to control the number of contracts. To place a limit buy order, click the box located to the left of the desired price. Conversely, clicking the box to the right creates a limit sell order. In both instances, an order box will appear, allowing you to review and confirm the order details.

Conclusion

This newly launched integration now makes it possible to trade options contracts alongside stocks, ETFs, and crypto. Using TradingView's core features, like Strategy Builder, you can not only place trades but also visualize and evaluate a strategy’s potential performance before execution.

Keep in mind that no single tool provides a complete picture. It's essential to understand the limitations of any single tool and validate your findings with additional technical indicators and comprehensive analysis. However, combining theoretical insights with practical application can help strengthen your overall options trading approach.

For more on integrating options trading with Alpaca Trading API account and TradingView, see the additional resources below:

- Sign up for an Alpaca Trading API account

- How to Get Alpaca Trading API Key and Start Connecting

- How to Start Paper Trading with Alpaca Trading API

- How to Connect Your Alpaca Trading API Account with TradingView

If you’d like to learn more about trading algorithmically with Alpaca Trading API, explore the resources below:

Frequently Asked Questions

Is it free to trade options on TradingView?

While you can use TradingView’s tools and data for free, placing actual trades will incur standard brokerage commissions and fees. You will not be charged by TradingView for using the platform to trade.

Can you trade options without a broker?

No. You must have a brokerage account to trade options. TradingView is a front-end platform that allows you to analyze and place orders, but it routes those orders to a connected brokerage (like Alpaca Trading API account) for execution.

Is TradingView good for options?

Yes. TradingView offers advanced charting, a strategy builder, and in-depth analysis tools that are highly useful for options traders. By connecting your Alpaca Trading API account, you get the benefit of TradingView’s powerful interface for analysis combined with Alpaca’s trade execution for a seamless, end-to-end trading experience.

Please note that this article is for general informational purposes only and is believed to be accurate as of the posting date but may be subject to change. The examples above are for illustrative purposes only.

Alpaca Securities LLC, Alpaca Crypto LLC and AlpacaDB. Inc. are not affiliated with TradingView and are not responsible for the liabilities of the other.

Options trading is not suitable for all investors due to its inherent high risk, which can potentially result in significant losses. Please read Characteristics and Risks of Standardized Options before investing in options.

All investments involve risk, and the past performance of a security, or financial product does not guarantee future results or returns. There is no guarantee that any investment strategy will achieve its objectives. Please note that diversification does not ensure a profit, or protect against loss. There is always the potential of losing money when you invest in securities, or other financial products. Investors should consider their investment objectives and risks carefully before investing.

The Paper Trading API is offered by AlpacaDB, Inc. and does not require real money or permit a user to transact in real securities in the market. Providing use of the Paper Trading API is not an offer or solicitation to buy or sell securities, securities derivative or futures products of any kind, or any type of trading or investment advice, recommendation or strategy, given or in any manner endorsed by AlpacaDB, Inc. or any AlpacaDB, Inc. affiliate and the information made available through the Paper Trading API is not an offer or solicitation of any kind in any jurisdiction where AlpacaDB, Inc. or any AlpacaDB, Inc. affiliate (collectively, “Alpaca”) is not authorized to do business.

Commission-free trading is available to Alpaca's retail customers. Commission-free trading means that there are no commission charges for Alpaca self-directed individual cash brokerage accounts that trade U.S.-listed securities and options through an API. However, certain arrangements with authorized business partners or the use of the Elite Smart Router as part of the Alpaca Elite offering may preclude commission free trades by Alpaca Securities. Please refer to the Brokerage Fee Schedule for more information. Relevant regulatory fees may apply. Alpaca reserves the right to charge additional fees if it is determined that order flow is non-retail in nature.

Securities brokerage services are provided by Alpaca Securities LLC ("Alpaca Securities"), member FINRA/SIPC, a wholly-owned subsidiary of AlpacaDB, Inc. Technology and services are offered by AlpacaDB, Inc.

Cryptocurrency services are made available by Alpaca Crypto LLC ("Alpaca Crypto"), a FinCEN registered money services business (NMLS # 2160858), and a wholly-owned subsidiary of AlpacaDB, Inc. Alpaca Crypto is not a member of SIPC or FINRA. Cryptocurrencies are not stocks and your cryptocurrency investments are not protected by either FDIC or SIPC. Please see the Disclosure Library for more information.

This is not an offer, solicitation of an offer, or advice to buy or sell securities or cryptocurrencies or open a brokerage account or cryptocurrency account in any jurisdiction where Alpaca Securities or Alpaca Crypto, respectively, are not registered or licensed, as applicable.

Please see the Disclosure Library for additional information and disclosures from Alpaca Securities and Alpaca Crypto.