This blog was last updated on February 3rd, 2025.

In options trading, credit spreads offer a pre-determined risk-reward profile by creating a strategic positions strategy. This defined-risk strategy enables precise calculation of loss and profit boundaries at entry.

In this guide, we’ll cover the basics of credit spreads including what they are, the types of credit spreads, their advantages and disadvantages, the risks associated with them, and considerations to make when using them in algo trading.

To get the most out of this guide, explore the following resources first:

What Are Credit Spreads?

Credit spreads are strategies where you initiate a position by selling one option (generally at a higher premium) and buying another option (generally at a lower premium). Both contracts share the same underlying asset and typically the same expiration, differing only in strike prices.

Your total cost basis is a net credit, meaning you receive more premium from the sold option than you pay for the purchased option. This is where they get the name.

Important: For American-style options, early assignment of a contract can alter real outcomes. The profit and loss figures below should be seen as theoretical best-case or worst-case scenarios at expiration, assuming no early exercise. Risk-management logic should also account for the possibility of early assignment and real-time monitoring of ex-dividend dates when short calls are involved. We also do not consider transaction fees (brokerage fees, commissions, etc) in the profit/loss scenarios below.

Key Components of Credit Spreads

Buying and Selling Options: The key components of a credit spread strategy is that it pairs a short option position (premium received) with a long option position (premium paid).

Getting the Credit: In a credit spread, credit is received because the premium received from selling an option is higher than the premium of the option contract bought, allowing for the retention of the entire net credit. For example: Net Credit = Premium Received - Premium Paid

Risk-Reward Parameters: The long option caps some of the otherwise unlimited risk of selling naked options, but early assignment can disrupt what is otherwise considered a defined-risk scenario.

Systematic Implementation: For algorithmic traders, credit spreads can be coded into a rules-based system that identifies opportunities for net credit collection while simultaneously hedging some of the risk. However, risk-management logic should also account for the possibility of early assignment and real-time monitoring of ex-dividend dates when short calls are involved. The strategy's defined parameters enable systematic execution through:

- Market scanning for optimal strike price combinations

- Automated net credit calculations

- Programmatic risk management based on position boundaries

Types of Credit Spreads Explained

Below, we examine each common type of credit spread in terms of market outlook, setup, profit/loss scenarios, risk-reward, and examples. The profit/loss scenarios will refer to the theoretical scenario at expiration, without early exercise or any additional trading fees that would be considered if live trading.

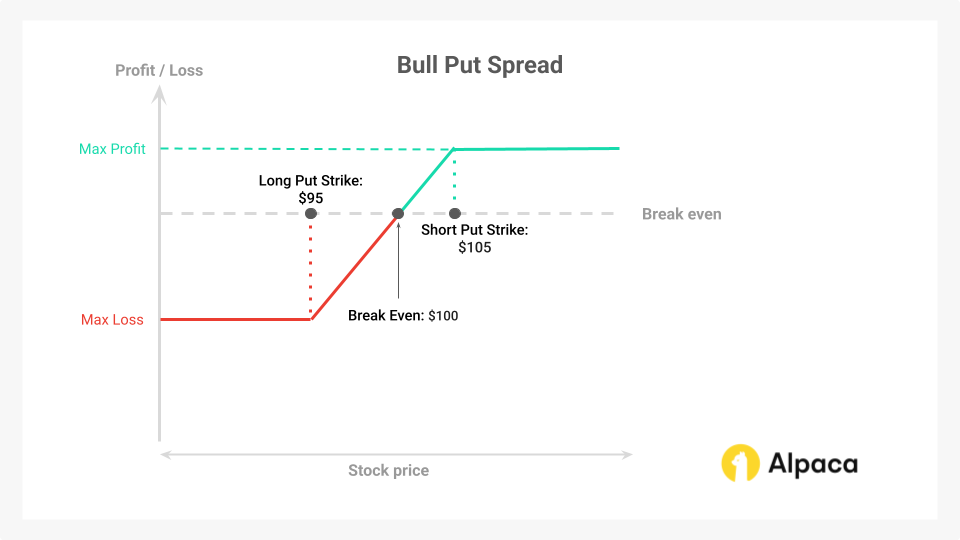

Bull Put Spreads (Short Put Credit Spread)

A bull put spread is a credit spread strategy used when you have a bullish outlook on the underlying. The strategy involves selling a put option at a higher strike price and buying a put option at a lower strike price, both typically with the same expiration date. This is a defined-risk strategy because it hedges the short put against the long put, making the bull put spread a relatively conservative strategy suitable for options traders.

Market outlook: Bullish, meaning you expect the price of the underlying asset to rise or remain above the sold put’s strike price.

How to setup a bull put spread:

- Sell a higher strike put option (this put has a higher premium, meaning it’s closer to being at the money (ATM)).

- Buy a lower strike put option (this put has a lower premium, meaning it is relatively far from ATM).

- Both put options often have the same expiration date.

Profit/Loss Scenario

- Theoretical Max Profit: The net credit received if the underlying asset’s price stays above the higher strike price at expiration (i.e., both puts expire worthless).

- Theoretical Max Loss: The difference between the strike prices minus the net credit received. This happens if the underlying closes below the lower strike price at expiration ((width of put strikes – credit received) x 100).

- Breakeven: The breakeven point is the strike price of the sold put option minus the net credit received when entering the trade. The equation turns out to be: Sold Put Strike – Net Credit Received

Example Scenario:

Let’s consider a bull put spread with the underlying stock price at $98, where you:

- Sell a put at a $100 strike for a $3 premium.

- Buy a put at a $95 strike for a $1 premium.

Therefore, in this scenario, the theoretic maximum profit, loss, and breakeven point would be the following:

- Theoretical Max Profit: $200 (This represents the total premium collected when entering the position, which is $2 ($3 - $1) per share, multiplied by the 100 shares in the contract).

- Theoretical Max Loss: $300 (This is calculated by the obligation to buy 100 shares of the underlying stock at the short put option strike price ($100) while selling it at the long option strike price ($95), subtracting the initial credit of $200. This results in a maximum loss of $3 per share, multiplied by the 100 shares in the contract).

Breakeven Point: $98 (This value is determined by subtracting the initial credit received ($2) from the short put strike price ($100)).

In an algorithmic context, a bull put spread is a relatively conservative, risk-defined strategy. You could program your system to initiate these spreads during bullish trends or when certain technical indicators (e.g., moving averages, momentum oscillators) suggest upward or range-bound price movement.

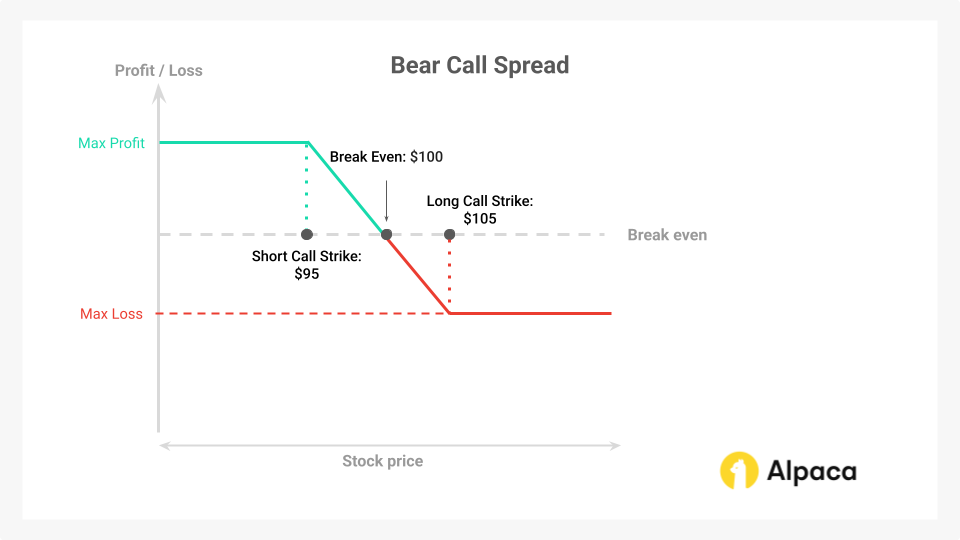

Bear Call Spread (Short Call Credit Spread)

A bear call spread is the flip side of the bull put spread. It’s a bearish strategy that involves selling a call at a lower strike while buying a call at a higher strike, both typically with the same expiration date. The net premium received is your income, and the protective long call caps your losses if the underlying price moves against your forecast.

Market Outlook: Bearish, meaning you expect the price of the underlying to fall or remain below the sold call strike.

How to set up a bear call spread:

- Sell a lower strike call.

- Buy a higher strike call.

- Both call options often have the same expiration date.

Profit/Loss Scenario

- Theoretical Max Profit: The net premium received if the underlying stays below the sold call’s strike price.

- Theoretical Max Loss: The difference between the strike prices minus the net credit received. This occurs if the underlying rallies above the purchased call’s strike.

- Breakeven: Sold Call Strike + Net Credit Received

Example Scenario:

Let’s consider a bear call spread with the underlying stock price at $98, where you:

- Sell a call at a $95 strike for a $3 premium.

- Buy a call at a $101 strike for a $1 premium.

Therefore, in this scenario, theoretical profit, loss, and breakeven point would be the following:

- Theoretical Max Profit: $200 (This represents the total premium collected when entering the position, which is $2 ($3 - $1) per share, multiplied by the 100 shares in the contract).

- Theoretical Max Loss: $400 (This is calculated by the obligation to sell 100 shares of the underlying stock at the short call option strike price ($95) while buying it at the long option strike price ($101), adding the initial credit of $200. This results in a maximum loss of $4 per share, multiplied by the 100 shares in the contract).

Breakeven Point: $97 (This value is determined by adding the initial credit received ($2) to the short call strike price ($95)).

For traders or quants expecting a mild downward or stagnant movement, a bear call spread might be more appealing than shorting shares outright, especially for margin considerations.

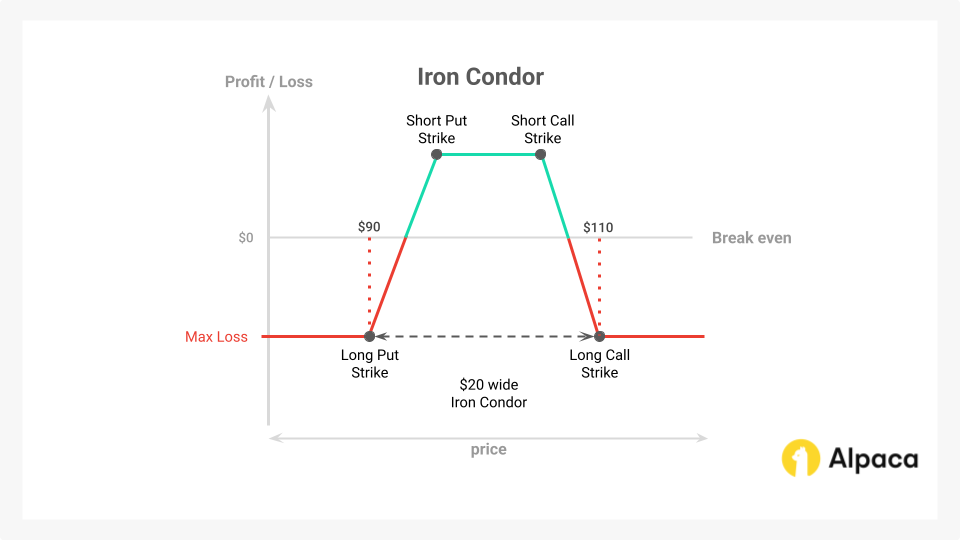

Iron Condor

An iron condor is a defined-risk options strategy that profits from the underlying asset's price remaining within a specific range. It is a market-neutral strategy that essentially merges a bear call spread and a bull put spread, both mostly with the same expiration date. In another perspective, it involves selling an out-of-the-money (OTM) call and an OTM put, while simultaneously buying further OTM call and put options to limit potential losses, typically with the same expiration.

Market Outlook: Neutral, meaning you expect the underlying to remain in a relatively tight range.

How to set up an iron condor:

- Bear Call Spread: Sell a call at a lower strike and buy a call at a higher strike.

- Bull Put Spread: Sell a put at a higher strike and buy a put at a lower strike.

- Both credit spreads normally hold the same expiration date.

Profit/Loss Scenario

- Theoretical Max Profit: The net premium received from the combination of both credit spreads if they both expire worthless.

- Theoretical Max Loss: Often described as limited on each side; however, the risk can feel large if the underlying makes a big move. The maximum loss on either side is the difference between each vertical spread’s strike prices minus the total credit ((width of the wider spread – credit received) x 100).

- Breakeven:

- Upper Breakeven: Sold Call Strike + Total Premium Received

- Lower Breakeven: Sold Put Strike – Total Premium Received

Example Scenario:

Let’s consider an iron condor spread with the underlying stock price at $98, where you could buy and sell the following options at different strike prices:

The total option premium collected per contract in this scenario is $450 for shorting the $96 strike price put and the $101 strike price call. While the total premium paid is $180 for longing the $105 call and $94 put. Therefore, the net premium collected is then $270.

Therefore, in this scenario, maximum profit, loss, and breakeven points would be the following:

- Theoretical Max Profit: $270 (This represents the total premium collected when entering the position, which is $2.70 per share, multiplied by the 100 shares in the contract).

- Theoretical Max Loss: $130 (This is calculated by taking the width of the wider spread ($4 in this example) and subtracting the initial credit of $2.70. This results in a maximum loss of $1.30 per share, multiplied by the 100 shares in the contract).

- Upper Breakeven Point: $103.70 (This value is determined by adding the initial credit received ($2.70) to the short call strike price ($101)).

- Lower Breakeven Point: $93.30 (This value is determined by subtracting the initial credit received ($2.70) from the short put strike price ($96)).

For algorithmic trading, iron condors may be an option if your strategy can accurately identify low-volatility environments or tight trading ranges. An algo might regularly scan for underlying assets exhibiting stable price action and relatively high implied volatility, positioning you to collect worthwhile premiums.

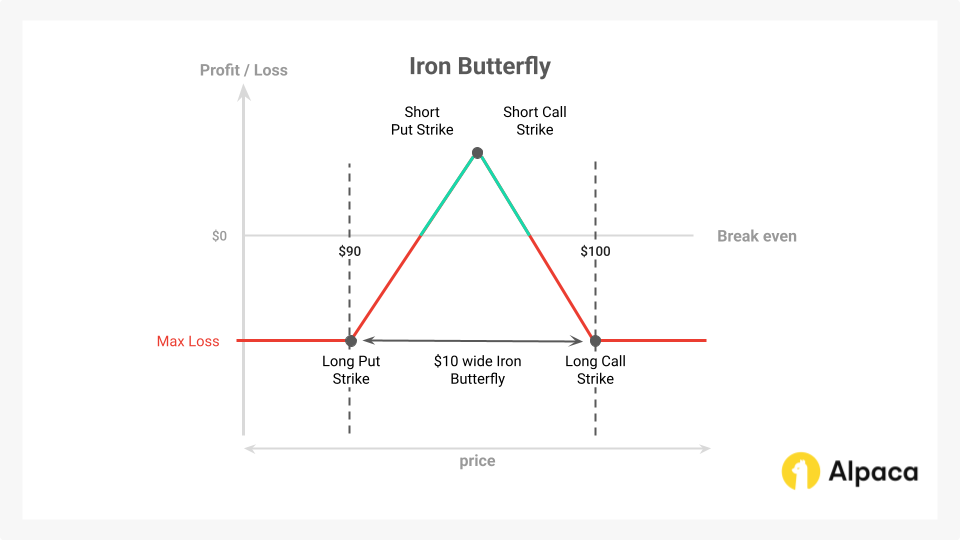

Iron Butterfly

An iron butterfly is similar to an iron condor but uses the same strike for selling both the call and the put. The wings (the options you buy for protection) are at different strikes further away from the center strike. In contrast to the iron condor, where short strikes are OTM, the iron butterfly's short strikes converge ATM.

Both credit spreads in an iron butterfly also have the same expiration date. This creates a much narrower profit zone because the breakevens are closer to the center, but it collects a higher net premium since the ATM options have higher extrinsic value.

For more, check out our guide comparing the iron condor and iron butterfly.

Market Outlook: Neutral; you anticipate the price to stay near the middle (sold) strike.

How to set up an iron butterfly:

- Sell an ATM call and an ATM put (same strike).

- Buy one OTM call and one OTM put at different strike prices.

- Both credit spreads mostly hold the same expiration date.

Profit/Loss Scenario

- Theoretical Max Profit: The net credit received if the underlying settles right at the middle strike at expiration.

- Theoretical Max Loss: The difference between wider side’s strike prices minus the net credit received. This happens if the market moves significantly ((width of the spread – credit received) x 100).

- Breakeven:

- Upper Breakeven: Middle Strike + Net Credit Received

- Lower Breakeven: Middle Strike – Net Credit Received

Example Scenario:

Let’s consider an iron condor spread with the underlying stock price at $98, where you could buy and sell the following options at different strike prices:

The total option premium collected per contract in this scenario is $700 for shorting the $98 strike price put and the $98 strike price call. While the total premium paid is $460 for longing the $101 call and $92 put. Therefore, the net premium collected is then $240.

Therefore, in this scenario, theoretical profit, loss, and breakeven points would be the following:

- Theoretical Max Profit: $240 (This represents the total premium collected when entering the position, which is $2.40 per share, multiplied by the 100 shares in the contract).

- Theoretical Max Loss: $360 (This is calculated by taking the difference between the strike prices of the long and short options, which is $6 in this example, and subtracting the initial credit of $2.40. This results in a maximum loss of $3.60 per share, multiplied by the 100 shares in the contract).

- Upper Breakeven Point: $100.40 (This value is determined by adding the initial credit received ($2.40) to the short call strike price ($98)).

- Lower Breakeven Point: $95.60 (This value is determined by subtracting the initial credit received ($2.40) from the short put strike price ($98)).

Advantages and Disadvantages of Credit Spreads

Credit spreads have both advantages and disadvantages in options trading.

Advantages

Premium Collection: By selling options, you collect premiums upfront, which can work well in sideways or low-volatility markets. This advantage often aligns with systematic trading strategies looking to capitalize on time decay.

Defined Risk: The maximum theoretical loss in a credit spread is defined by the difference in strike prices, also known as the initial margin requirement. This feature may be highly appealing for both discretionary and automated traders who want potentially more predictable risk profiles.

Strategy Diversification: Credit spreads can be combined with other trading strategies. For instance, you can add them to a portfolio that already includes directional trades, futures, or other derivatives, thereby diversifying market exposure. Traders can also choose whether they want to take a bullish or bearish position.

Low Capital Requirement: Compared to naked options where algorithmic traders must set aside a substantial amount of capital as margin to cover potential losses, credit spreads generally require lower margin. This factor can be crucial for traders with limited capital who may want to deploy multiple strategies or scale their existing ones.

Disadvantages

Limited Profit Potential: Your upside is defined at the net premium you receive. If the market moves drastically in the desired direction, you will potentially miss out on those large gains.

Requires Active Management: Credit spreads often need monitoring, especially as expiration nears and the underlying’s price approaches the sold strike. Automated trading may help with real-time adjustments.

Potential for Losses if the Market Moves Significantly: While risk is defined for many credit spread strategies, you can still lose the difference between strike prices minus the net credit if the trade goes against you. For example, in a bull put spread, you anticipate the underlying stock price will rise. However, if the market declines and reaches the break-even point, the option holder may exercise the option, forcing you to buy 100 shares at the higher strike price.

Time Decay Works Against You in Some Cases: While time decay usually benefits option sellers, unforeseen events or sudden volatility spikes can erode your position quickly if the market doesn’t cooperate.

Understanding the Risks Associated With Credit Spreads

While credit spreads are generally considered lower-risk, every option strategy carries inherent risks. By buying an option to offset the sold option, you’re limiting your potential maximum loss. Specifically, your risk is typically defined by the difference in the strike prices of the options minus the premium received.

However, keep in mind that entering the market with a short option in your position carries the risk of early assignment. For example, in the case of a short call, an early assignment could result in a short stock position, which might require additional margin or expose you to dividend risk if the stock pays a dividend. It's important to account for these scenarios when managing your positions.

Considerations for Algorithmic Traders

The algorithmic trading of credit spreads hinges on identifying optimal market conditions. This could mean employing signals that detect:

Overbought/oversold conditions: Identify low or high implied volatility environments. Underlying assets in a stable channel or showing a bullish/bearish trend, depending on the chosen spread.

Dynamic Risk Management: Algorithms can monitor positions in real time and adjust them if the underlying price moves near critical strike levels. For example, an algo can roll spreads to different strikes or expirations to reduce exposure when sudden volatility spikes occur.

Theta Decay: Some option Greeks, like theta, work in favor of credit spread sellers, as the options lose value each day. Algorithmic models often incorporate theta decay calculations to time entries and exits based on the “decay curve,” capturing a larger portion of time-value erosion.

Liquidity and Execution: Liquidity is paramount when trading options. Wide bid-ask spreads in illiquid options can erode the advantages of collecting premiums. Additionally, execution speed and slippage matter, especially for high-volume or high-frequency algorithms. Monitoring real-time quotes may help ensure you get favorable fills.

Backtesting: Systematic traders should backtest each option strategy over various market conditions–bullish, bearish, sideways, and volatile. This data-driven approach refines your parameters (such as strike distance, delta thresholds, or time to expiration) to maximize returns while carefully managing risk.

Optimization: Parameters like strike distance, expiry selection, and desired credit can all be optimized. Machine learning models, or simpler parameter sweeps, can help find robust configurations likely to perform well across a range of market scenarios.

Extra Consideration for Live Trading

Transaction Costs: For multi-leg strategies, commissions may add up quickly, particularly when establishing or closing a spread. Slippage should also be accounted for in trade cost calculations. Every brokerage has different transaction costs but you can trade options commission free with Alpaca’s Trading API to eliminate commission fees and reduce total transaction costs.

Latency: In fast-moving markets, the time it takes to execute your trades and receive market data can affect profitability. High-frequency or near-real-time algorithmic traders may need co-located servers or premium data feeds.

Risk Management Algorithms: Real-time risk management can employ stop-loss rules, volatility filters, or portfolio-level hedging. If a strategy’s risk threshold is breached, an algorithm can close positions or open offsetting trades.

By using Alpaca’s Trading API, traders can avoid commission fees and build low-latency algorithms to execute credit spread strategies more efficiently.

Further Strategies and Enhancements

Beyond the strategies above, experienced traders may be able to expand the uses of credit spreads.

Combining Credit Spreads with Other Strategies

Credit spreads can be integrated with other options strategies to create more sophisticated risk-reward profiles and enhance portfolio optimization objectives.

Pairs Trading: You can integrate credit spreads with pairs trading or statistical arbitrage if you identify correlated underlyings. The goal is to collect premium while neutralizing market risk via offsetting positions.

Hedging: Traders might add a credit spread to hedge another position in an options or equity portfolio. For instance, if you hold a long equity position, a bear call spread could potentially generate income while partially protecting against a moderate downturn.

Multi-leg Strategies: Beyond the spreads discussed (iron condors, iron butterflies, etc)., you can combine credit spreads with calendar spreads, diagonal spreads, or other multi-leg strategies to refine your risk/reward profile.

Machine Learning and Credit Spreads

Machine learning models can enhance credit spread trading by identifying statistical patterns in volatility surfaces and optimizing position parameters through supervised learning on historical options data.

Predicting Volatility: Volatility is a key factor in options pricing. Machine learning can improve your ability to forecast implied and realized volatility, helping you decide when to sell premium and which strike prices offer the best risk-reward.

Algorithmic Optimization: Using machine learning or advanced data analytics, you can optimize your credit spread strategy dynamically. For instance, your system could learn how far from the money to position your strikes based on rolling historical data and implied volatility patterns.

Conclusion

Credit spreads, when integrated with robust market analysis tools and carefully crafted risk management rules, can be a tool for quants, developers, and algo traders seeking to enhance both profitability and risk control. The natural limit on losses and potential for income from premium collection can turn credit spreads into an excellent building block for more sophisticated, multi-strategy portfolios.

Summary of Key Points

Here are some of the key concepts of credit spreads.

- Credit Spreads provide a defined risk-return profile by pairing sold and bought options.

- The types of credit spreads covered–bull put spread, bear call spread, iron condor, and iron butterfly–each offer unique ways to profit from specific market conditions.

- Advantages include premium collection, lower capital requirements, defined risk.

- Risks include limited upside and possible losses if the market moves significantly against your position.

- For algorithmic traders, leveraging market condition filters, dynamic risk management, and extensive backtesting can bolster the effectiveness of credit spreads.

Ready to incorporate credit spreads into your algo trading pipeline? Start by backtesting these strategies across various market conditions to see how they perform. Leverage Alpaca’s Trading API and their Paper Trading Environment to hone your credit spread approach in real time, without risking real capital.

With the right parameters, technology, and risk management in place, credit spreads can be a valuable component of your algorithmic options trading repertoire.

Interested in learning more? Here are a few resources to help you get start options trading with Alpaca’s Trading API:

- Read more of our options trading tutorials

- Learn how to start trading options trading with Alpaca’s Trading API and Dashboard

- Documentation of level 3 option tradings with Alpaca’s Trading API: Multi-leg options trading

Frequently Asked Questions

Are credit spreads bullish or bearish?

Credit spreads can be constructed for both bullish and bearish biases (e.g., bull put spread for bullish outlook, bear call spread for bearish). Neutral positions are also possible with strategies like an iron condor and iron butterfly.

What happens if a credit spread expires out of the money?

If all the short options in the spread expire out of the money, the entire position expires worthless and you keep the net premium. This is typically the preferred outcome for credit spread strategies.

How can I identify optimal credit spread opportunities programmatically?

You can scan for conditions such as elevated implied volatility, strike prices with favorable risk-reward ratios, and matching liquidity thresholds. Algorithmic filters often include technical, fundamental, or volatility-based signals to pinpoint the most promising spreads.

What are the best practices for managing risk in credit spread strategies?

Traders may want to use strategies like defining clear exit criteria, setting stop-loss or adjustment triggers, and avoiding overleveraging their account. Diversify across multiple underlyings or expirations to mitigate single-event risk.

What’s the difference between a credit spread and a debit spread?

A credit spread generates a net premium paid to you upfront, while a debit spread requires you to pay a net premium. Credit spreads typically profit from options expiring worthless, whereas debit spreads may need a larger price move in your favor to become profitable.

How can I backtest credit spread strategies effectively?

Gather high-quality options data, replicate real-world trading conditions (including slippage and commissions if they exist), and simulate various market scenarios. Use robust metrics–such as win rate, drawdowns, and Sharpe ratio–to assess performance over multiple time frames. All of this is possible with Alpaca’s Trading API for options.

What are the challenges of implementing credit spreads in high-frequency trading?

Rapidly changing market conditions and the need for low-latency execution can make timing and order placement difficult. Slippage, data feed latency, and margin requirements further complicate managing multi-leg positions in a high-speed environment.

*Commission-free trading means that there are no commission charges for Alpaca self-directed individual cash brokerage accounts that trade U.S.-listed securities through an API. Relevant regulatory fees may apply. Commission-free trading is available to Alpaca's retail customers. Alpaca reserves the right to charge additional fees if it is determined that order flow is non-retail in nature.

Options trading is not suitable for all investors due to its inherent high risk, which can potentially result in significant losses. Please read Characteristics and Risks of Standardized Options before investing in options.

Past hypothetical backtest results do not guarantee future returns, and actual results may vary from the analysis.

The Paper Trading API is offered by AlpacaDB, Inc. and does not require real money or permit a user to transact in real securities in the market. Providing use of the Paper Trading API is not an offer or solicitation to buy or sell securities, securities derivative or futures products of any kind, or any type of trading or investment advice, recommendation or strategy, given or in any manner endorsed by AlpacaDB, Inc. or any AlpacaDB, Inc. affiliate and the information made available through the Paper Trading API is not an offer or solicitation of any kind in any jurisdiction where AlpacaDB, Inc. or any AlpacaDB, Inc. affiliate (collectively, “Alpaca”) is not authorized to do business.

Please note that this article is for general informational purposes only and is believed to be accurate as of the posting date but may be subject to change. The examples above are for illustrative purposes only.

All investments involve risk, and the past performance of a security, or financial product does not guarantee future results or returns. There is no guarantee that any investment strategy will achieve its objectives. Please note that diversification does not ensure a profit, or protect against loss. There is always the potential of losing money when you invest in securities, or other financial products. Investors should consider their investment objectives and risks carefully before investing.

Securities brokerage services are provided by Alpaca Securities LLC ("Alpaca Securities"), member FINRA/SIPC, a wholly-owned subsidiary of AlpacaDB, Inc. Technology and services are offered by AlpacaDB, Inc.

This is not an offer, solicitation of an offer, or advice to buy or sell securities or open a brokerage account in any jurisdiction where Alpaca Securities are not registered or licensed, as applicable.