When a new president takes office, markets may react to speculation about potential policy changes, economic shifts, and regulatory adjustments. And as President Donald Trump returns to the White House in 2025, traders face a unique opportunity to examine the market dynamics influenced by his policy priorities.

Trump's first term showed a strong focus on deregulation, tax reform, and traditional energy, later extending to a cautious embrace of cryptocurrency. These focuses, combined with his ability to trigger market volatility, may present both opportunities and risks for algorithmic trading strategies.

In this analysis, we hypothesize that, similar to his first term, sectors sensitive to deregulation like defense and aerospace, finance, and oil and gas may be affected by his policies, but the extent and direction of the impact remain uncertain. By analyzing trends from Trump's first presidency and past Republican administrations, we aim to develop a Python algorithm to identify and execute trades based on our trading hypothesis.

It’s important to note that the hypothesis below is built using Polygon’s Historical Data API and should not be seen as an investment recommendation. It is impossible to predict future results based on past performance.

Before diving into the guide, make sure you’ve completed the following:

Historical Trends: Republican Wins and the Stock Market

As we create our hypothesis, let’s take a look at some of the past data points around Republican presidencies including election years and overall impact.

The Election Year Stock Market History of Past Republican Wins (General Trend)

Some sectors of the stock market have tended to respond favorably to Republican victories, largely due to pro-business policies. Historically, there have been a few consistent themes:

- Pro-business policies: Republican administrations often champion policies like tax cuts, deregulation, and reduced government interference, which markets view favorably.

- Corporate tax reductions: Trump's Tax Cuts and Jobs Act (TCJA) reduced corporate tax rates, aiming to drive profitability and economic growth.

- Increased defense and infrastructure spending: Traditionally, Republican administrations advocate for increased spending in these areas, directly benefiting industries like construction, defense, and energy.

Key Data from Trump's First Presidency

The period following Trump’s 2016 election was marked by optimism and overall market gains. Some highlights include:

- S&P 500 Performance: In 2017, the S&P 500 Index returned around 19.42%. By the end of his term in 2021, the S&P 500 returned 63.0%.

- Dow Jones Industrial Average: The DJIA experienced a significant rise in 2017, with a price return of about 25.08%. By the time Trump left office in 2021, the Dow Jones returned 56%, the highest for a Republican since the 1920s.

- Sector Performance in Trump’s First Year:

- Technology Sector: A standout performer, with total returns around 12.6% on S&P 500 returns in Q1 2017.

- Financials Sector: Posted strong relative performance during Q1 2017.

- Energy Sector: Subdued early in 2017 but saw increased interest in the third and fourth quarters.

- Defense Sector: Experienced robust growth of 3.9% in growth in 2017, reflecting higher defense spending globally.

Looking back at historical data helps to provide insight into how markets may behave in 2025 and beyond, especially if similar policies are implemented.

Impact of Republican Control on the Stock Market

Let’s dive deeper into the sector-level impacts observed during Trump’s first presidency, as these trends could potentially repeat in his second term.

It’s important to remember that while many of these sectors were expected to experience growth in his last presidency, that isn’t always the case, as markets are unpredictable in how they respond to policies. Traders should exercise caution whenever using trends to try and predict future results as there are several differing opinions on a president’s impact on the stock market.

Defense

Increased defense rhetoric boosted companies like Lockheed Martin, RTX Co., and Northrop Grumman Corp, which benefited from government contracts. While increased military spending is possible again, it's uncertain whether it will lead to the same market trends as during his first term.

Technology

Despite Trump’s seemingly confrontational relationship with some major tech companies, the sector performed well. Regulatory rollback in areas like data privacy and net neutrality created a business-friendly environment for growth. It will be interesting to see how the tech sector responds under Trump in his second term.

Financials

Trump’s administration rolled back significant portions of the Dodd-Frank Act, easing regulations on banks and financial institutions. This led to decreased tax rates, higher profits, and revenue increases for several financial institutions. And while Trump is expected to ease regulations on banks again, it is unclear how they will respond on the stock market.

Energy

Known for his pro-fossil fuel stance, traditional fossil fuel companies thrived to a certain extent under Trump’s pro-energy policies. Key moves included withdrawing from the Paris Climate Agreement and supporting increased drilling and fracking. While ETFs like XLE saw early gains in Trump’s presidency, by the time he left office, COVID-19, as well as other global impacts, had left a substantial impact on the sector as a whole.

Healthcare

Efforts to repeal the Affordable Care Act created consumer uncertainty, but pharmaceutical companies often fared better in the long run. This may have been because of the steps the administration took to make drug prices more affordable. How the healthcare industry will respond this time is yet to be determined.

Algotrading Considerations

Algorithmic trading strategies can capitalize on historical patterns and anticipate how Trump’s second presidency might influence markets. Below are key considerations for designing trading algorithms tailored to the expected market environment.

Sector Rotation

Sector rotation is a key concept in algotrading during periods of political transition. Republican victories have typically been associated with spikes in performance in specific sectors like energy, manufacturing, and defense. Algorithms could be used to track sector-specific ETFs like XLE (Energy Select Sector SPDR Fund), XLF (Financial Select Sector SPDR Fund), or XAR (SPDR S&P Aerospace & Defense) to identify sector-wide trends and analyze sector momentum using historical and real-time data to predict rotations and capitalize on short-term movements.

Volatility & Event-Driven Trading

Trump’s presidency was synonymous with market volatility, often driven by unpredictable announcements, policy changes, and geopolitical events. Event-driven algos could focus on short-term price swings following key announcements, such as tax reforms or trade policies or leverage historical volatility data from Trump’s first term to anticipate market reactions to similar events in 2025.

Possible strategies to use could include:

- Mean-reversion: Exploiting price overreactions to policy announcements.

- Arbitrage: Identifying discrepancies between related assets during high-volatility periods.

Momentum Trading

The 2017 post-election rally is a prime example of a momentum-driven market, with sectors like finance, energy, and defense experiencing gains. Momentum algorithms could be used to track stocks in industries that are expected to benefit from Trump’s policies or incorporate momentum indicators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) to time entries and exits.

Sentiment Analysis and News-Based Trading

Known for speaking his mind, news and sentiment played a critical role in market movements during Trump’s first term. Algos can use Natural Language Processing (NLP) to analyze news headlines, social media posts, and policy announcements for sentiment shifts. They can also react to key events like trade negotiations, executive orders, or legislative developments.

Potential applications could be using sentiment analysis on Trump’s tweets to predict market reactions or tracking news related to corporate tax cuts and deregulation to identify potentially affected stocks.

Factor-Based Strategies

Factor-based investing focuses on financial characteristics that drive returns. During Trump’s presidency, factors like value and momentum performed particularly well. Value investing may help identify undervalued stocks in sectors like energy, industrials, and financials. Meanwhile, momentum strategies may help identify stocks demonstrating strong price trends that are aligned with Trump’s policies.

And while the Trump administration leaned toward a hands-off approach to financial markets, crypto regulation was a contentious topic. Algorithms are used to monitor regulatory developments, as stricter regulations could impact prices, and analyze sentiment around policy announcements to predict short-term price movements.

Cryptocurrency and Blockchain

While cryptocurrency markets played only a peripheral role during Trump's first term, they are likely to become a more central focus in his second presidency. Despite limited regulatory clarity in his initial administration, when Bitcoin saw significant growth periods, Trump has since shown increasing interest in digital assets.

This evolving stance suggests new opportunities for algorithmic trading in the crypto markets. Since winning his second term, the cryptocurrency markets have continued to trend upward.

Economic Data

Trump’s presidency often had far-reaching effects on global markets, driven by policies like tariffs, trade negotiations, and foreign relations. Algorithms could monitor both economic indicators, like GDP growth, unemployment rates, and inflation, or trade policies, like international agreements, tariffs, and manufacturing policies.

Building A Trading Algorithm to Leverage Trump’s Presidency

Based on the analysis and different trends above, we developed a trading algorithm leveraging Polygon’s Historical Data API and Alpaca’s Trading API within a paper trading environment. More specifically, we built a cash-secured put strategy around the thesis that there could be continued growth in the defense and aerospace sector in Trump’s second term.

Overall, this cash-secured put strategy aims to establish strategic positions in three major defense-related corporations: Lockheed Martin (LMT), RTX Co. (RTX), and Northrop Grumman Corp. (NOC). If you want to follow along with building the strategy yourself, make sure to sign up for an Alpaca Trading API account and connect it with our paper trading environment for free.

Please note that the stocks Lockheed Martin (LMT), RTX Co. (RTX), and Northrop Grumman Corp. (NOC) are used as examples and should not be considered investment advice.

Please note: This strategy is a hypothesis and should be seen for educational purposes only. Markets are inherently risky and trading strategies should be backtested and factor in a wide range of risk management.

What is a Cash-Secured Put Strategy?

The cash-secured put involves writing an at-the-money (ATM) or out-of-the-money (OTM) put option while simultaneously setting aside enough cash to purchase the stock if assigned. The goal is to earn income on the option premium or potentially acquiring the stock at a price below its current market value. For example, if the contract is assigned, the stock is acquired at a price lower than the current price and if it is not assigned, they earn a premium which leads to profitable gains.

However, the cash-secured put strategy involves risks and may not be suitable for all investors. For example, if the put option is assigned, it means that the seller of the put option is obligated to buy the underlying stock at the strike price, even if the market price is lower. This could result in a loss if the stock price drops significantly. Another risk is the opportunity cost. While the seller of the put option collects a premium, they miss out on potential gains if the stock price rises significantly.

Strategy Considerations

It’s important to build risk management into your algorithms. One example of doing this is to build an algorithm that dynamically adjusts the strike prices of the puts based on delta and implied volatility (IV), two option Greeks, ensuring alignment with the strategy’s risk tolerance and desired probability of assignment.

- Delta: Provides insight into the option’s sensitivity to price changes in the underlying stock and serves as a proxy for the probability of assignment.

- Implied Volatility (IV): Represents anticipated price movement in both the positive and negative direction. Higher IV can be a disadvantage for this strategy, as it increases the market value of the put, raising the cost of closing out the position if needed.

In the following example, we predefine the following parameters for a cash-secured put strategy, where the goal is to generate premium income while being prepared to purchase the underlying stock if assigned:

- The interest volume threshold is set to a minimum of 100 to ensure liquidity.

- The buying power limit is kept under 5% of the total buying power to avoid overexposure.

- Appropriate delta levels are set between -40 and -20 for put options to balance the likelihood of assignment.

This approach ensures that sufficient cash is reserved in the account to cover the potential purchase of the underlying stock if the option is assigned, which is fundamental to the cash-secured put strategy.

More advanced options traders could use Alpaca’s Trading API to build multi-leg strategies like: straddles, strangles, iron butterflies, iron condors, and spreads to capitalize on specific market volatility, range-bound price movements, and directional trends. However, we decided to choose a more simplified strategy for the purposes of this tutorial.

Note: While we are using Jupyter Notebook for this tutorial, you can use Google Collab or any other IDE as your code environment. You can also find all of the below code on Alpaca’s Github page.

Step 1: Setting Up the Environment for Polygon.io

This block is used to import all the essential libraries, such as Polygon and Plotly, along with standard Python libraries like datetime, os, and numpy. We will add Alpaca’s libraries in step 3.

!pip install polygon-api-client

!pip install plotly

#import modules

from polygon import RESTClient

import datetime as dt

import pandas as pd

import numpy as np

import plotly.graph_objects as go

from plotly.offline import plot

from datetime import datetime, timedelta

# Create client and authenticate with Polygon.io

# [Reference](https://github.com/polygon-io/client-python)

polygonAPIkey = 'YOUR_POLYGON_API_KEY'

client = RESTClient(polygonAPIkey) # api_key is used

def calculate_days_between(from_date, to_date):

from_date_obj = datetime.strptime(from_date, '%Y-%m-%d')

to_date_obj = datetime.strptime(to_date, '%Y-%m-%d')

return (to_date_obj - from_date_obj).daysStep 2: Historical Market Data Analysis with Polygon.io API

This section defines functions to fetch historical stock data, specifically from Trump’s first term, calculating the Average True Range (ATR) for a specified period. The ATR helps quantify volatility, providing valuable input for selecting underlying stocks suitable for options trading.

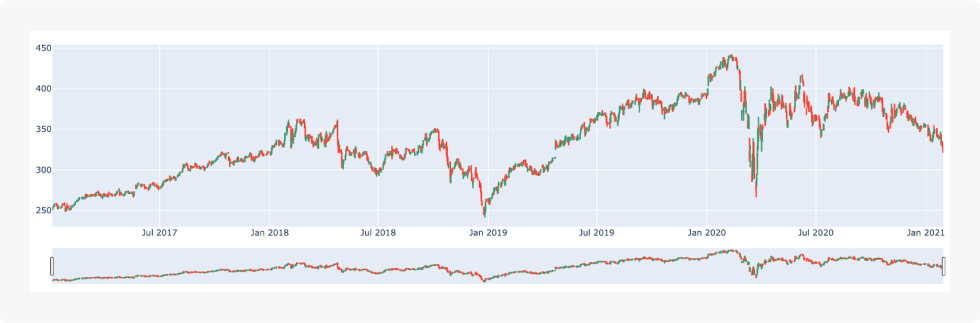

# Daily bars of target stocks (one of LMT, RTX, NOC). The code below checks "LMT" stock.

dataRequest = client.get_aggs(ticker="LMT",

multiplier=1,

timespan='day',

from_='2017-01-01',

to='2021-01-31')

# List of polygon agg objects to DataFrame

priceData = pd.DataFrame(dataRequest)

# Create Date column

priceData['date'] = pd.to_datetime(priceData['timestamp'], unit='ms')

priceData = priceData.set_index('date')

# Generate plotly figure

fig = go.Figure(data=[go.Candlestick(x=priceData.index,

open=priceData['open'],

high=priceData['high'],

low=priceData['low'],

close=priceData['close'])])

# Open figure directly in the Colab notebook

fig.show()The code above generates a chart like the one shown below. This visualization helps to provide an understanding of how the stock “LMT” performed over Trump’s first presidency.

Now, let’s dive deeper into utilizing the ATR of each stock to assess market conditions.

The oil and gas sector can be particularly sensitive to macroeconomic and political developments, making it crucial for the algorithm to account for volatility spikes during key announcements or events. While the ATR indicator explained below helps track volatility, complementary tools like the Relative Strength Index (RSI) can provide additional insight into market conditions.

# Fetch the stock data from the Polygon API

def get_stock_data(underlying_symbol, from_date, to_date):

# Get daily bars for the underlying stock

req = client.get_aggs(ticker=underlying_symbol,

multiplier=1, # 1-day timespan

timespan='day',

from_=from_date,

to=to_date)

# List of polygon agg objects to DataFrame

priceData = pd.DataFrame(req)

# Create Date column

priceData['date'] = pd.to_datetime(priceData['timestamp'], unit='ms')

priceData = priceData.set_index('date')

return priceData

# Calculate True Range for the underlying stock in the last 90 days

def calculate_true_range(data):

data['prev_close'] = data['close'].shift(1) # Shift the closing price by 1 day

data['tr'] = np.maximum(

data['high'] - data['low'],

np.maximum(

abs(data['high'] - data['prev_close']),

abs(data['low'] - data['prev_close'])

)

)

return data

# Calculate ATR for the underlying stock on the last 90 days

def calculate_atr(data, period=14):

data['atr'] = data['tr'].rolling(window=period).mean()

return data

# Calculate ATR for multiple stocks

def get_atr_for_stocks(stock_symbols, period, from_date, to_date):

results = {}

for symbol in stock_symbols:

print(f"Processing {symbol}...")

data = get_stock_data(symbol, from_date, to_date)

data = calculate_true_range(data)

data = calculate_atr(data, period=period)

results[symbol] = data[['tr', 'atr']].dropna() # Store TR and ATR data for each stock

return results

# List of stock symbols

stock_symbols = ['LMT', 'RTX', 'NOC']

# Call the function for multiple stocks

atr_results = get_atr_for_stocks(stock_symbols, period=14, from_date='2024-01-05', to_date='2024-12-31')

# Display ATR results for each stock

for symbol, result in atr_results.items():

# Calculate the mean ATR for the past days

atr_mean = result["atr"].mean()

days = calculate_days_between('2024-01-01', '2024-12-31')

print(f"\nThe average ATR for {symbol} over the past {days} days is:\n")

print(atr_mean)The analysis calculated the ATR values for the selected stock lists as of January 12, 2025. Over the preceding 365-day period,

- The average ATR for LMT over the past 365 days is: > 7.548020068693011

- The average ATR for RTX over the past 365 days is: > 1.757702431610942

- The average ATR for NOC over the past 365 days is: > 7.94581468085106

This data is provided for illustrative purposes only.

Step 3: Sell Cash-Secured Puts (CSPs)

This code sets up the Alpaca trading client for executing trades. It uses environment variables to securely load API credentials and sets key parameters like the open interest threshold (OI_THRESHOLD), buying power limit (BUY_POWER_LIMIT), and option strike price range (STRIKE_RANGE).

!pip install alpaca-py

import alpaca

from alpaca.trading.client import TradingClient

from alpaca.trading.requests import GetOptionContractsRequest, MarketOrderRequest

from alpaca.data.requests import OptionLatestQuoteRequest, OptionSnapshotRequest

from alpaca.data.historical.option import OptionHistoricalDataClient

from alpaca.data.historical.stock import StockHistoricalDataClient, StockLatestTradeRequest

# API credentials for Alpaca

API_KEY = "YOUR_ALPACA_API_KEY_FOR_PAPER_TRADING"

API_SECRET = 'YOUR_ALPACA_API_SECRET_KEY_FOR_PAPER_TRADING'

BASE_URL = None

## We use paper environment for this example

PAPER = True # Please do not modify this. This example is for paper trading only.

trade_client = TradingClient(api_key=API_KEY, secret_key=API_SECRET, paper=PAPER, url_override=BASE_URL)

stock_data_client = StockHistoricalDataClient(api_key=API_KEY, secret_key=API_SECRET)

option_historical_data_client = OptionHistoricalDataClient(api_key=API_KEY, secret_key=API_SECRET, url_override=BASE_URL)

# Set expiration range for options

today = datetime.now().date()

# Set the open interest volume threshold

OI_THRESHOLD = 100

# Buying power percentage to use for the trade

BUY_POWER_LIMIT = 0.05

# Check account buying power

buying_power = float(trade_client.get_account().buying_power)

# Calculate the limit amount of buying power to use for the trade

buying_power_limit = buying_power * BUY_POWER_LIMIT

# Define a 10% range around the underlying price

STRIKE_RANGE = 0.1This block defines a function to fetch the latest stock prices using the Alpaca API. It loops through the target stocks (['LMT','RTX','NOC']) and retrieves their most recent trade prices.

# Set the expiration date range for the options

min_expiration = today + timedelta(days=7)

max_expiration = today + timedelta(days=35)

# Get the latest price of the underlying stock

def get_underlying_price(symbol):

# Get the latest trade for the underlying stock

underlying_trade_request = StockLatestTradeRequest(symbol_or_symbols=symbol)

underlying_trade_response = stock_data_client.get_stock_latest_trade(underlying_trade_request)

return underlying_trade_response[symbol].price

# Get the latest price of the underlying stock

for symbol in stock_symbols:

# Get the latest price of the underlying stock

underlying_price = get_underlying_price(symbol)

print(f"\n{symbol} stock price: {underlying_price}")The get_put_options function fetches available put options for a given stock within a specified strike price range and expiration window. This data is critical for identifying suitable options for cash-secured puts.

# Check for put options

def get_put_options(underlying_symbol, min_strike, max_strike, min_expiration, max_expiration):

# Fetch the options data to add to the portfolio

req = GetOptionContractsRequest(underlying_symbols=[underlying_symbol],

strike_price_gte=min_strike,

strike_price_lte=max_strike,

status="active",

expiration_date_gte=min_expiration,

expiration_date_lte=max_expiration,

type="put",

)

# Get put option chain of the underlying symbol

put_options = trade_client.get_option_contracts(req).option_contracts

return put_optionsThis next block defines the find_short_put_option function to filter put options based on:

- Delta value (between -0.40 and -0.20, with slight buffers on both ends).

- Implied volatility (IV ≤ 60).

- Buying power limit (5% of Alpaca account buying power).

It fetches option quotes and Greeks using option_historical_data_client function and checks if each option meets the criteria.

# Find the appropriate short put option to sell based on the delta, IV, and buying power limit

def find_short_put_option(put_options, buying_power_limit):

short_put = None

for option_data in put_options:

try:

# Ensure open_interest is valid and open_interest_date exists

if option_data.open_interest is None or option_data.open_interest_date is None:

# Skip options with missing open interest or quote data

continue

# Check open interest meets the threshold

if float(option_data.open_interest) <= OI_THRESHOLD:

print(f"Skipping option {option_data.symbol} due to lack of open interest. You may change the OI_THRESHOLD")

continue

# Get the latest quote for the option price

option_symbol = option_data.symbol

option_quote_request = OptionLatestQuoteRequest(symbol_or_symbols=option_symbol)

option_quote = option_historical_data_client.get_option_latest_quote(option_quote_request)[option_symbol]

# Extract option details

option_price = (option_quote.bid_price + option_quote.ask_price) / 2

option_size = float(option_data.size)

strike_price = float(option_data.strike_price)

# Fetch delta for each option

# get option chain by underlying_symbol including IV, Greeks, and other information

req = OptionSnapshotRequest(

symbol_or_symbols = option_symbol

)

snapshot = option_historical_data_client.get_option_snapshot(req)

delta = snapshot[option_symbol].greeks.delta

iv = snapshot[option_symbol].implied_volatility

print(f"delta is {delta} and IV is {iv}")

# Check if delta is between -0.42 and -0.18, if IV is less than or equal to 60, and if the total contract exceeds the buying power limit

if delta is not None and delta >= -0.42 and delta <= -0.18 and iv <= 60 and strike_price * option_size < buying_power_limit:

# Create the appropriate short put option in the dictionary format

short_put = {

'close_price': option_data.close_price,

'close_price_date': option_data.close_price_date,

'expiration_date': option_data.expiration_date,

'id': option_data.id,

'name': option_data.name,

'open_interest': option_data.open_interest,

'open_interest_date': option_data.open_interest_date,

'root_symbol': option_data.root_symbol,

'size': option_data.size,

'status': option_data.status,

'strike_price': option_data.strike_price,

'style': option_data.style,

'symbol': option_data.symbol,

'tradable': option_data.tradable,

'type': option_data.type,

'underlying_asset_id': option_data.underlying_asset_id,

'underlying_symbol': option_data.underlying_symbol,

'initial_delta': delta,

'initial_iv': iv,

'initial_option_price': option_price,

}

print(f"short_put is {short_put}")

# If the short put is found, break the loop

if short_put:

break

except KeyError as e:

print(f"Missing data for option {option_symbol}: {e}")

continue

return short_putThe execute_cash_secured_put function integrates all components to:

- Fetch the latest stock price.

- Identify suitable put options using the

find_short_put_optionfunction. - Submit a market order for the selected option if criteria are met.

def execute_cash_secured_put(underlying_symbol, buying_power_limit, min_expiration, max_expiration):

# Get the latest price of the underlying stock

underlying_price = get_underlying_price(underlying_symbol)

# Set the minimum and maximum strike prices based on the underlying price

min_strike = str(underlying_price * (1 - STRIKE_RANGE))

max_strike = str(underlying_price) # In cash-secured put, we explore options whose strike price is below the underlying price

# Get put options

put_options = get_put_options(underlying_symbol, min_strike, max_strike, min_expiration, max_expiration)

if put_options:

# Get the latest price of the underlying stock

underlying_price = get_underlying_price(symbol=underlying_symbol)

# Find appropriate short put options

short_put = find_short_put_option(put_options, buying_power_limit)

# Proceed if short put options are found

if short_put:

# Place orders for the short put if credit received meets a threshold (e.g., minimum profit)

req = MarketOrderRequest(

symbol=short_put['symbol'],

qty=1,

side='sell',

type='market',

time_in_force='day'

)

trade_client.submit_order(req)

success_message = (f"Placing Cash Secured Put on {underlying_symbol} successfully:\n"

f"Sell {short_put['initial_delta']} Delta Put: {short_put['symbol']} "

f"(Strike: {short_put['strike_price']}, Premium to Receive: {short_put['initial_option_price']})")

return success_message, short_put

else:

return "Could not find suitable options which has delta between -20 and -40 and iv less than or equal to 60.", None

else:

return "No put options available for the underlying symbol.", NoneThis block optimizes execution using Python's concurrent.futures library, allowing simultaneous processing of multiple stocks (['LMT','RTX','NOC']). It runs the find_short_put_option function for each stock in parallel, reducing overall execution time.

import concurrent.futures

stock_symbols = ['LMT', 'RTX', 'NOC']

# You can run the `find_short_put_option` function just to find the short put option.

def process_stock(symbol):

# Get the latest price of the underlying stock

underlying_price = get_underlying_price(symbol)

min_strike = str(underlying_price * (1 - STRIKE_RANGE))

max_strike = str(underlying_price)

put_options = get_put_options(symbol, min_strike, max_strike, min_expiration, max_expiration)

return find_short_put_option(put_options, buying_power_limit)

with concurrent.futures.ThreadPoolExecutor() as executor:

results = list(executor.map(process_stock, stock_symbols))

print(results)The Importance of Timing, Paper Trading, and Historical Backtesting

Creating a hypothesis and algorithm is just a small part of building an algo trading strategy. It’s also important to consider how you could time the execution, test on paper, and backtest using historical data.

Timing of Policy Announcements

Algorithmic trading strategies should account for major policy changes, executive orders, and regulatory shifts, as these often trigger rapid market movements. During Trump’s previous term, his quick decisions could impact the markets. In 2025, algos could be programmed to factor in these impacts.

Event-driven trading is one approach, designed to anticipate or react to key moments like tax reform announcements, deregulation, or major economic decisions. Tracking events such as quarterly earnings reports or Federal Reserve meetings allows algorithms to position trades ahead of anticipated market shifts.

Paper Trading for Strategy Validation

Simulated paper trading is essential for testing strategies before deployment. This allows traders to assess strategy performance under real-world conditions without financial risk. It also helps them to refine algorithms for speed, accuracy, and risk management. Paper trading ensures strategies behave as intended during critical events like executive orders or sudden regulatory changes. One way to do this is by using Alpaca’s paper trading environment for Trading API.

Historical Backtesting

Historical data is invaluable for refining strategies, especially when adjusting to a new president’s policies.

For instance:

- Trump’s First Term (January, 2017 to January, 2021): Defense, financials, and tech companies responded strongly to policies like tax reforms and deregulation. Backtesting with data from January 2017 to January 2021 may help with identifying patterns for future scenarios.

- Sector-Specific Trends: Backtesting highlights which sectors are most sensitive to policy changes, enabling sector-focused strategies for areas like energy or financials.

By leveraging timely reactions, robust paper trading, and thorough backtesting, traders can build well-prepared algorithms ready for opportunities tied to Trump’s second presidency.

Conclusion

Trump's return to the presidency in 2025 presents both challenges and opportunities for algorithmic trading. By analyzing historical trends, sector-specific patterns, and integrating advanced tools like natural language processing, traders can develop robust strategies that capitalize on policy-driven market movements.

Algorithmic approaches–from sector rotation and volatility trading to sentiment analysis and cryptocurrency strategies–offer systematic ways to navigate the anticipated market dynamics of Trump's second term. With careful design and rigorous testing, these algorithms can help traders transform policy-driven volatility into consistent trading opportunities.

Ready to test and build your own trading algorithm? Sign up for a free Trading API account and get started with our paper trading environment today.

References:

- How presidential elections affect the stock market: https://www.usbank.com/investing/financial-perspectives/market-news/how-presidential-elections-affect-the-stock-market.html

- Trump's US presidency return ushers in new era of volatile markets: https://www.reuters.com/markets/us/trumps-us-presidency-return-ushers-new-era-volatile-markets-2025-01-15/

- Market Impact of Democratic vs. Republican Wins: https://www.home.saxo/learn/guides/us-election/market-impact-of-democratic-vs-republican-wins

- What Is the Tax Cuts and Jobs Act (TCJA)? https://www.investopedia.com/taxes/trumps-tax-reform-plan-explained/#toc-federal-tax-brackets

- S&P 500 Historical Annual Returns: https://www.macrotrends.net/2526/sp-500-historical-annual-returns

- S&P 500 Performance by President: https://www.macrotrends.net/2482/sp500-performance-by-president

- Dow Jones Returns: https://www.slickcharts.com/dowjones/returns

- Here's how the stock market performed under President Donald Trump, and how it compares to previous administrations: https://markets.businessinsider.com/news/stocks/stock-market-performance-under-president-donald-trump-dow-jones-sp500-2021-1-1029987163

- Quarterly Sector Update, 2017: https://www.fidelity.com/bin-public/060_www_fidelity_com/documents/Q2%202017%20QSU_Fidelity.pdf

- 2018 Global aerospace and defense industry financial performance study: https://www2.deloitte.com/content/dam/Deloitte/global/Documents/Energy-and-Resources/gx-eri-global-a-d-industry-financial-performance-study-sept-2018.pdf

- Major defense stocks surge to all-time highs after Trump’s tough rhetoric against North Korea: https://www.cnbc.com/2017/08/09/major-defense-stocks-surge-to-all-time-highs-after-trumps-tough-rhetoric-against-north-korea.html

- Here’s how tech’s most valuable companies have performed under Trump: https://www.cnbc.com/2020/10/28/trump-tech-good-apple-amazon-microsoft-alphabet-facebook.html

- President Trump Signs the First Major Financial Services Deregulation Law in a Decade: https://www.jonesday.com/en/insights/2018/06/president-trump-signs-the-first-major-financial-se

- Trump tax cut hands $32-billion windfall to America’s top banks: https://www.latimes.com/business/story/2020-01-16/trump-tax-cut-banks-huge-profits

- 'Extreme' fossil fuel investments have surged under Donald Trump, report reveals: https://www.theguardian.com/environment/2018/mar/28/extreme-fossil-fuel-investments-have-surged-under-donald-trump-report-reveals

- Health care stocks rally on Trump's modest drug reform plan: https://www.cbsnews.com/news/health-care-stocks-rally-after-trump-pledges-to-lower-drug-prices/

- Trump’s Return: Which Sectors Will Benefit Most?: https://www.theglobeandmail.com/investing/markets/stocks/XOM/pressreleases/29496950/trumps-return-which-sectors-will-benefit-most/

Alpaca Securities LLC and Polygon.io, Inc (“Polygon”) are not affiliated and neither are responsible for the liabilities of the other.

Alpaca Securities LLC and Alpaca Crypto have no political affiliation or bias toward any political party or individual politician. The content of this article should not be interpreted as an endorsement of any kind.

The content of this article is for general information only and is believed to be accurate as of the posting date but may be subject to change. Alpaca Securities and Alpaca Crypto do not provide investment, tax, or legal advice. Please consult your own independent advisor as to any investment, tax, or legal statements made herein. All references are for illustrative purposes only.

Options trading is not suitable for all investors due to its inherent high risk, which can potentially result in significant losses. Please read Characteristics and Risks of Standardized Options before investing in options.

Past hypothetical backtest results do not guarantee future returns, and actual results may vary from the analysis.

The Paper Trading API is offered by AlpacaDB, Inc. and does not require real money or permit a user to transact in real securities in the market. Providing use of the Paper Trading API is not an offer or solicitation to buy or sell securities, securities derivative or futures products of any kind, or any type of trading or investment advice, recommendation or strategy, given or in any manner endorsed by AlpacaDB, Inc. or any AlpacaDB, Inc. affiliate and the information made available through the Paper Trading API is not an offer or solicitation of any kind in any jurisdiction where AlpacaDB, Inc. or any AlpacaDB, Inc. affiliate (collectively, “Alpaca”) is not authorized to do business.

All investments involve risk, and the past performance of a security, or financial product does not guarantee future results or returns. There is no guarantee that any investment strategy will achieve its objectives. Please note that diversification does not ensure a profit, or protect against loss. There is always the potential of losing money when you invest in securities, or other financial products. Investors should consider their investment objectives and risks carefully before investing.

Cryptocurrency is highly speculative in nature, involves a high degree of risks, such as volatile market price swings, market manipulation, flash crashes, and cybersecurity risks. Cryptocurrency is not regulated or is lightly regulated in most countries. Cryptocurrency trading can lead to large, immediate and permanent loss of financial value. You should have appropriate knowledge and experience before engaging in cryptocurrency trading. For additional information please click here.

Securities brokerage services are provided by Alpaca Securities LLC ("Alpaca Securities"), member FINRA/SIPC, a wholly-owned subsidiary of AlpacaDB, Inc. Technology and services are offered by AlpacaDB, Inc.

Cryptocurrency services are made available by Alpaca Crypto LLC ("Alpaca Crypto"), a FinCEN registered money services business (NMLS # 2160858), and a wholly-owned subsidiary of AlpacaDB, Inc. Alpaca Crypto is not a member of SIPC or FINRA. Cryptocurrencies are not stocks and your cryptocurrency investments are not protected by either FDIC or SIPC. Please see the Disclosure Library for more information.

This is not an offer, solicitation of an offer, or advice to buy or sell securities or cryptocurrencies or open a brokerage account or cryptocurrency account in any jurisdiction where Alpaca Securities or Alpaca Crypto, respectively, are not registered or licensed, as applicable.