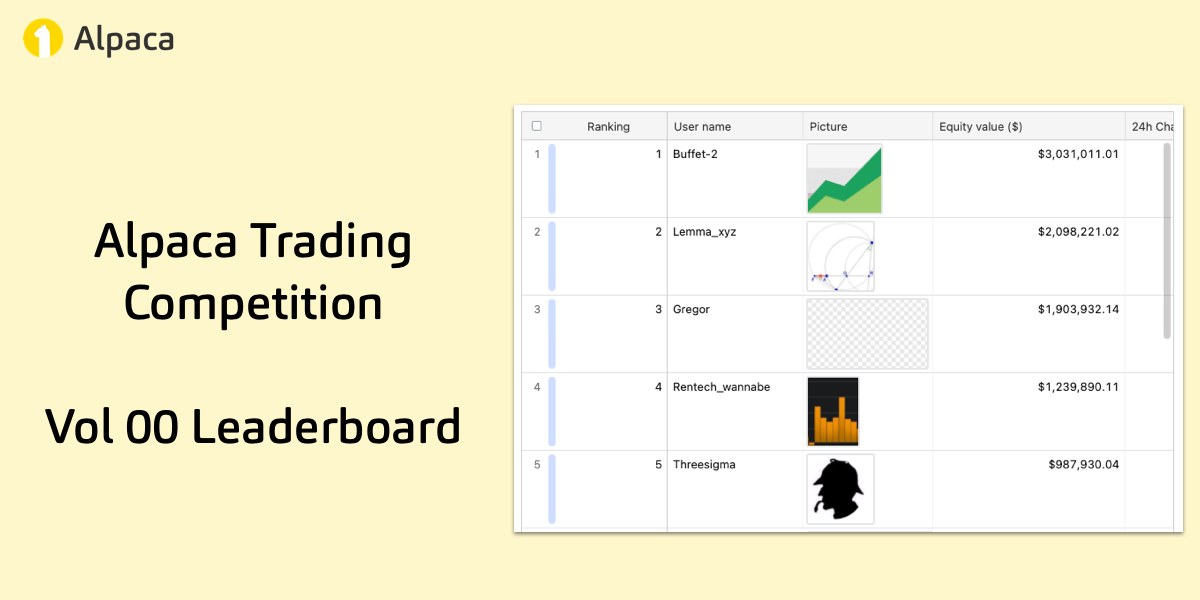

In this article we interview two of the top performers and also our runner ups in the 2nd Trading Competition held by Alpaca. The leaderboard for the 2nd Trading Competition can be found here.

In case you haven't, check out Part 1 here.

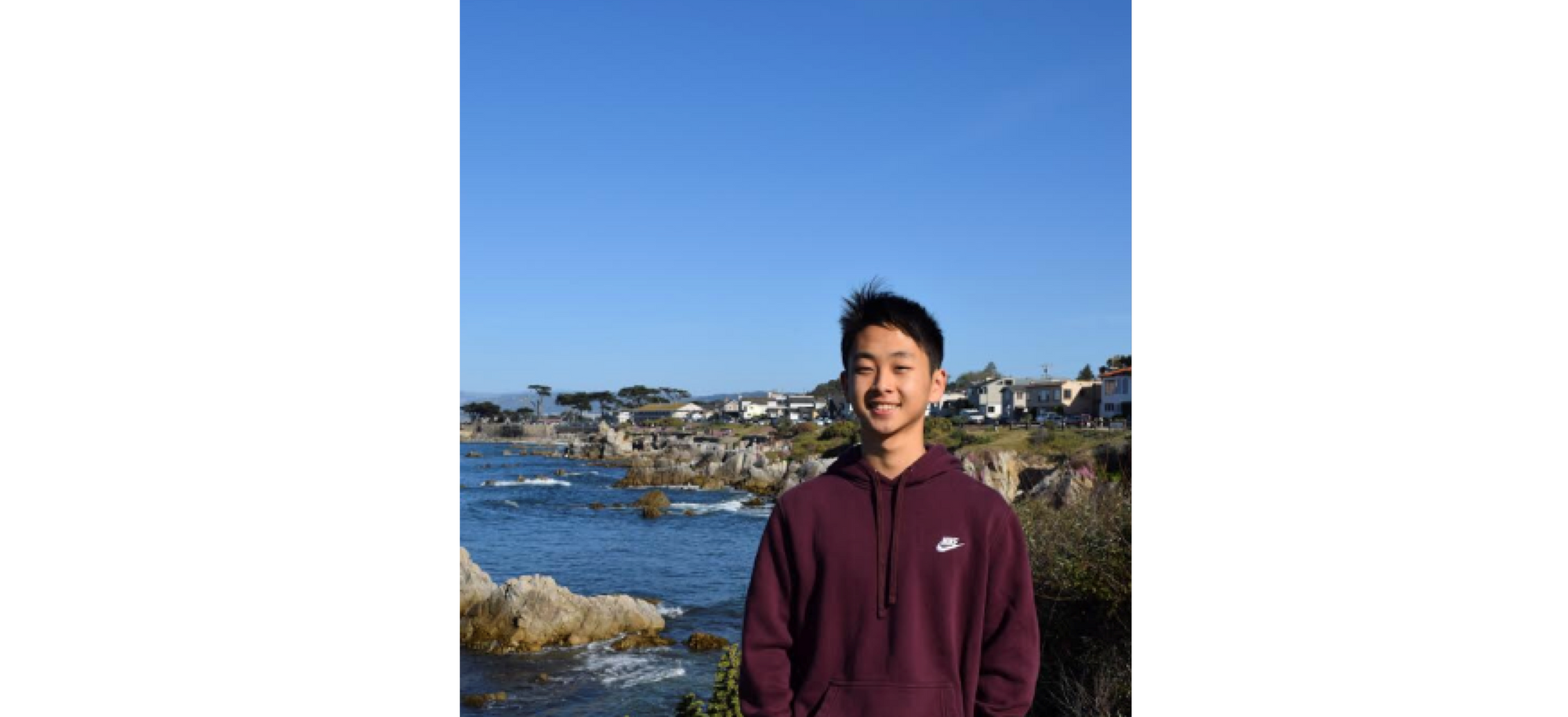

#1. Allen Ye (YAHALLO) - $ 95,128.00 [Profit]

Twitter: AllenYe66

Allen, a student living in California found out about Alpaca’s Trading competition through a group on discord. Allen recently started paper trading and decided to take part in the trading competition to get some experience with algorithmic trading as well as have some fun!

1. Hi Allen, What made you start Algorithmic Trading? and when did you start practicing it?

I am pretty new to trading so I only started researching algorithmic trading when I found out about the Alpaca trading contest and API. After this contest, however, I definitely intend to do a lot more algorithmic trading in the future and use Alpaca’s API.

2.Do you currently trade live or are planning to anytime soon?

Right now, I currently have a TD Ameritrade paper trading account where I just experiment with graphs and have fun. I intend to create an actual account soon after learning more about algorithmic and day trading.

3.What aspects of competition did you like and what do you think we can improve on?

I think the overall competition was very smooth and easy to take part in as a participant. There is honestly not much that I can find to improve on.

The entire Alpaca team thanks you for your participation Allen, and congratulations again on being one of the top performers in the trading competition.

#3. Julia Nguyen(UXJULIA) - $91,650.00 [Profit]

Twitter: uxjulia

Our second runner up, Julia Nguyen is based in Virginia and she found out about our Trading Competition through an algo trading subreddit ! Wow!

We asked Julia how her experience went in our competition.

1.Hi Julia, What made you start Algorithmic Trading? and when did you start practicing it?

I wanted to automate trades so that I didn’t have to worry about timing or human emotions getting in the way. I started dabbling in algo trading in 2017 when Bitcoin was making its historic run.

2.Do you currently trade live or are planning to anytime soon?

I don’t currently algo trade live, but may consider it down the road.

The entire Alpaca team thanks all our participants and our winners for putting in their best effort forward. We look forward to introducing more events at Alpaca. Stay tuned for more updates through our newsletter or through our community Slack.

Technology and services are offered by AlpacaDB, Inc. Brokerage services are provided by Alpaca Securities LLC (alpaca.markets), member FINRA/SIPC. Alpaca Securities LLC is a wholly-owned subsidiary of AlpacaDB, Inc.

You can find us @AlpacaHQ, if you use twitter.