Alpaca has upgraded the premium data subscription offering for individuals. It’s a great option for traders looking for a powerful and easy-to-use API data option for building trading applications, algorithmic trading strategies, self-directed investing, and more.

However, Alpaca isn't the only player in this space, and choosing between the many different options can be tough. Therefore, in this article, we’ll explore how Alpaca’s data plans compare to Polygon.io.

We’ll start off by comparing each service’s premium offering, Alpaca’s Unlimited data plan, and Polygon’s Advanced data plans.

Alpaca’s Unlimited Plan vs. Polygon’s Advanced Plans

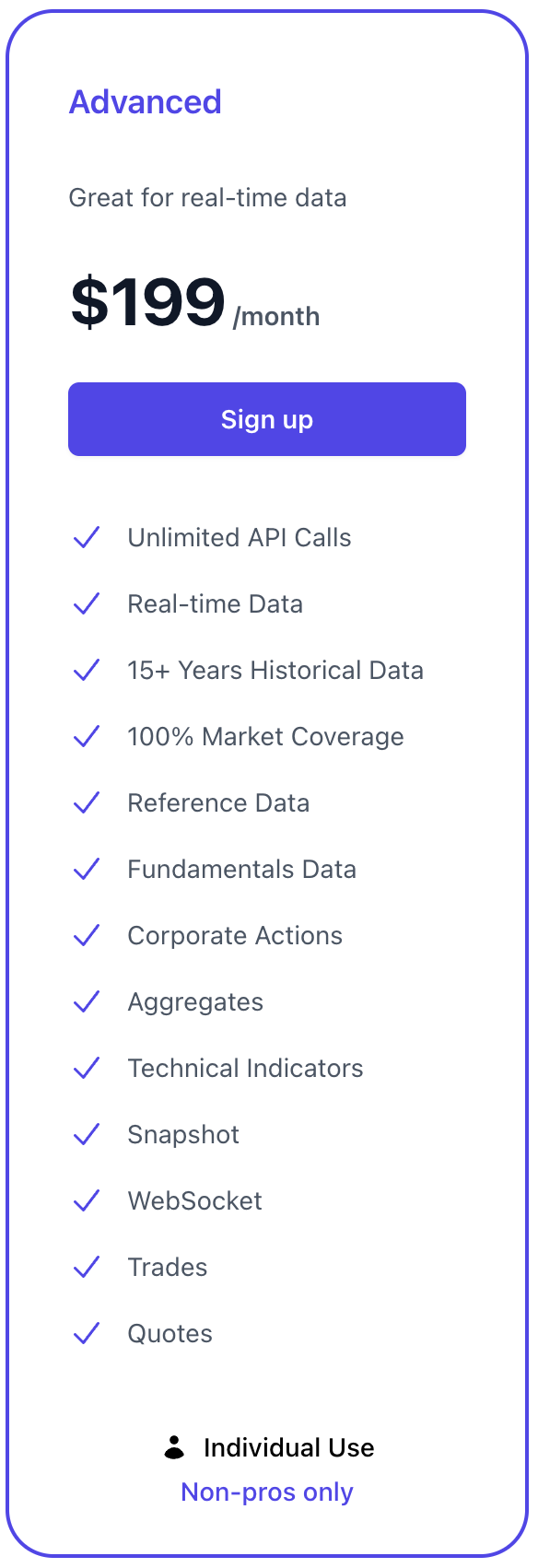

The first difference between these services is that Alpaca’s data plan provides an all-in-one option for consuming market data, and Polygon has broken up its market data into categories that you must subscribe to. By contrast, Alpaca bundles its services into one subscription plan, making the API more accessible for developers. This means that if you don’t know exactly what data you need, or if you’re interested in developing strategies over more than one type of data, you can do so easily without subscribing to a new plan. On the other hand, Polygon offers market data for options and forex, while currently, Alpaca does not.

Querying for market data of multiple stock symbols is handled differently between these services as well. Starting with Alpaca, there are specific endpoints that handle lists of symbols for trade, quote, aggregate bar, and snapshot data. Polygon’s Advanced plan includes endpoints for each of these categories of data, but for trade and quote data you must query for individual symbols per API call. For example, in requesting the quote data for a set of 20 stocks, it would take 1 API request with Alpaca and 20 API requests with Polygon.

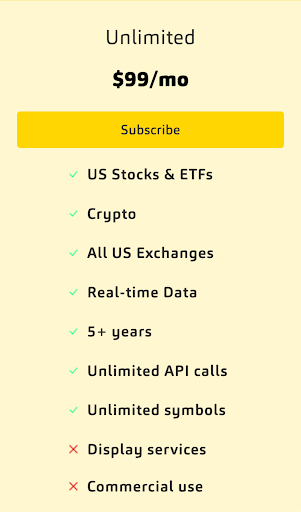

The last difference we’ll cover between these two plans is price. Alpaca’s unlimited plan comes in at $99/month, which is an all-in-one data option for both stocks and crypto. Polygon’s pricing is structured differently than Alpaca’s so we’ll cover a few different scenarios. Subscribing only to Polygon’s advanced plan for stocks is $200/month. One thing to note is that Polygon includes fundamental data while Alpaca does not. If you would like a comparable Polygon package for both stocks and crypto data, it will be $249/month. At this price point, it will also include forex data, which isn’t available on Alpaca. Taking full advantage of Polygon’s services, the premium package for stocks, options, and currencies will total $449/month. Like forex data, options data is not available on Alpaca.

Overall, coming in at less than half the price and offering a more developer-friendly experience, Alpaca’s Unlimited data plan is a strong and cost-effective solution for your market data needs.

Price aside, both services offer free market data for users that aren’t ready to invest in a paid subscription plan yet. We’ll explore the free plans next.

Alpaca’s Free Plan vs. Polygon’s Basic Plan

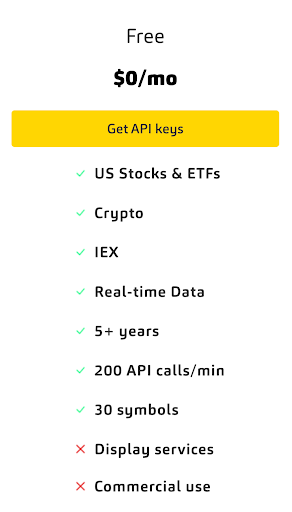

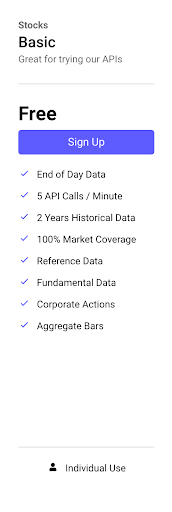

The most prominent difference between these two plans is the rate limits. This is a significant detail because, without considering rate limits, one risks their program’s data flow being interrupted. Therefore, the rate limit of your data solution is a detail that should never be overlooked. Alpaca’s free plan allows 200 API calls/minute. In contrast, the rate limit for each of Polygon’s free plans is 5 API calls/minute. In practice, this means Alpaca’s free plan offers a greater degree of freedom when being integrated into your workflow.

Another difference is the types of data available to the user. Alpaca’s free plan includes all the same endpoints as the premium plan for stocks and crypto data. This includes real-time data via WebSocket, and historical aggregate bars, quotes, trades, and snapshots. In comparison, of these categories mentioned, Polygon’s free plan only has aggregate bars. However, Polygon’s free plan includes reference and fundamental data while Alpaca’s does not.

The last difference we’ll touch on is the timeframe of available data. On Alpaca’s free plan, although real-time data is available via WebSocket, querying for historical data will be delayed by 15-minutes. This is different from Polygon’s free plan, where there is no real-time data available. In addition, the historical data that can be queried is end-of-day data. In practice, this means that the current day’s stock market data is unavailable until after the market has closed.

Conclusion

We’ve touched on some of the differences between Alpaca and Polygon’s data plans in this article. There are certainly pros and cons that come along with using any service, and we hope that you’re now able to make a more informed decision on what service suits your needs. Sign up for a free account with Alpaca today if you’d like to see our API in action.

References

[1] - “Unlimited access to real-time US Stock Market Data: Alpaca data API,” Alpaca. [Online]. Available: https://alpaca.markets/data. [Accessed: 06-Jun-2022].

[2] - Polygon.io. [Online]. Available: https://polygon.io/pricing. [Accessed: 06-Jun-2022].

Alpaca and Polygon.io, Inc are not affiliated. Please note that this article is for general informational purposes only and is believed to be accurate as of posting date but may be subject to change. All screenshots are for illustrative purposes only. Alpaca does not recommend any specific securities, cryptocurrencies or investment strategies.

All investments involve risk and the past performance of a security, or financial product does not guarantee future results or returns. Keep in mind that while diversification may help spread risk it does not assure a profit, or protect against loss, in a down market. There is always the potential of losing money when you invest in securities, or other financial products. Investors should consider their investment objectives and risks carefully before investing.

Alpaca does not prepare, edit, or endorse Third Party Content. Alpaca does not guarantee the accuracy, timeliness, completeness or usefulness of Third Party Content, and is not responsible or liable for any content, advertising, products, or other materials on or available from third party sites.

Securities brokerage services are provided by Alpaca Securities LLC ("Alpaca Securities"), member FINRA/SIPC, a wholly-owned subsidiary of AlpacaDB, Inc. Technology and services are offered by AlpacaDB, Inc.

Cryptocurrency is highly speculative in nature, involves a high degree of risks, such as volatile market price swings, market manipulation, flash crashes, and cybersecurity risks. Cryptocurrency is not regulated or is lightly regulated in most countries. Cryptocurrency trading can lead to large, immediate and permanent loss of financial value. You should have appropriate knowledge and experience before engaging in cryptocurrency trading. For additional information please click here.

Cryptocurrency services are made available by Alpaca Crypto LLC ("Alpaca Crypto"), a FinCEN registered money services business (NMLS # 2160858), and a wholly-owned subsidiary of AlpacaDB, Inc. Alpaca Crypto is not a member of SIPC or FINRA. Cryptocurrencies are not stocks and your cryptocurrency investments are not protected by either FDIC or SIPC. Please see the Disclosure Library for more information.

This is not an offer, solicitation of an offer, or advice to buy or sell cryptocurrencies, or open a cryptocurrency account in any jurisdiction where Alpaca Crypto is not registered or licensed, as applicable.