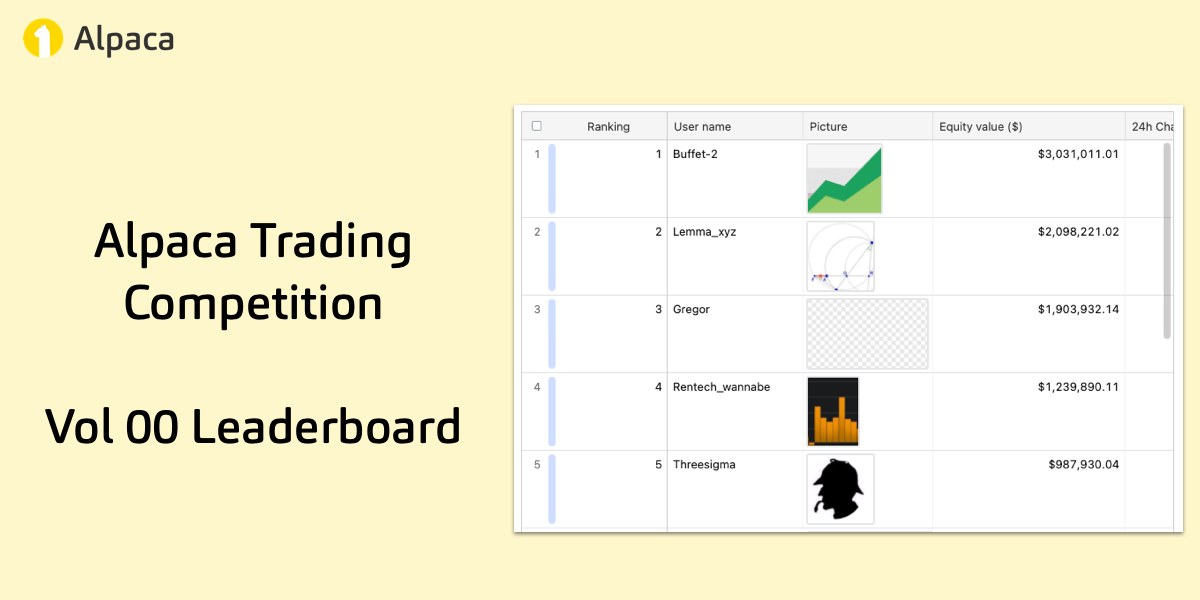

Alpaca hosted its second Trading Competition last month and we thank all our participants as well as welcome new users! Although we had a great number of individuals who performed well, we chose to interview the 3 top performers of our competition. In this article we interview John, who led the leaderboard at $140,040.44 Profit!

The leaderboard for the 2nd Trading Competition can be found here.

#1. John (CHIEFSMURPH) - $ 140,040.44 [Profit]

Twitter: beachonkey

John, a San Francisco native enjoys living a nomad life as a Software Engineer. He attended the Berklee College of Music to study Piano, songwriting and music production and started algorithmic trading 5 years ago.

We asked John a couple of questions about his career in algorithmic trading.

1. Hi John, what made you start Algorithmic Trading? and when did you start practicing it?

I started algorithmically trading about five years ago. I traded stocks manually for a year, but then I realized it was a logical step to incorporate another one of my passions - programming. I started with standalone tools that would fetch fundamental data as well as calculate metrics that were not easily accessible from existing trading platforms. Then I experimented with different methods for calculating social sentiment scores for various tickers. These tools have gone through many revisions and still play a part into my algo trading platform that I work on today.

What led me to pursue a more automated and "legit" algo trading system is the idea that passive income is great. I've gotten to the point where I rely much on my algo trading setup to influence my manual trades, but several sources point out that the inevitable human emotions that arise from trading can come at a hindrance of consistent profits. I believe algo trading is the type of challenge that rewards fresh ideas and new perspectives.

2. Do you currently trade live or are planning to anytime soon? If yes, do you have a platform in mind and what made you choose it?

Yes, I am currently trading live. I experimented with a few different traditional algo trading platforms, but I wanted to keep things simple and did not want the infrastructure pushing me a certain way. Alpaca offers that connection to the markets while giving me the freedom to run my strategies and backtest on my own terms.

I think most of the algo traders can relate to the passion and the several challenges faced during algo trading. The grind is all the more rewarding on those days when you see the effort pay off.

Thank you Alpaca for finally creating a stock brokerage catered specifically for algorithmic trading!

The entire Alpaca team thanks all our participants and our winners for putting their best effort forward. We look forward to introducing more events at Alpaca. Stay tuned for more updates through our newsletter or through our community Slack.

Technology and services are offered by AlpacaDB, Inc. Brokerage services are provided by Alpaca Securities LLC (alpaca.markets), member FINRA/SIPC. Alpaca Securities LLC is a wholly-owned subsidiary of AlpacaDB, Inc.

You can find us @AlpacaHQ, if you use twitter.