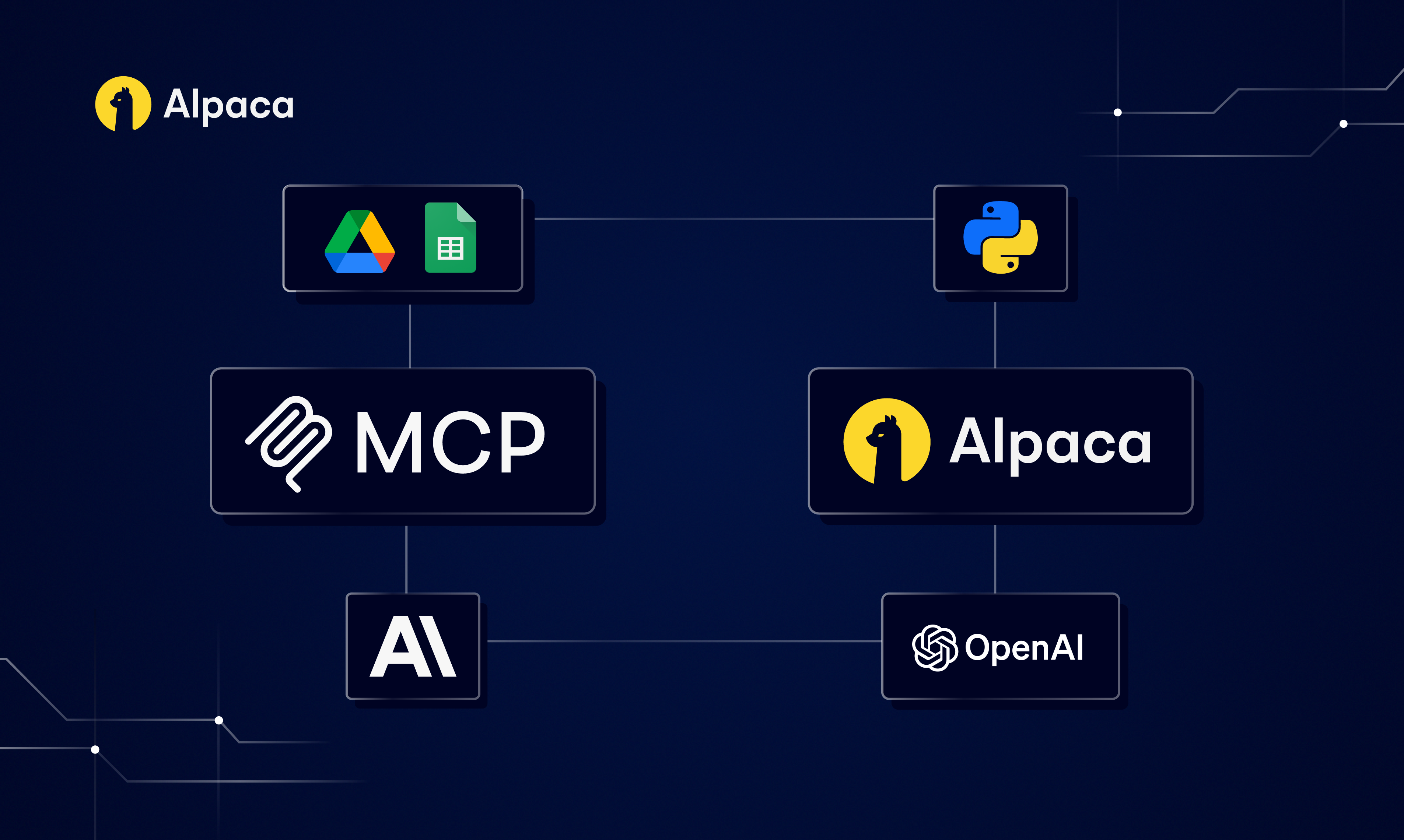

With the rise of large language models (LLM) we may now use AI agents to handle tasks from analyzing markets to placing orders on their own. Model Context Protocol (MCP) would give those agents one clear way to reach out to services. By following this guide you will link Claude or Cursor with Alpaca’s Trading API and Google Sheets to build a reliable, end‑to‑end trading workflow.

What This Guide Covers

This guide will show you how to use an MCP server with Alpaca’s Trading API that can fetch stock market data, analyze trends, and generate trade recommendations. Specifically, you’ll learn:

- How MCP works and why they’re useful

- How to set up your Claude desktop with two MCP servers for an integrated trading automation system.

- How to write prompts on Claude to automate stock market analysis tasks, place the trading order, and log the trading record in a spreadsheet

The aim is to understand the potential MCP has to simplify building automated or AI‑assisted trading strategies, fostering smoother interactions between Large Language Models (LLMs) and your trading activities.

To get the most out of this guide, explore the following resources first:

What Is an MCP Server? Understanding Model Context Protocol for AI Trading

An MCP is like a shared set of rules that helps LLM (like Claude or ChatGPT) connect to different applications and services including databases, trading platforms, and tools like Slack or GitHub. The benefit of MCP is that it uses one common way to connect, which helps avoid the need to build lots of separate, special links for each tool.

Essentially, MCP works like a translator between AI and apps. When you ask the AI to do something, like get market data, place a trade, or update a spreadsheet, MCP helps it understand how to talk to each service so it can follow through on your request without you needing to write any code.

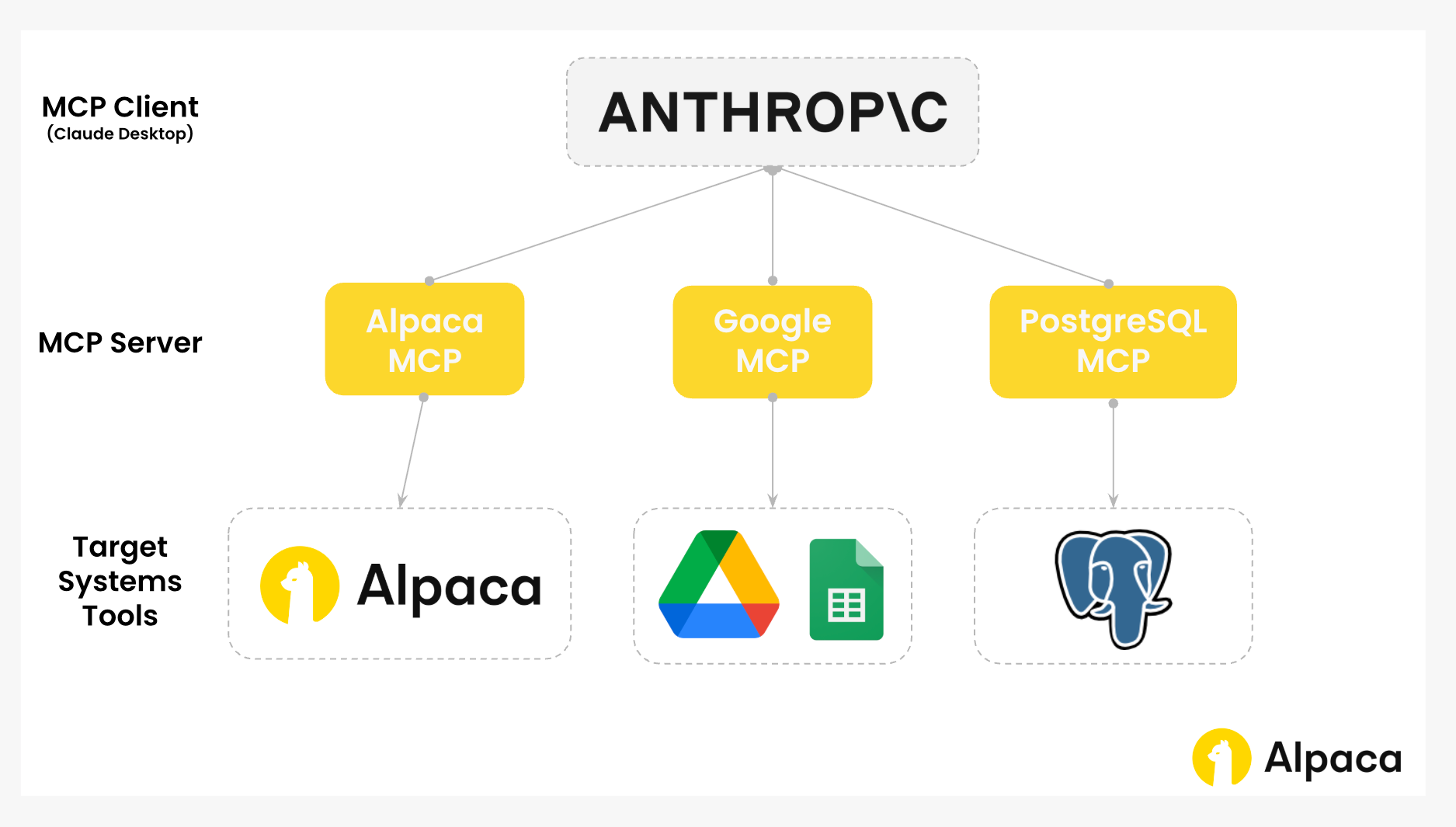

To build an MCP environment, three key components are required:

- Host (MCP Client): This is the interface where a user interacts with AI tools, like Claude Desktop or Cursor. When a prompt is entered (e.g., “Get latest quote for XXX stock”), the MCP client processes the request and sends it to the MCP server.

- MCP Server: Acting as middleware, the MCP server receives prompts from the client. It utilizes custom helper code (often Python) to execute specific functions, such as retrieving quotes (

get_quote()) or placing orders (place_order()). These functions can then interact with designated target systems, like Alpaca’s Trading API. - Target Systems/Tools: These are the actual data sources or services the AI interacts with, such as databases (like PostgreSQL), file systems (like Google spreadsheet), web services (like GitHub or Slack) or trading APIs (like Alpaca's Trading API). The MCP server essentially acts as a translator between these tools.

Why MCP Matters For Traders Right Now

Trading is like any other work with repetitive tasks to handle. You used to write code to automate your trading workflow. Now you may possibly ask an AI agent to do the job without building and maintaining that system yourself. MCP provides one integration gateway so your AI agent can access all your data sources and services through the MCP client.

Advantages of MCP for Traders

Natural Language Processing (NLP): You can trade using plain English (or any preferred languages). With MCP, you simply tell your assistant what you want—like “Buy 10 shares of TSLA and log it on Google Sheets.”—and it handles everything from execution to recording in Google Sheets. No code or context switching needed.

Extensible Workflows with AI Agent: MCP lets us connect multiple services to handle more advanced, multi-step processes—like scanning the market, applying different models, placing trades, and updating logs—all in one seamless flow. It’s easy to expand or adjust the setup without needing to rebuild everything from scratch.

No code edits after API updates: When using an official MCP server maintained by the API provider, your workflow stays compatible even after API changes. Simply redeploy the latest MCP server version and no client-side updates are needed. This does not apply if you maintain your own MCP server.

Traceable Decisions: MCP logs which model and settings led to each trade, giving us a clean, auditable record. You can always look back and understand exactly how a decision was made.

Use Case: Live Trading and Logging with Claude AI, Alpaca’s Trading API, and Google Sheets via MCP

Now that we understand the overview of the MCP and its potential, let’s try setting up some useful workflows with MCP servers that traders often do manually.

Below is a quick demo showing how Claude Desktop can execute a full workflow using the MCP server including analyzing the market, placing a trade on Alpaca’s Trading API, and logging the position (including price, profit target, stop loss, and timestamp) in Google Sheets.

If you’d like to try yourself, we’ve gone over the steps for you to follow below.

Note:

- This example procedure is based on macOS. Windows or Linux users might have different steps to take.

- We are using TSLA as an example and it should not be considered investment advice.

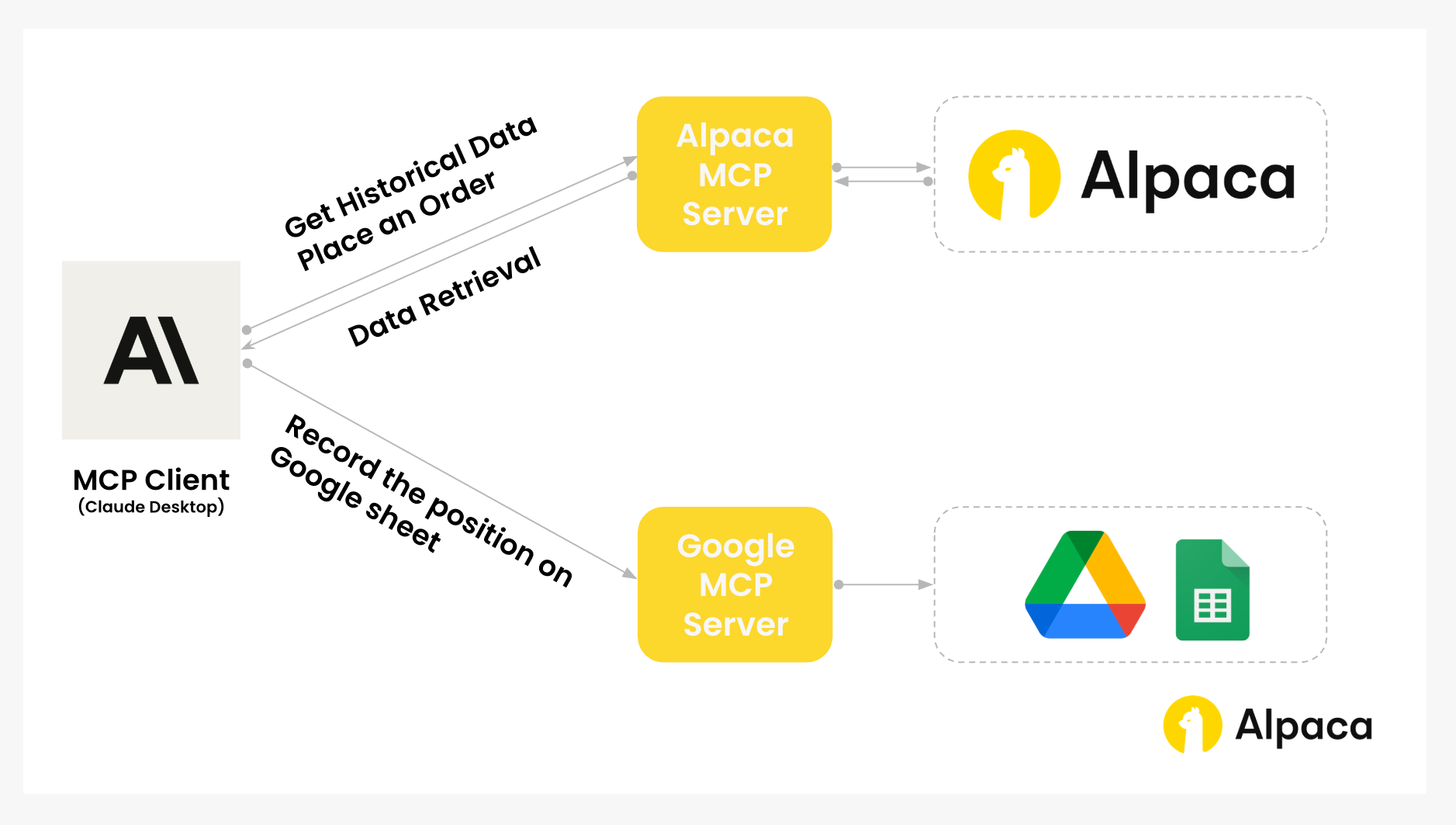

Workflow Overview

First, set up a trading workflow using Claude Desktop as your MCP client. The objective of the workflow is to:

- Analyze the market via Alpaca’s Trading API

- Place on order via Alpaca’s Trading API

- Record positions in Google Sheets (with trade price, profit-target, stop loss, and timestamps)

Below is the visual overview of the MCP system architecture.

Basic Environment Set Up

We need several accounts to set up and download the Claude desktop. Please check the following webpages to set up each.

- Google Drive account

- An Alpaca account. Sign up for a Trading API account

- Connection to Alpaca’s API

- A Claude account

- Google Claude Platform (GCP)

- Terminal

- MCP Client: Claude Desktop

- MCP Server:

- Alpaca's MCP Server (https://github.com/alpacahq/alpaca-mcp-server)

- Google Sheets MCP Server (mcp-google-sheets)

Google Sheets MCP Server Set Up

To enable Claude desktop (MCP client) to interact with Google Drive (MCP server) for creating, reading, and editing files, we will configure the Google Sheets MCP Server, accessing the Google Drive API and Google Sheets API.

We will utilize the "mcp-google-sheets" from the Github repository, following the setup instructions provided by the server owner.

- Create or select a Google Cloud Project

- Enable the two required APIs

- Create a Service Account & download the JSON key

- (Optional) Share a Drive folder with your Service Account

- Set your environment variables

- Install `uv` (the runner)

- Run the MCP-Google-Sheets server

- Claude Desktop Configuration Setup with Google spreadsheet MCP server

Alpaca’s Trading API MCP Server Set Up

Having finished configuring the “MCP-Google-Sheets” server, the next step is to set up Alpaca's Trading API MCP server. For this, we will use the “alpaca-mcp-server” found in the Github repository, which was created by an Alpaca user. The MCP server owner provides the following setup instructions.

- Clone (Download) the Github Repository

- Move It to the Working Directory

- Install the Required Python Packages

- Create a .env file with your Alpaca API credentials

- Claude Desktop Configuration Setup with Alpaca’s MCP server

Example Prompts on Claude Desktop with MCPs Integration

After we set up the required environments, we can experience the integration through MCP. When making requests via Alpaca’s Trading API, it’s important to understand which parameters need to be included. Alpaca provides detailed guidance in the Alpaca-py Documentation where we can find examples and explanations for constructing API requests effectively. Note: We are using TSLA as an example and it should not be considered investment advice.

Prompt Overview

In the prompt for Claude desktop, we cover three main requests:

- Market Analysis:

- This makes Claude desktop extracts market data through Alpaca’s Trading API via the MCP server.

- Example prompt: "Analyze current market conditions for *** stocks"

- Executing Trades:

- This instructs Claude desktop to place an order through Alpaca’s Trading API via the MCP.

- Example prompt: "Buy 10 shares of TSLA at a limit price of XXX."

- Recording Positions:

- This defines how the trade details should be recorded to Google Sheets.

- Example prompt: "Record this TSLA trade in my spreadsheet with entry price of $198, profit target of $210, stop loss at $190, and profit-loss ratio of 3.00."

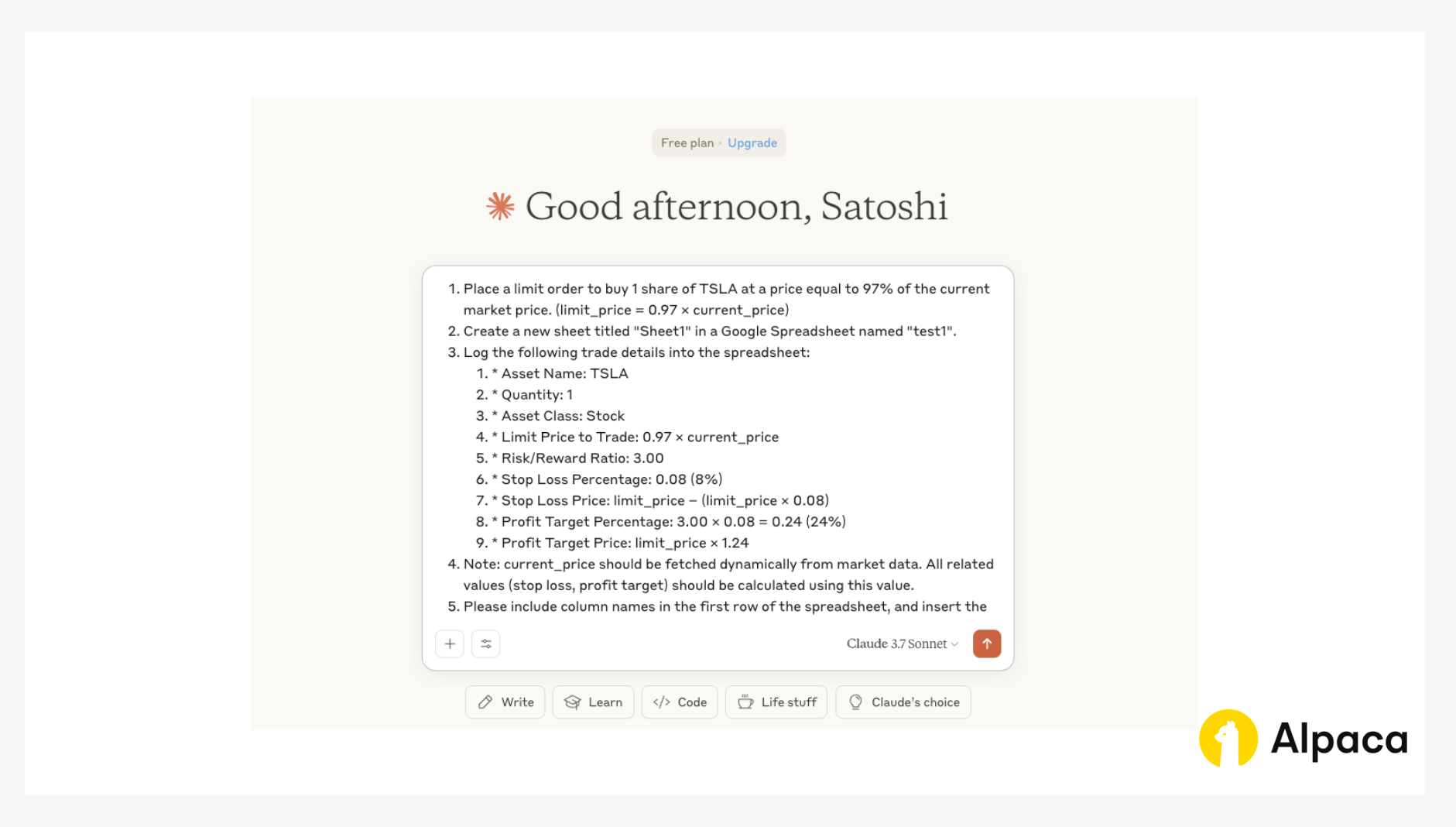

First Prompt Example:

Using Alpaca’s Trading API, please do the following:

“Extract historical market data for TSLA over the past 90 days using daily bar charts.”

“Calculate only the most recent Bollinger Bands based on that 90-day historical data.”

- Place a limit order to buy 1 share of TSLA at a price equal to 97% of the current market price.

limit_price = 0.97 × current_price- Create a new sheet titled "Sheet1" in a Google Spreadsheet named "test1".

- Log the following trade details into the spreadsheet:

- Asset Name: TSLA

- Quantity: 1

- Asset Class: Stock

- Limit Price to Trade: 0.97 × current_price

- Risk/Reward Ratio: 3.00

- Stop Loss Percentage: 0.08 (8%)

- Stop Loss Price: limit_price − (limit_price × 0.08)

- Profit Target Percentage: 3.00 × 0.08 = 0.24 (24%)

- Profit Target Price: limit_price × 1.24

Note:

current_priceshould be fetched dynamically from market data. All related values (stop loss, profit target) should be calculated using this value.Instruction: Please include column names in the first row of the spreadsheet and insert the calculated values in the row below. If you find any additional relevant information for this trade (e.g., timestamp, market signal), include those as extra columns.

The Risks and Vulnerabilities of MCP

While MCP offers exciting possibilities for trading workflows and integrations, potential risks and vulnerabilities exist. It's prudent to consider these before adopting any new technology. Addressing each proactively may help traders harness automated workflows more reliably.

Permission and Access Control

- Use least‑privilege, role‑based credentials for data write operations (such as in Google Sheets and Docs) so each action is scoped and auditable.

Rate Limiting and Cost Control

- Enforce per‑endpoint rate limits, quotas, and short‑term caching to protect APIs and manage costs.

Data Quality and Consistency

- Validate every required field—symbol, quantity (and limit price for limit orders), and buy/sell side—before sending trades through the MCP server to avoid mistakes.

Conclusion

AI has the potential to transform how you trade, but getting tools like Claude to work with platforms like Alpaca’s Trading API or Google Drive (like spreadsheets) often involves tedious steps and many errors handling. MCP can help offer a cleaner solution and standardizes how LLMs connect to APIs, spreadsheets, and trading platforms, removing the need for one-off connectors.

With MCP, you are able to build automated trading workflows that analyze market data, place orders, and record trades in spreadsheets—all through natural language prompts. Instead of managing a web of connections between every tool and service, MCP centralizes them through a single hub (Claude Desktop), drastically reducing complexity on a daily basis.

In this guide, we walked you through a practical setup using Claude Desktop, Alpaca’s Trading MCP server, and Google Sheets server to create a fully integrated trading flow—from Bollinger Band analysis to order execution.

Despite its benefits, MCP brings challenges that require care. You need least privilege role based credentials for data reads, order entry, and sheet writes to keep actions audited. Enforce rate limits, quotas, and caching to protect APIs and control costs. Validate symbols, quantities, prices, and sides before sending orders to avoid errors. With these controls in place, MCP still streamlines your trading stack, cuts operational friction, and enables AI automation.

If you haven’t registered for Alpaca’s Trading API to start your own trading integration on Claude desktop, you can sign up on Alpaca’s website. If you’re making your own MCP integration with Alpaca, feel free to share it on social media and tag us or share it in our community forum, Slack community, or subreddit! We’d love to see what our community is working on. For account assistance, you can contact customer support as well.

Frequently Asked Questions

What is MCP in simple terms?

It’s a protocol that lets AI tools communicate with apps (like trading platforms) using a shared context layer.

Is Alpaca’s MCP server safe to use?

Yes, it uses API key-based authentication and doesn’t share sensitive data beyond what’s requested.

Can I use MCP without coding knowledge?

Yes, especially with tools like Cursor or Claude that support natural language commands.

Alpaca is not affiliated with any of the companies or creators referenced in this article and is not responsible for the liabilities of the others.

Please note that this article is for educational and informational purposes only. All screenshots are for illustrative purposes only. Alpaca does not recommend any specific securities or investment strategies.

All investments involve risk, and the past performance of a security, or financial product does not guarantee future results or returns. There is no guarantee that any investment strategy will achieve its objectives. Please note that diversification does not ensure a profit, or protect against loss. There is always the potential of losing money when you invest in securities, or other financial products. Investors should consider their investment objectives and risks carefully before investing.

Past hypothetical backtest results do not guarantee future returns, and actual results may vary from the analysis.

The Paper Trading API is offered by AlpacaDB, Inc. and does not require real money or permit a user to transact in real securities in the market. Providing use of the Paper Trading API is not an offer or solicitation to buy or sell securities, securities derivative or futures products of any kind, or any type of trading or investment advice, recommendation or strategy, given or in any manner endorsed by AlpacaDB, Inc. or any AlpacaDB, Inc. affiliate and the information made available through the Paper Trading API is not an offer or solicitation of any kind in any jurisdiction where AlpacaDB, Inc. or any AlpacaDB, Inc. affiliate (collectively, “Alpaca”) is not authorized to do business.

Securities brokerage services are provided by Alpaca Securities LLC ("Alpaca Securities"), member FINRA/SIPC, a wholly-owned subsidiary of AlpacaDB, Inc. Technology and services are offered by AlpacaDB, Inc.

This is not an offer, solicitation of an offer, or advice to buy or sell securities or open a brokerage account in any jurisdiction where Alpaca Securities is not registered or licensed, as applicable.