You've built, tested, and backtested your algorithmic trading strategy. But how do you know when it's time to take it live? Should you continue with paper trading or start live trading? And once you're live, should you continue testing in your paper account? Or make your adjustments in live conditions? These are all common questions that new algo traders ask.

There’s no universal answer, and while best practices have emerged from experienced traders across Reddit, blogs, and YouTube, much of this advice is anecdotal, relying more on opinion than data. The truth is, while nothing fully replicates the emotional and technical realities of live trading, paper trading can remain a valuable first step. It’s especially useful if you’re new to algo trading, working with a new API, or experimenting with new strategies.

However, staying in paper environments long-term isn’t optimal either. Knowing when to make the transition is one that can block many new traders from ever starting, especially when you’re expecting the same profitability in live conditions as you were having in paper.

Has anybody been successful paper trading but when they started trading with their real money they were losing? In other words, is paper trading way different than using your real money?

byu/Nesquick19 inthinkorswim

Because the emotional blockers to placing your first live trade can be so strong, we wanted to provide algorithmic traders with data-backed insights, rather than personal opinion.

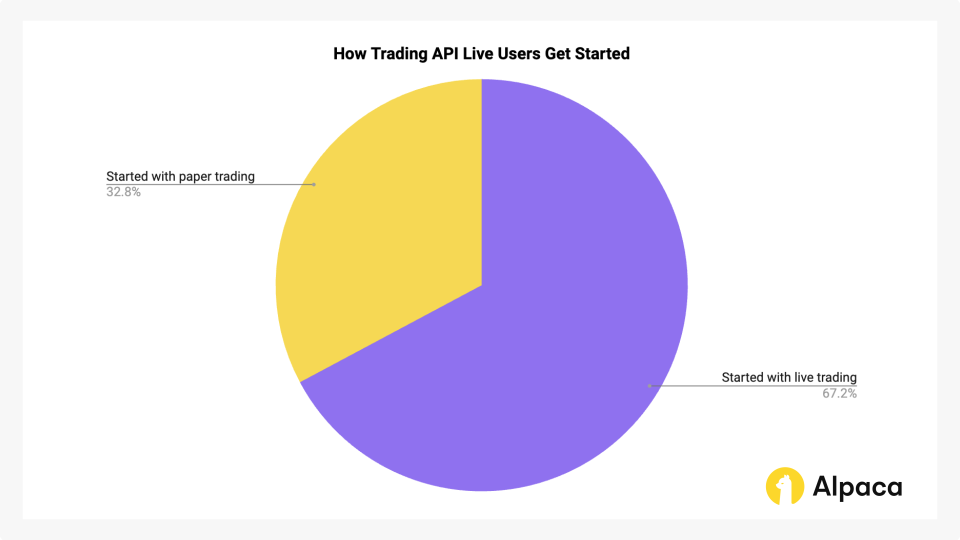

That’s why we recently analyzed how our Trading API users who placed a live trade between June 1, 2024, and May 31, 2025, interact with paper trading and live trading. Analyzing this audience, we found some quantitative insights that may help algo traders build the confidence to make the transition from paper trading to live trading.

Here’s a brief overview of the key takeaways and highlights:

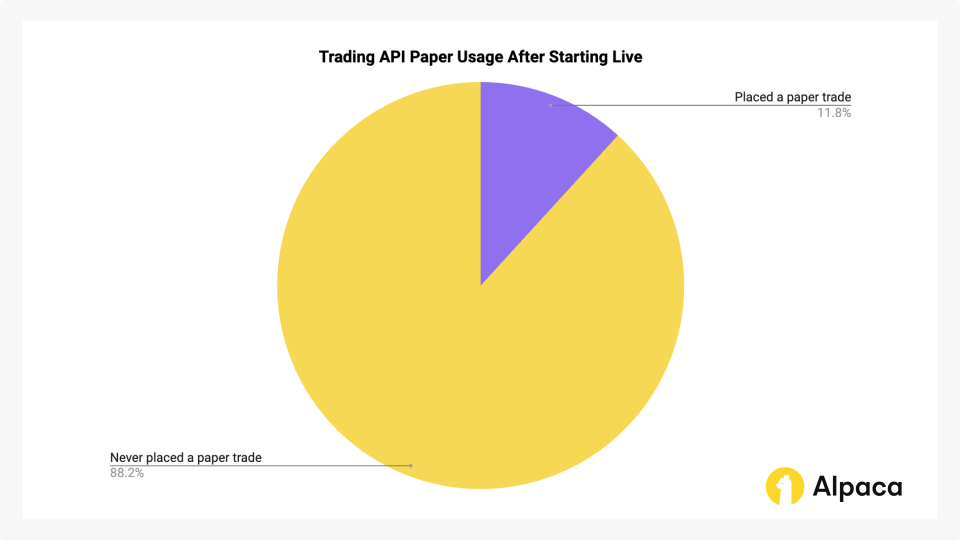

- More than two-thirds of Trading API users (67.2%) who placed a live trade between June 1, 2024, and May 31, 2025, started trading in live conditions, not paper. Of this segment, 11.8% utilized paper trading after live trading.

- Takeaway: Paper trading may not be the default starting point for algorithmic traders, and many of them (88.2%) may prefer building, testing, and iterating in live conditions.

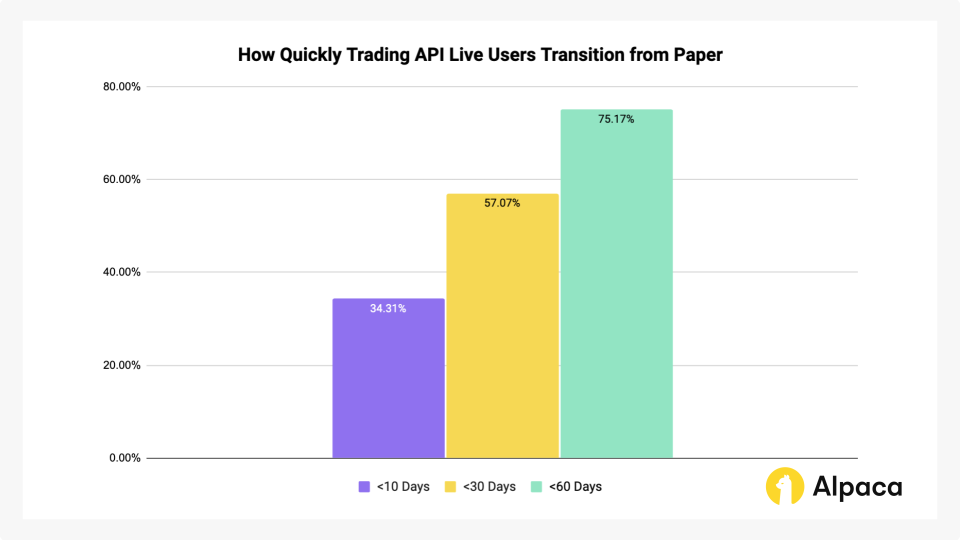

- Of the remaining 32.8% of Trading API users who placed a live trade, over half (57.1%) started with paper trading and placed their first live trade within 30 days of their first paper trade, while three-quarters (75.1%) did so within 60 days.

- Takeaway: Paper trading may be used more as a tool for environmental testing, rather than as a long-term simulation tool. Live trading brings in real-world factors, which can offer different insights you won’t get from simulation alone.

Please note that this data is just for API users and does not include those who trade through our dashboard.

What is Paper Trading?

Paper trading, also known as simulated or demo trading, allows algo traders to test strategies using historical or real-time data without risking real capital. It provides a safe environment to refine algorithms, explore new ideas, and gain confidence in market mechanics. However, paper trading has limitations as it doesn’t fully capture the nuances of live conditions, such as slippage, latency, liquidity issues, or emotions.

What is Live Trading?

Live trading is the execution of your strategy with real capital in real market conditions. It’s a necessary step, but one that introduces variables paper trading can’t replicate. Many traders discover that even if their strategy is profitable on paper, going live can feel like starting over. The psychological and technical shifts are real, and that’s where preparation matters most.

Paper Trading vs. Live Trading: Key Differences

The table below compares paper trading vs live trading across key areas:

Why Both Environments Matter

Paper trading is often used for learning the ropes: understanding APIs, identifying bugs, and testing strategies risk-free. Without it, traders risk jumping into live trading with technical or strategic flaws that could result in real losses.

But staying in a simulated environment for too long also comes with downsides. It can create a false sense of readiness. Real markets introduce psychological pressure and execution challenges that paper trading can’t fully replicate.

Paper trading is all logic Money trading is all Emotion Answer: Remove emotion from money trading

by in

Many experienced algo traders across Reddit forums and communities agree: no amount of simulation will prepare you for every variable. Once your strategy is stable, the way to build skill and confidence is by taking your strategy live. This is supported by the behavior we’re seeing from our Trading API users.

When Alpaca Users Transition from Paper to Live

Recently, we analyzed how Trading API users who placed a live trade between June 1st, 2024 and May 31st, 2025 interact with paper trading and live trading. This was determined as the ideal segment because they have made the transition to live trading, and the insights from their behavior could benefit first-time traders.

After looking into their trading activity, we discovered some interesting findings. Please note that this data does not factor in the complexity of their strategy, the asset class they traded, or the amount of capital they trade with.

Firstly, we discovered that 67.2% of these Trading API users started by placing a live trade, not a paper trade.

On top of that, only 11.8% of this audience ever placed a paper trade after live trading. This may indicate that most live users (88.2%) prefer building, testing, and iterating in live conditions rather than paper.

There are a couple of potential reasons for this including:

- They may be experienced with algorithmic trading on other platforms, so they already know how to deal with emotions, loss, and sticking to their plan, making them comfortable with live trading.

- They understand that paper trading has its drawbacks and prefer to learn about the API or platform in situations that reflect real-life scenarios.

Secondly, we found that of the 32.8% of these Trading API users who placed a paper trade before live trading:

- 34.3% placed their first live trade within 10 days of their first paper trade

- 57.1% placed their first live trade within 30 days of their first paper trade

- 75.2% placed their first live trade within 60 days of their first paper trade

This supports the hypothesis that spending a long time in paper environments isn’t always the best way to learn. It may be better to use the paper environment to understand the basics of the platform and then make the shift to live trading to understand how your strategy will perform in real market conditions.

Once you start trading live you realize that you know nothing, and greed takes over. The sooner you go live the faster you will learn.

byu/R0zika inDaytrading

In summary, if you’ve been algo trading in paper environments consistently for over 60 days, you may have the skills and familiarity to consider taking your strategy live. If you’re still unsure, we’ve included additional qualitative indicators below to help guide your decision.

Common Indicators That You’re Ready to Take Your Strategy Live

So, when should you start live trading? While every trader’s timeline is different, here are some signs—based on both Alpaca user behavior and insights from algo trading communities—that suggest you’re ready to make the leap.

You Understand the Platform

Paper trading is a common way to get comfortable with a broker’s platform, API, and order mechanics. If you can confidently troubleshoot errors, work with historical data, and run backtests without hiccups, that’s a strong sign of readiness. For most of Alpaca’s live traders, this takes about 30 to 60 days of paper trading.

You’ve Had Consistent Performance Over Time

Paper trading success doesn’t guarantee live trading profits—but consistent performance is still a strong indicator that you understand market dynamics and your strategy has potential.

Key signs include:

- You’ve maintained steady paper profits over several weeks or months.

- Your results aren’t driven by a lucky streak or one-off market conditions.

- You’ve stress-tested your strategy in different market environments (e.g. high volatility, low volume).

At this stage, many traders suggest testing with small amounts to observe how their strategy holds up under live conditions.

You Have a Defined Risk Management and Trading Plan

Live trading introduces real consequences, so having a clear plan helps you stay grounded—even when emotions run high. A solid risk management framework may reduce costly mistakes in your first trades.

You may be ready if:

- You’ve set concrete rules for stop-losses, position sizing, and capital allocation.

- You’ve defined your personal risk tolerance—for example, many traders follow the rule of risking no more than 1–2% of their capital on any single trade.

- You’ve practiced following your plan in paper trading, even during losing streaks or fast-moving markets.

Having structure in place not only protects your capital, but also helps you build the discipline needed to grow as a live trader.

You Have a Clearly Defined Capital Allocation

Live trading means putting real money on the line—and that requires a thoughtful approach to how much you’re willing to risk. A common practice is to start small. This helps you build emotional tolerance and avoid over-leveraging while you get used to live execution.

You might be ready if:

- You’ve decided on an initial trading budget you're comfortable losing (e.g. a small percentage of your portfolio).

- You’ve limited your position sizes to avoid large drawdowns early on.

- You’ve factored in commissions, slippage, and potential losing streaks into your capital plan.

You’re Emotionally Prepared

Paper trading doesn’t simulate fear, greed, or stress—yet these are some of the most powerful forces in live trading. Emotional preparedness is just as important as technical readiness.

You may be ready to go live if:

- You’ve honestly assessed your ability to handle gains and losses with real money.

- You’ve experienced simulated large drawdowns in paper trading—and learned to stay disciplined.

- You understand that even a sound strategy can lose money short-term, and you’re mentally prepared for that. Live trading will test your psychology.

No emotion, no attachment, the money ain't real. You can literally reset the balance in an instant. No slippage, instant fills, no keystrokes errors, platform issues or any real possible world scenarios. That's why paper trading should really be long enough to learn and get use to the platform of your choosing. The sooner you get real money, your own money involved. The sooner you can gain actual experience.

byu/Deja__Vu__ inDaytrading

Recognizing this ahead of time—and having a plan to manage your reactions—is what separates traders who persist from those who quit after a few bad trades.

How to Build Confidence in Live Trading

Making the jump to live trading doesn’t mean the learning stops. In fact, this is where some of the most important lessons begin. Here are a few ways to build confidence and maintain discipline once real money is on the line:

Compare Paper vs. Live Results

Continue logging paper trades alongside your live trades for a month. Analyze differences in performance to understand how real-world factors, like slippage, latency, and fees, impact your results. This helps you calibrate expectations and identify gaps between simulation and reality.

Trade in Micro Amounts

Start small. Use minimal capital to test your strategy under real market conditions without risking significant losses. This allows you to experience execution delays, partial fills, and volatility while keeping emotions and risk in check.

Adjust Based on Data, Not Emotion

Don’t make changes out of fear, excitement, or after a streak of wins or losses. Let data guide your decisions. Look for patterns across multiple trades and timeframes before making any tweaks to your system.

Keep a Trading Journal

Document each live session—your plan, trade rationale, emotional state, and post-trade analysis. Track metrics like win rate, drawdown, Sharpe ratio, and maximum consecutive losses. Over time, this journal becomes your most valuable feedback tool for spotting biases and refining your approach.

Stick to the Plan

If you’ve built a system, trust it. Some of the most common mistakes new traders make include abandoning strategies too early, oversizing positions, or exiting based on emotion. Discipline is what transforms a backtested idea into a consistently executable live strategy.

Final Thoughts: Trading Is a Journey

As we saw, two-thirds of our Trading API users who placed a live trade between June 1, 2024, and May 31, 2025, placed their first trade in a live environment. Of the remaining third, over half placed their first live trade within 30 days of their first paper trade and three-quarters of our users make the transition to live trading in less than two months. If you find yourself getting to the third, sixth, or tenth month of paper trading, you may be ready to start live trading.

This indicates that while transitioning from paper trading to live trading can be a significant milestone, it is only the beginning. When making the transition to live trading, you will probably make mistakes. You may lose money. However, the goal of live trading isn’t to be perfect. That’s not possible. Instead, it’s to improve through iteration, to stay disciplined, and to protect capital while scaling up slowly.

- Sign up for an Alpaca's Trading API account

- Connect to Alpaca's Trading API

- Start Paper Trading with Alpaca's Trading API

- Make sure you understand the differences between paper trading and live trading.

- Review the indicators listed above and reflect on your experience.

- Create a detailed plan and determine a date to start live trading—even if it’s with just a small amount.

- Journal your experience and share findings in communities like r/algotrading and r/stocks, or Alpaca’s community forum and Slack.

You may grow faster with accountability and feedback from other algo traders.

Frequently Asked Questions

Is paper trading accurate?

To a degree. Paper trading is great for testing strategies, learning the platform, and building technical confidence. However, it doesn’t simulate key live trading dynamics like slippage, emotional pressure, liquidity constraints, or real-world order execution.

Is paper trading necessary before live trading?

Not always—but it is recommended. Paper trading helps you get familiar with APIs, platform behavior, and strategy logic in a risk-free environment. Some experienced traders go straight to live trading with very small capital, but many start with paper first to avoid preventable mistakes.

Should you ever stop paper trading?

That depends on your goals and experience. Many traders continue using paper accounts to test new strategies while live trading their core systems. Paper trading remains a useful toolbox—as long as you remember its limitations and don’t rely on it as a perfect proxy for live trading.

How long should you paper trade?

There’s no fixed rule. Reddit communities often recommend 2–6 months, while Alpaca data shows many users transition within 1–2 months. The key indicators are consistency, platform fluency, a defined trading plan, and emotional readiness. When those align, it’s okay to start small and go live.

Securities brokerage services are provided by Alpaca Securities LLC ("Alpaca Securities"), member FINRA/SIPC, a wholly-owned subsidiary of AlpacaDB, Inc. Technology and services are offered by AlpacaDB, Inc.

This is not an offer, solicitation of an offer, or advice to buy or sell securities or open a brokerage account in any jurisdiction where Alpaca Securities is not registered or licensed, as applicable.

The Paper Trading API is offered by AlpacaDB, Inc. and does not require real money or permit a user to transact in real securities in the market. Providing use of the Paper Trading API is not an offer or solicitation to buy or sell securities, securities derivative or futures products of any kind, or any type of trading or investment advice, recommendation or strategy, given or in any manner endorsed by AlpacaDB, Inc. or any AlpacaDB, Inc. affiliate and the information made available through the Paper Trading API is not an offer or solicitation of any kind in any jurisdiction where AlpacaDB, Inc. or any AlpacaDB, Inc. affiliate (collectively, “Alpaca”) is not authorized to do business.

All investments involve risk, and the past performance of a security or financial product does not guarantee future results or returns. There is no guarantee that any investment strategy will achieve its objectives. Please note that diversification does not ensure a profit, or protect against loss. There is always the potential of losing money when you invest in securities, or other financial products. Investors should consider their investment objectives and risks carefully before investing.

Please note that this article is for educational and informational purposes only. All examples and screenshots are for illustrative purposes only. The views and opinions expressed are those of the author and do not reflect or represent the views and opinions of Alpaca. Alpaca does not recommend any specific securities or investment strategies.

Alpaca does not prepare, edit, endorse, or approve Third Party Content. Alpaca does not guarantee the accuracy, timeliness, completeness or usefulness of Third Party Content, and is not responsible or liable for any content, advertising, products, or other materials on or available from third party sites.