The treaty (reduced) withholding rate on dividends for India is 25%, which is posted in Ledgie as a DIVNRA. These are dividends (DIV) paid to the customer account by US sourced securities.

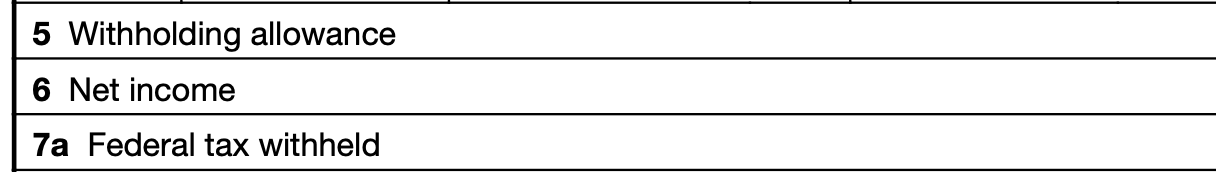

- Note foreign account withholding is reflected in both box 5 and box 7a on the 1042-S:

- Note income is reported in box 2 on the 1042-S:

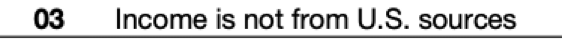

- If a foreign account is paid a dividend by a foreign-sourced security, the dividend income is reported on a 1042-S tax statement, but it will have an exemption code of “03”.

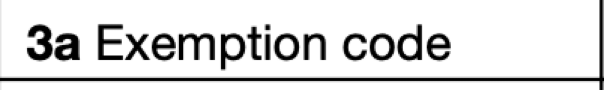

And here is where the exemption code is displayed on the 1042-S

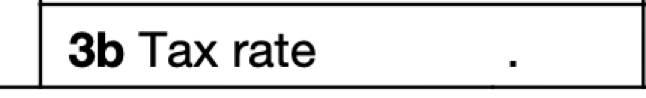

along with a 00 tax rate (which is displayed here on the 1042-S)

and no withholding will occur as the dividend is exempt from withholding. The most common income code for dividends is “06”:

Please see the following link to view all of the 1042-S income codes and authority for exemption codes:

https://www.irs.gov/pub/irs-pdf/f1042s.pdf

Please note that a 1042-S tax statement is issued for each distinct type of income code in which a customer receives income. In addition, please also be aware that the IRS only requires us to generate a 1042-S if the income received for the tax year is equal to or greater than $.50, which will automatically round up to a whole $1.00 on the statement. If the withholding is not equal to or greater than $0.50, it will be rounded down to $0.00. In other words, both the withholding as well as the income must reach $0.50 or greater to round to the next whole dollar.

- If a foreign account disposes of a security that is a publicly traded partnership, withholding is triggered (SLWH) at a fixed 10% of the sale or disposition.

- If a customer sends in documentation or Alpaca receives documentation that a fund has deemed certain dividend distributions as “qualified interest” and the dividend was previously credited to the account. We will reverse the dividend (DIV) and repost it as interest (INT) for the portion of the amount declared as qualified interest. This may result in a new reduced (DIV) amount, which will automatically reduce the DIVNRA amount, and a new interest or (INT) record is posted to the account, which is exempt from withholding. The 1042-S exemption code for this type of payment is “05”

Spin-offs and Reverse Splits in foreign Accounts do not impact the 1042-S tax statement; however, they could impact the monthly customer statement gains and losses.

Spin-offs and Reverse Splits do not initiate a taxable event for the client until they sell their shares. (Note: Here, we are focused on the monthly statement effects as only Publicly Traded Partnership sales impact the 1042-S)

Most Spin-Offs have an adjustment on the cost basis for the old security and the new security, which will change the cost basis per share, but the total cost basis value of both positions combined remains the same.

Reverse Splits will change the cost basis on a per-share basis, but the total value of the position remains the same.